As the global stage embraces India with open arms, recognizing its robust economy and potential to lead the world towards a prosperous future, Nikkei Asia’s recent article highlights India’s pivotal role in sustaining the engine of the global economy during turbulent times. However, amid this upward trajectory, concerns regarding the nation’s debt have emerged. Certain segments of the media and Congress leaders have recently disseminated narratives rooted in apprehension, emphasizing India’s indebtedness as a worrisome factor. These assertions advocate the notion that India’s debt situation is unfavorable, raising pertinent questions about its implications for the country’s growth.

We will start with claims made by the opposition’s leaders.

Congress spokesperson Supriya Shrinate claimed in her press interaction that, “Government is taking huge debt but only Prime Minister’s capitalist friend is reaping the benefit from it. Meanwhile, the poor and middle-income group continues to suffer.”

Mahila Congress Sevadal also instituted a similar message through an infographic image.

Another Congress leader Geet tweeted, casting the fear of India’s bankruptcy.

Foul-mouthed Bollywood movie critic Kamal Rashid Khan tweeted in a similar vein.

The statements put forth by the Congress leader have left many Indian citizens contemplating the potential consequences of the government taking loans and its impact on the economy. They raise crucial questions: Could India face bankruptcy for the first time in its history? How detrimental is this situation for the overall economy? Is there any validity to the concerns expressed by the Congress leader?

In our pursuit of factual accuracy, we embark on a comprehensive fact-checking endeavor, digging into the intricate matters of the economy through expert analysis. Our objective is to present the truth behind the claims made by the Congress leader in a clear and concise manner, unraveling the complexities of the ongoing debt saga. Our aim is to provide readers with a nuanced understanding of these apprehensions, ensuring accessibility to all.

Fact Check

We will start our investigation by understanding the concept of the debt-GDP ratio. According to Wikipedia, “In economics, the debt-to-GDP ratio is the ratio between a country’s government debt (measured in units of currency) and its gross domestic product (GDP) (measured in units of currency per year). A low debt-to-GDP ratio indicates that an economy produces goods and services sufficient to pay back debts without incurring further debt.”

Wikipedia clearly sums up the concept of debt-to-GDP ratio, it says, ‘A low debt-to-GDP ratio indicates that an economy produces goods and services sufficient to pay back debts without incurring further debt.’

By taking this into account let’s see where India stands in terms of a debt-to-GDP ratio. According to ICICI Direct, “While the Western economies near a possible recession, India ranks better than global powerhouses such as US, UK, Japan in terms of its Debt-to-GDP ratio. Infact, as per a report – Recession Probability Worldwide 2023, India is the safest with 0% chance of recession.”

ICICI direct explained this self-explanatory infographic image.

In the realm of fiscal responsibility, understanding a nation’s debt is of paramount importance. In this context, a country’s debt is typically evaluated relative to its Gross Domestic Product (GDP). Moreover, taking into account the impressive strides made by India’s economy, characterized by its colossal GDP of $3.75 trillion, it becomes evident that India possesses a commendable credit standing, enabling it to procure loans to fulfill its national requirements. Presently, India maintains a GDP-to-debt ratio of approximately 81 percent. However, it is crucial to acknowledge that given the vast expanse of the country, India still retains substantial capacity to augment its GDP-to-debt ratio well beyond the existing 81 percent, if deemed necessary. Undeniably, there remains a considerable reserve of credit available to the nation, facilitating its future endeavors.

Therefore, it becomes abundantly evident that India does not encounter any obstacles of recession or bankruptcy, as asserted by certain leaders from the Congress party. Nevertheless, in order to provide solid substantiation for our conclusions, we will seek the insights and analysis of esteemed economic experts.

According to the Financial Express, “India will likely have a stable debt-to-GDP ratio going forward even as public debt as a ratio to GDP soared across the world during Covid-19 and is expected to remain elevated, the International Monetary Fund (IMF) said.

India’s general government debt (Centre and states) to GDP, which was 67.1% in FY14, rose sharply to 88.5% in the Covid-hit FY21, before declining to 83.1% in FY23. It has projected India’s debt to GDP to remain around 83.6% till FY28, according to IMF’s April Fiscal Monitor report.”

According to the International Monetary Fund (IMF), India’s debt-to-GDP ratio remains steady, dispelling any concerns surrounding it. The IMF further acknowledged that the debt ratio experienced an increase during the pandemic period, primarily attributable to factors such as nationwide lockdowns, the temporary halt in economic activities, and the significant endeavor to ensure food security for the Indian population. It is noteworthy that India operates the world’s largest food distribution program, known as the Pradhan Mantri Garib Kalyan Anna Yojana, which plays a vital role in addressing the nutritional needs of the vulnerable sections of society.

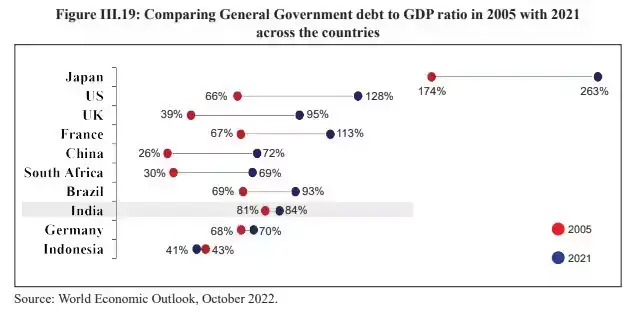

The Economic Survey report from 2023, speaks at the same volume as this report. According to Money Control, “The Union government’s debt-to-GDP ratio has increased only modestly over the last 15 years, while that of other countries has increased substantially over the same period, according to the Economic Survey 2022-2023.”

The report further said, “A comparison of the change in General Government debt to GDP ratio from 2005 to 2021 across the countries highlights a substantial increase for most countries. For India, this increase is modest, from 81 percent of GDP in 2005 to around 84 percent of GDP in 2021. It has been possible on the back of resilient economic growth during the last 15 years leading to a positive growth-interest rate differential, which, in turn, has resulted in sustainable Government debt to GDP levels.”

In a compelling turn of events, three separate reports have emerged, effectively refuting the claims made by Congress leaders and other opposition figures. These reports carry substantial weight as they originate from distinct entities: India’s premier private bank, the International Monetary Fund (IMF), and the official data released by the Indian government. Such a diverse range of sources leaves no room for bias or manipulation, bolstering their credibility. Remarkably, all three reports unanimously assert that India’s economy is not under any imminent threat. The debt ratio is deemed non-alarming, and India’s growth trajectory is poised for impressive acceleration.

Recently, at the India Today conclave, Congress senior leader and former finance minister, P. Chidambaram, said, “I would like to give credit to this government for a single-minded focus on containing the deficit and the debt management.”

Henceforth, it becomes evident that Supriya Shrinate, a prominent leader of the Congress party, along with her fellow members from the opposition, lack any substantial evidence or credibility to support their claims. Their rhetoric seems aimed at instilling fear within the general public, with fearmongering serving as their most potent weapon. However, amidst the cacophony of misinformation, the Onlyt Fact stands tall, serving as an impregnable fortress that dismantles their weapon and reveals the genuine reality.

| Claim | Modi government has brought India’s economy into enormous debt, as much as it will face bankruptcy. |

| Claimed by | Congress leaders |

| Fact Check | Misleading |

The goal of the Only Fact Team is to provide authentic news facts and debunk lies to safeguard readers’ interests.

Dear Readers, we are working to debunk fake news which is against India. We don’t have corporate funding like others. Your small support will help us grow further.

If you like our work, support and donate us using the Livix Media Foundation QR code.

Jai Hind!