In India, there’s a long-standing trend of political parties not acknowledging each other’s contributions. From the introduction of GST to the construction of the Ram Mandir, instances exist where opposition parties have refrained from crediting the BJP government for its initiatives. This time, the focus is on the UPI, with opposition figures attempting to claim recognition for its inception.

Recently, on November 20th, Kalvakuntla Taraka Rama Rao, also known as KTR, assumed various key roles in Telangana, serving as the Minister for Municipal Administration and Urban Development, Industries and Commerce, as well as Information Technology, Electronics, and Communications. He featured on a podcast called “Unfiltered by Samdish,” which is accessible on the YouTube channel named “UNFILTERED by Samdish.”

During a specific segment in the video, precisely at the 5-minute and 15-second mark, KTR made an intriguing statement. He mentioned that the Unified Payments Interface (UPI) was started during Manmohan Singh’s term.

An X handler named Chay also shared a picture of a conversation between Samdish and KTR and wrote, Yesss!! UPI was not started by Modi or BJP. People should know this. All my educated cousins, especially.

So, is it true that UPI was started during Manmohan Singh’s term? Let’s Fact Check.

Also Read: Supriya Shrinate Misleads Again: No, The Killers of Kanhaiya Lal Were Not The Members of BJP

Fact Check

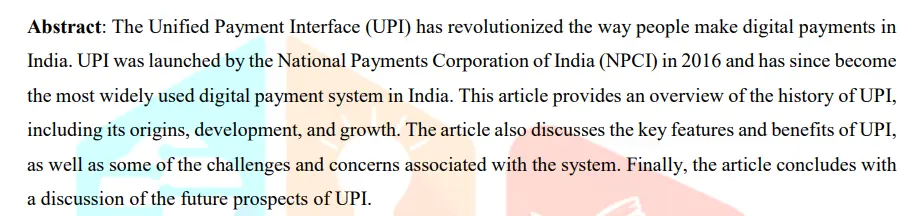

During our investigation, we conducted an extensive keyword research using the inquiry, “who launched UPI.” This quest led us to an enlightening discovery within a PDF sourced from the International Journal of Creative Research Thoughts (IJCRT). According to this document, UPI was launched by the National Payments Corporation of India (NPCI) in 2016. Since its introduction, UPI has undergone remarkable growth and currently stands as the most widely embraced digital payment system throughout the nation.

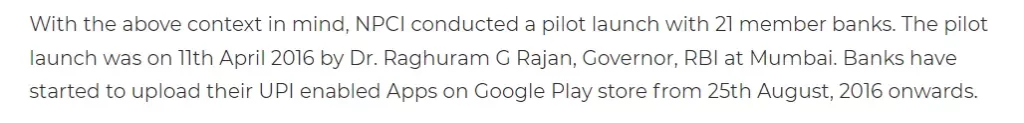

Following our investigation, we turned to the official website of the National Payments Corporation of India (NPCI) to gather more clarity regarding the launch of UPI. As per the information provided on the NPCI website, the UPI journey commenced with a pilot launch involving 21 member banks. This pivotal event took place on April 11, 2016, under the auspices of Dr. Raghuram G Rajan, the Governor of the Reserve Bank of India, held in Mumbai.

A significant stride occurred when the banks initiated the process of uploading their UPI-enabled applications onto the Google Play Store, commencing from August 25, 2016. This step marked a critical milestone in making UPI accessible to the public, amplifying its reach and usability among users seeking efficient digital payment solutions.

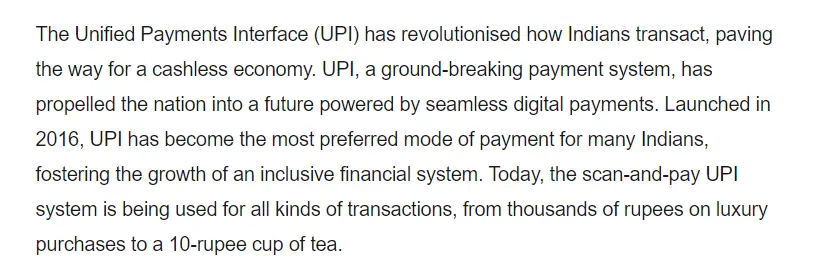

Continuing our investigation, we stumbled upon a report by the Times of India published on July 15, 2023. According to this report also, UPI was launched in 2016. The report emphasized how UPI, established in 2016, has swiftly risen to prominence as the foremost payment mode among Indians.

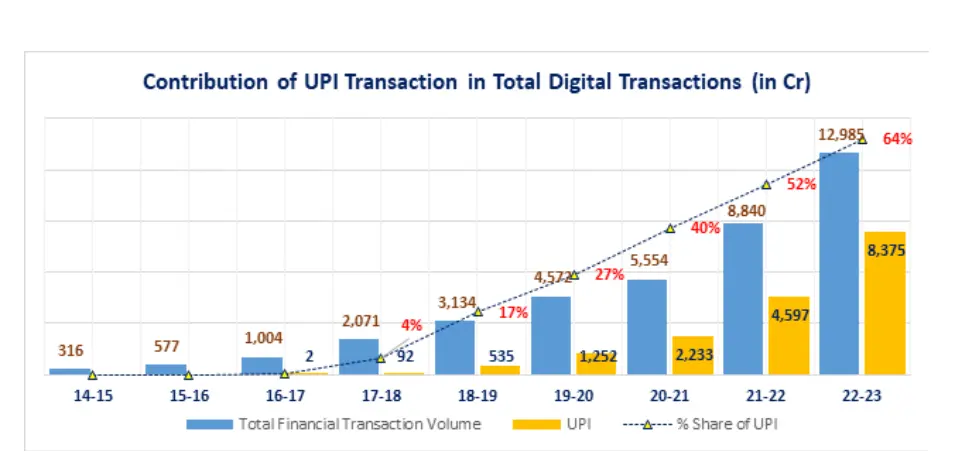

Continuing our exploration, we stumbled upon a report by Forbes India, dated August 11, 2023, shedding more light on the trajectory of UPI. According to this report, Unified Payments Interface made its debut in April 2016 and has rapidly evolved into the leading payment system in India.

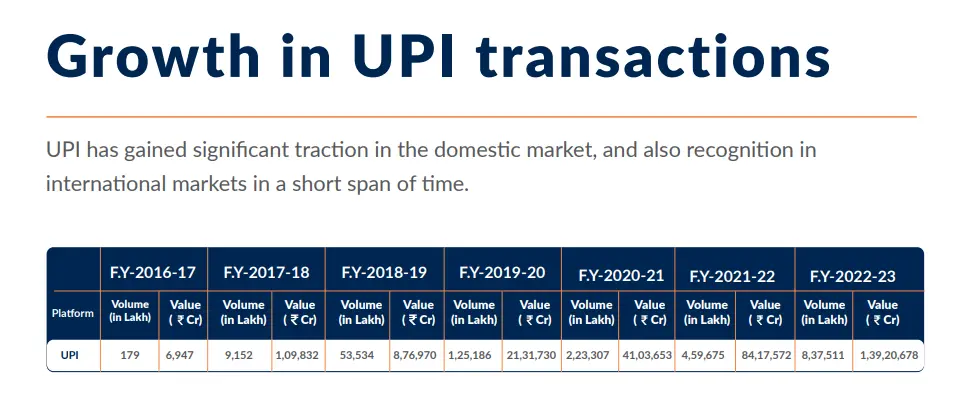

Since its inception, UPI has swiftly ascended to a position of prominence within the country’s payment landscape. Notably, the Reserve Bank of India’s June 2023 bulletin, drawing from PwC data, forecasted a staggering projection: the Unified Payments Interface (UPI) is anticipated to constitute a remarkable 90 percent share of retail digital transaction volumes within the upcoming five years. This projection marks a significant increase from its already impressive 75.6 percent share in FY23, affirming the undeniable dominance that UPI commands within the Indian payment ecosystem.

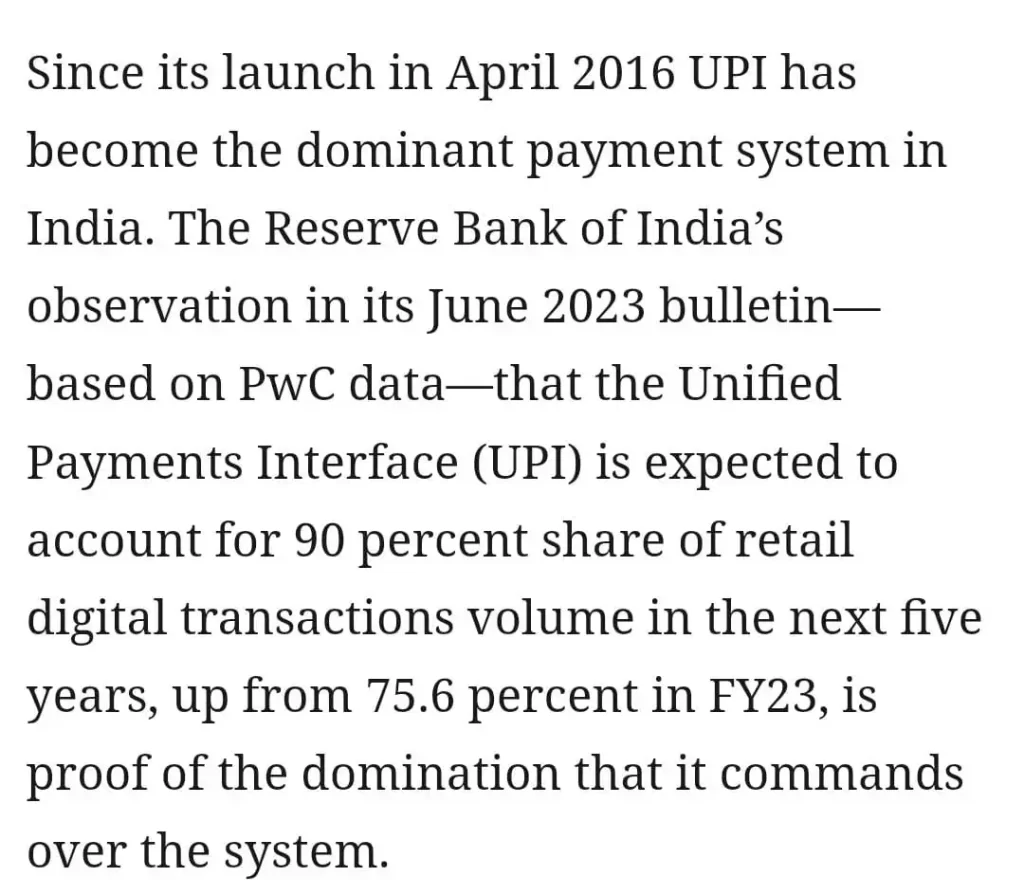

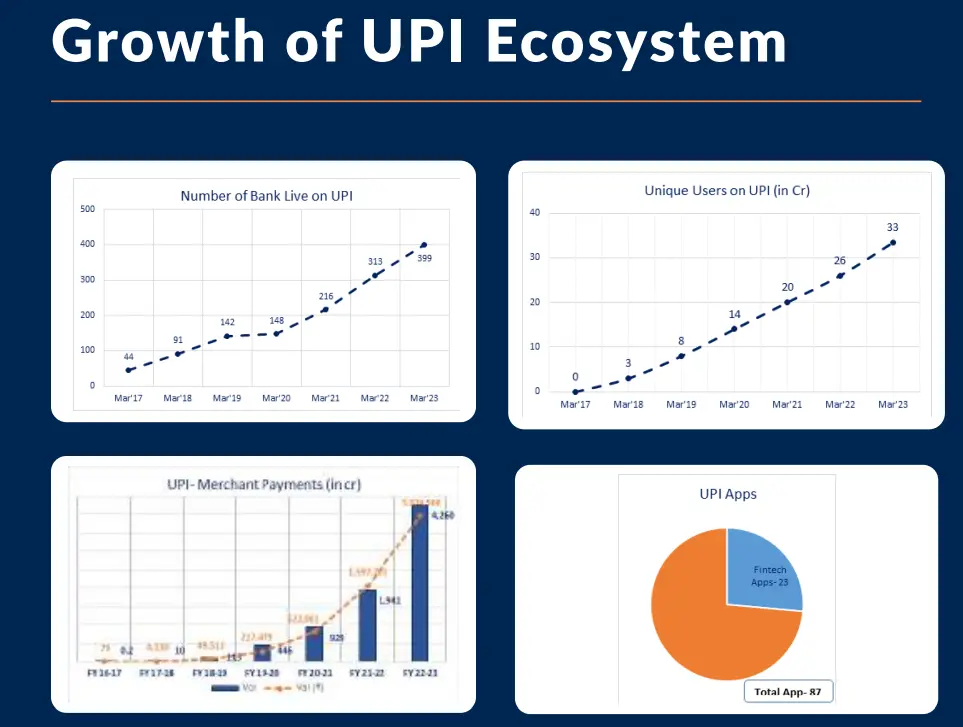

Additionally, in the concluding stages of our investigation, we stumbled upon a document titled “RISE OF A NEW ERA IN DIGITAL PAYMENTS” available on the official website of the Ministry of Information and Broadcasting, Government of India. This document served as a comprehensive compendium, illustrating the burgeoning growth of the UPI ecosystem and UPI transactions since its inception, backed by an array of insightful statistics.

Hence, all these points prove that UPI did not occur during Manmohan Singh’s era. Instead, it distinctly emerged and thrived during the leadership of PM Modi in 2016.

| Claim | UPI was started during Manmohan Singh’s term |

| Claimed by | KTR, Chay, etc |

| Fact Check | False |

Also Read: The Claim of Ricky Ponting Referring to BCCI as “Cricket Mafia” is Fake