Media news portals like The Times of India, Business Standards, Money Control, and an initiative project called ET BFSI.Com by Economic Times, claimed in their reports that the RBI says “Big-bang privatisation of banks may cause more harm than good.”

Fact Check

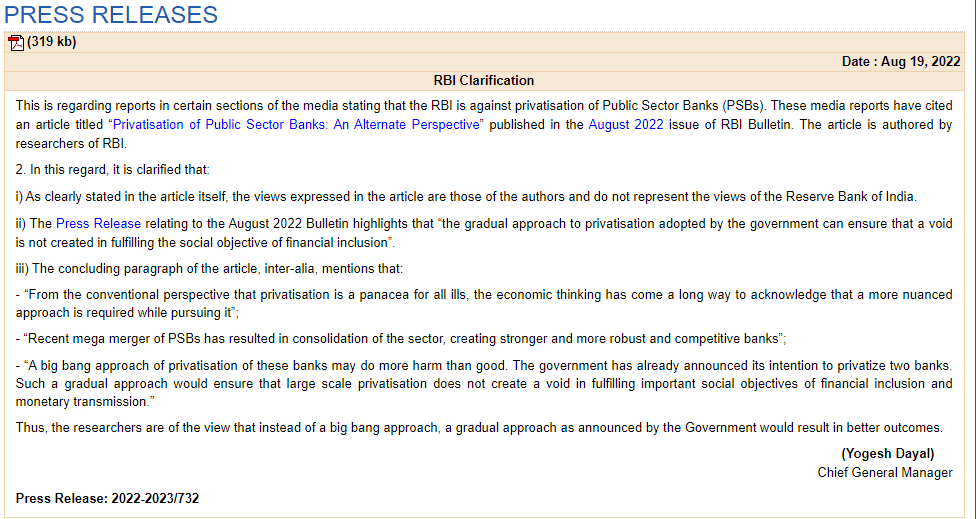

After primary google search claim about the RBI statement on privatisation of banking service by the media portals seems suspicious, so our team conducted in-depth research about the matter. After keyword search of “Big-bang privatisation of banks may cause more harm than good”, we found a report by the Chief Secretary Manager Yogesh Dayal of the RBI. The report provides clarification on claims made by the media outlets that the RBI opposes the privatisation of public sector banks (PSBs). As per the report, on August 18, 2022, an article was published in the RBI bulletin titled “Privatisation of Public Sector Banks: An Alternative Perspective.“

According to the RBI clarification report, the opinions expressed in that article are those of the author and do not reflect those of the Reserve Bank of India.

Plus, the concluding paragraph of the article, inter-alia, mentions that:

– “From the conventional perspective that privatization is a panacea for all ills, the economic thinking has come a long way to acknowledge that a more nuanced approach is required while pursuing it”;

– “Recent mega merger of PSBs has resulted in consolidation of the sector, creating stronger and more robust and competitive banks”;

– “A big bang approach of privatization of these banks may do more harm than good. The government has already announced its intention to privatize two banks. Such a gradual approach would ensure that large-scale privatization does not create a void in fulfilling important social objectives of financial inclusion and monetary transmission.” Thus, the researchers are of the view that instead of a big bang approach, a gradual approach as announced by the Government would result in better outcomes.

Hence, The Times of India, ET BSFI.com, Business Standards, and Money control represented the matter in a distorted manner to delude the people.

| Claim | RBI says: More harm than good from PSBs’ privatisation | |

| Claimed by | Times of India, ET BSFI.com, Business Standards, and Money control | |

| Fact Check | Misleading |

The Only Fact India team’s sole objective is to debunk the lies and misinformation, which spread in the hope to delude the people. JAI HIND!

Dear Readers, We are working to debunk fake news which is against India. We don’t have any corporate funding like others. Your small support will help us grow further. Please Support.

JAI HIND!