With Donald Trump’s fixation on reciprocal tariffs, global markets crashed on Monday. From Tokyo and Amsterdam to Hong Kong and Mumbai, stock markets witnessed a bloodbath. In India, opposition parties wasted no time in blaming Prime Minister Modi. While the blame game was still unfolding, the Government of India announced a hike in excise duty on diesel and petrol by ₹2 per litre. Given that global crude oil prices are significantly low, social media users began criticizing the government for “looting” the public through fuel price hikes despite the drop in international crude prices.

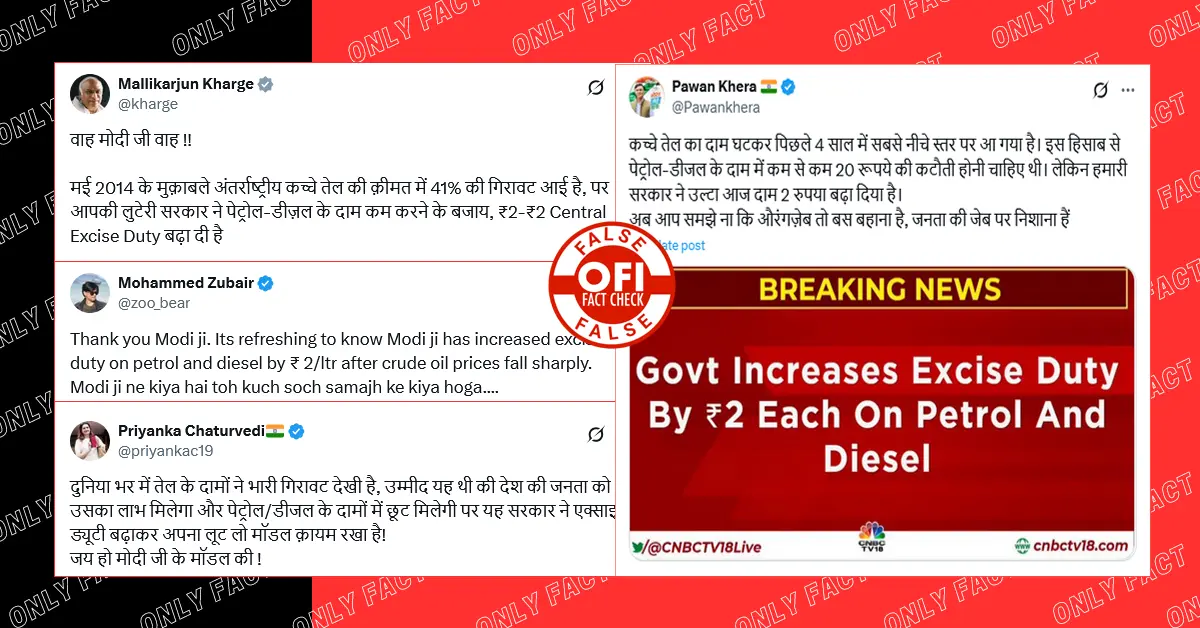

Priyanka Chaturvedi posted, ‘Oil prices have fallen drastically across the world. It was hoped that the people of the country would benefit from it and there would be a discount on petrol/diesel prices but this government has maintained its loot model by increasing the excise duty! Jai to Modiji’s model!’

दुनिया भर में तेल के दामों ने भारी गिरावट देखी है, उम्मीद यह थी की देश की जनता को उसका लाभ मिलेगा और पेट्रोल/डीजल के दामों में छूट मिलेगी पर यह सरकार ने एक्साइज ड्यूटी बढ़ाकर अपना लूट लो मॉडल क़ायम रखा है!

— Priyanka Chaturvedi🇮🇳 (@priyankac19) April 7, 2025

जय हो मोदी जी के मॉडल की ! pic.twitter.com/2uk2zzT16K

Muhammad Zubair, commenting sarcastically on PM Modi, said, ‘Thank you Modi ji. Its refreshing to know Modi ji has increased excise duty on petrol and diesel by ₹ 2/ltr after crude oil prices fall sharply. Modi ji ne kiya hai toh kuch soch samajh ke kiya hoga….’

Thank you Modi ji. Its refreshing to know Modi ji has increased excise duty on petrol and diesel by ₹ 2/ltr after crude oil prices fall sharply.

— Mohammed Zubair (@zoo_bear) April 7, 2025

Modi ji ne kiya hai toh kuch soch samajh ke kiya hoga…. pic.twitter.com/JUGJDPRLu6

Mallikarjun Kharge asserted, ‘Wow Modi ji wow!! Compared to May 2014, the international crude oil price has fallen by 41%, but instead of reducing the price of petrol and diesel, your plundering government has increased ₹ 2- ₹ 2 Central Excise Duty. You must not have felt relieved to see big and small investors in the stock market losing Rs 19 lakh crore in one go ₹ due to their Kumbhakarani sleep on the tariff policy, so your government has come to rub salt to the wound!’

वाह मोदी जी वाह !!

— Mallikarjun Kharge (@kharge) April 7, 2025

मई 2014 के मुक़ाबले अंतर्राष्ट्रीय कच्चे तेल की क़ीमत में 41% की गिरावट आई है, पर आपकी लुटेरी सरकार ने पेट्रोल-डीज़ल के दाम कम करने के बजाय, ₹2-₹2 Central Excise Duty बढ़ा दी है

टैरिफ़ नीति पर कुंभकर्णी नींद से शेयर बाज़ार में छोटे-बड़े निवेशकों का एक…

Surendra Rajput, Pawan Khera, Amock, Roshan Rai, Swati Chaturvedi, and Nimo Yadav also shared similar claims.

Also Read: Did PM Modi Really Wait for Muhammad Yunus at the BIMSTEC Summit?

Fact Check

We began our fact-checking process with a relevant Google search on the topic. This led us to a Times of India article published on April 7, 2025, which reported,“The Central government on Monday increased excise duty by ₹2 each on petrol and diesel.”

The article further mentioned, “According to a notification released by the Revenue Department under the Ministry of Finance, the excise duty on petrol was increased to ₹13 per litre and that on diesel to ₹10 per litre. While the order did not specify the impact on retail prices, industry sources indicated that retail prices are unlikely to change.”

In addition, we came across a post shared by the Ministry of Petroleum on X, which sought to dispel the panic surrounding the fuel price hike. It stated, “PSU Oil Marketing Companies have informed that there will be no increase in retail prices of petrol and diesel following the hike in excise duty rates announced today.”

PSU Oil Marketing Companies have informed that there will be no increase in retail prices of #Petrol and #Diesel, subsequent to the increase effected in Excise Duty Rates today.#MoPNG

— Ministry of Petroleum and Natural Gas #MoPNG (@PetroleumMin) April 7, 2025

This means that Public Sector Undertaking (PSU) oil companies—which are owned and operated by the Government of India—will absorb the increase in excise duty, ensuring that the additional cost is not passed on to consumers.

PSU oil companies in India are involved in various stages of the oil and gas industry, including exploration, production, refining, distribution, and marketing. Major PSU oil companies include: ONGC, IOCL, BPCL, HPCL, GAIL, Oil India Limited (OIL), and MRPL.

Excise Duty is an indirect tax levied by the government on the manufacture or production of goods within the country. In India, even after the introduction of GST, excise duty continues to apply to products such as petroleum, alcohol, and tobacco.

On the global crude oil front, prices opened the week lower after Saudi Arabia slashed the price of its flagship crude by the most in over two years. Additionally, the escalating trade war has raised fears of a global recession and weakening demand. The global benchmark Brent crude dropped nearly 4% to $63.21 per barrel—a four-year low—after an 11% decline the previous week. West Texas Intermediate (WTI) was trading at $59.79 per barrel. Meanwhile, Saudi Aramco announced a price cut of $2.30 per barrel for its key buyers in Asia starting May.

Therefore, the claim that Indian consumers will bear the burden of the increased excise duty on petrol and diesel is false. The Ministry of Petroleum has clearly stated that PSU oil companies will absorb the excise hike, and there will be no increase in retail fuel prices for consumers.

| Claim | The public will suffer due to the hike in excise duty on petrol and diesel. |

| Claimed by | Social media users |

| Fact Check | The hike in excise duty will be absorbed by PSU oil companies. There will be no impact on consumers. |

Also Read: News of Gursharan Kaur’s Security Reduced Shared With Misleading Claim