Not long ago, the opposition lobby of our country, sang the same chorus and danced to the same beat, narrating “The Tale of Gautam Das Adani.” However, since the release of the report of the expert panel set up by the Supreme Court, the voice of the opposition has started to fade, and the energy appears to flicker. Yet, the memory of the budget session of the parliament remains unforgettable, when the disruptive opposition raised the issue of the Adani-Hindenburg episode. It was a time when session disruptions and insults to the temple of democracy became routine, marked on the calendar of opposition parties led by the Congress. Amidst the cacophony, the opposition claimed that the Modi government had destroyed and would bankrupt financial institutions like the State Bank of India(SBI) and the Life Insurance Corporation(LIC).

Regardless, the people of India’s unflinching trust remained steadfast, and the opposition’s attack was confined to Twitter trends. The black sartorial parade by the leaders of the Congress Party was limited to newspaper photos and public ogling.

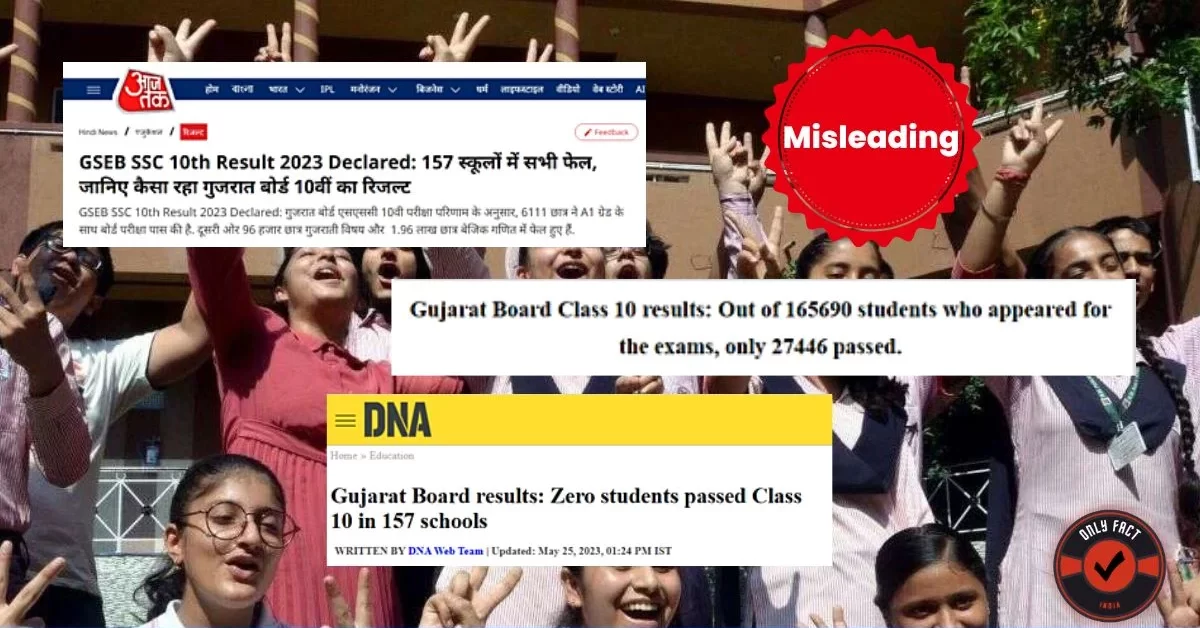

Below, I present some infamous tweets driven by allegations, aimed at harming Indian businessman Gautam Adani and launching an attack on Indian PM Narendra Modi.

In February 2023, Congress tweeted.

This tweet is also from the same time.

A tweet by Mahua Moitra.

Rahul Gandhi’s tweet from March 2023.

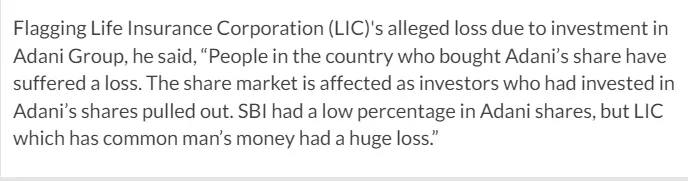

While speaking with Hindustan Times, Congress party stalwart Digvijay Singh, levelled allegations against the Adani.

AAP MP Sanjay Singh said the lives of crores of families will be destroyed who invested in LIC and SBI.

You should have a good notion of the type of attack launched against Indian industrialist, Gautam Adani by now. The concern is whether LIC and SBI will go bankrupt soon and people’s money will be lost permanently, as opposition leaders claim. Is the stability of financial institutions in jeopardy? Is the Congress Party instilling genuine fear?

In this fact-checking article, we will carefully analyze the available evidence and expert opinions to determine the accuracy of this claim and provide readers with a reliable assessment of the situation.

Fact Check

In recent times, four significant stories have dominated the headlines across the country. Firstly, the release of the Supreme Court panel’s findings on the Adani-Hindenberg issue has garnered widespread attention. Secondly, the Congress party’s remarkable victory in the Karnataka assembly elections has become a prominent highlight. Moving on, the State Bank of India’s report on the fourth quarter has attracted substantial interest, closely followed by the Life Insurance Corporation’s announcement of its Q4 results. These stories have captivated the nation’s focus and hold great significance in the nation’s current political and financial landscape.

Our fact-checking approach started with the Supreme Court expert committee panel report.

According to the Indian Express, ‘The expert panel concluded that Adani’s manipulation of stock price could not be established. SEBI’s vigilant surveillance system did not uncover any instances of price manipulation or compromised price discovery. The panel found no evidence of regulatory failure in this regard.’

‘The system generated 849 alerts regarding Adani stocks. Stock exchanges reviewed these alerts and submitted four reports to SEBI. Two reports were filed before the Hindenburg report, and two were filed after January 24, 2023. The report examined multiple periods of time and found no evidence of artificial trading or repeated “wash trades” between the same parties.’ the report said.

The expert panel also gave significant insight into the topics of market volatility, investor awareness, and regulatory failure.

However, most of the attacks from the opposition parties came on the issue of price manipulation and artificial trading, on which the Supreme Court expert gave a clean chit to the Adani group.

To further substantiate the findings of the Supreme Court, we looked for the SBI and LIC Q4 reports.

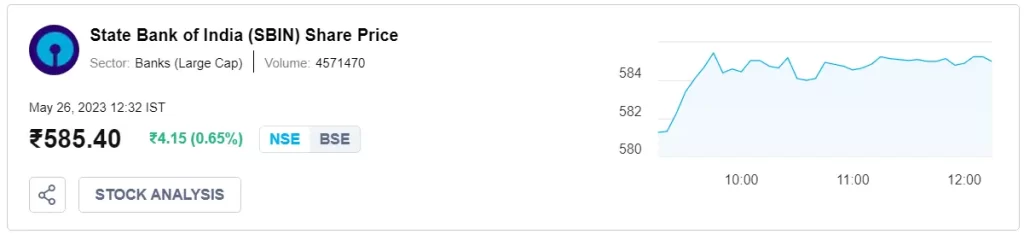

According to Business Today, SBI Q4 results: Net profit jumps 83% to Rs 16,695 crore; lender announces dividend of Rs 11.30 per share.

According to the report, the bank’s Q4 profit increased by 83.18%. It reached Rs 16,694.51 crore, compared to Rs 9,113.53 crore in the same period last year. Sequentially, the lender recorded a 17.52 rise in its March 2023 quarter profit. The bank earned Rs 92,951.06 crore as interest income in Q4 FY23 against Rs 70,733.25 crore in the year-ago period.

Moreover, SBI announced that its net profit for FY23 exceeded Rs 50,000 crore. It reached Rs 50,232 crore, reflecting a growth of 58.58% compared to the previous year. Notably, according to the SBI chairman, the bank loan to the Adani group is just 0.88% of its total.

On the basis of the report and today’s opening at the stock market, it’s clear beyond a doubt that the state-run SBI is functioning well enough. The data clearly suggests that the public’s money is safe, secure, and in good, profitable hands.

Additionally, upon a thorough examination of the Life Insurance Corporation (LIC) Q4 report, it became conclusive that the most challenging period has been overcome, and the Adani Group, LIC, and SBI have demonstrated resilience in enduring the trials of the time.

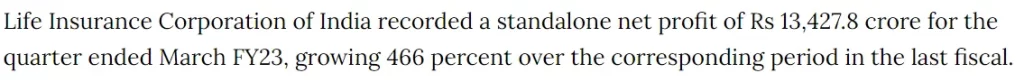

According to Money Control, “In the quarter ending in March FY23, LIC achieved a standalone net profit of Rs 13,427.8 crore. This represents a significant growth of 466% compared to the same period in the previous fiscal year..”

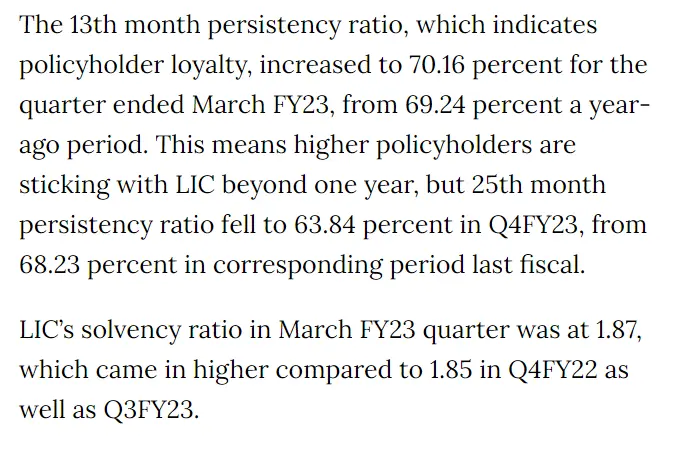

Most importantly, the report further cleared the air, ‘In the quarter ending in March FY23, the 13th-month persistency ratio of Life Insurance Corporation of India (LIC) rose to 70.16 percent. This indicates an increase in policyholder loyalty, as more policyholders are staying with LIC beyond one year. However, the 25th-month persistency ratio fell to 63.84 percent in Q4FY23 compared to 68.23 percent in the corresponding period of the previous fiscal year.’

Additionally, In the March FY23 quarter, Life Insurance Corporation of India (LIC) had a solvency ratio of 1.87. This ratio was higher than both the solvency ratio of 1.85 in Q4FY22 and the solvency ratio of Q3FY23.

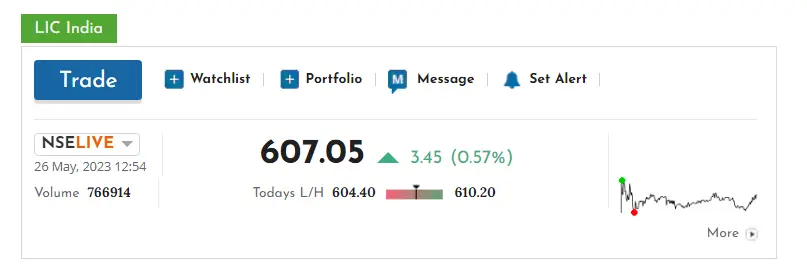

Moreover, on 26 May, the LIC share prices started bullish.

Furthermore, on May 24, Live Mint reported that LIC’s total stake in all Adani firms is valued at around ₹44,600 crores as against around ₹39,200 crores at the end of March. Based on the reports by, the Times of India, the exposure of LIC to the Adani group is less than 1 percent of its total investment.

The report also displayed the list of Adani’s enterprises in which the LIC has a stake.

If you look closely at the chart you will see that most of the investment is in ‘tangible assets.’ For instance- Adani Ports & SEZ, Adani Total Gas, Ambuja Cements, Adani Transmission, and Adani Enterprises are all infrastructural sectors. Simply put, these sectors are the engine of the economy. If the Indian economy has to grow at more than 6 percent, as the ADB data suggests, then the above-mentioned sectors ought to grow.

To corroborate my point, I will exhibit the article written by Alex Travelli and published in the New York Times. The article is titled, “After Nearly Collapsing, Indian Billionaire’s Stock is Back on the Rise.”

It stated, “There were many factors behind the Adani Group’s survival over the past four months. It had loyal investors among Indian state-run institutions, and bargain hunters came in and bought stock on the low. The other reason: Adani had tangible assets, mostly infrastructure projects, that were there for everyone to see. These businesses, whatever they were worth, had value that many investors found appealing.”

Therefore, with all the pieces of evidence presented above, it’s safe to say that the Indian business tycoon and the state-run financial organisation are in no financial danger. Regrettably, the sole adversity they encounter pertains to the unfounded accusations hurled by opposition factions, driven by their narrow political motives.

Nonetheless, there is no denying the fact that the foreign concocted conspiracy circulated in the cloak called the ‘Hindenburg Report,’ has tried its best to bleed dry the Adani group. In contrast, the above report suggests a different story. A story of resilience, faith and belief in one’s motives.

In conclusion, it is evident that opposition parties, fueled by foreign evil forces, sought to undermine India’s economic growth by spreading unverified and half-baked stories. However, their attempts have proven futile in the face of overwhelming evidence. The Indian financial system has emerged stronger than ever, providing a sense of security for investors, both in the short and long term. As a result, it is now more than ever a promising time to invest in India’s thriving economy. With solid foundations and resilient institutions, India stands poised to continue its upward trajectory, defying the unfounded narratives propagated by its detractors. In the pursuit of progress and prosperity, the nation remains steadfast, resilient, and open for business.

| Claim | PM Modi and Adani together bankrupted the state fun financial institutions like- SBI and LIC. |

| Claimed by | Indian opposition parties |

| Fact check | Misleading |

Also read: No, the Government of India didn’t contempt Supreme Court by bringing Ordinance

The goal of the Only Fact Team is to provide authentic news facts and debunk lies to safeguard readers’ interests.

Dear Readers, we are working to debunk fake news which is against India. We don’t have corporate funding like others. Your small support will help us grow further.

If you like our work, support and donate us using the Livix Media Foundation QR code.

Jai Hind!