A viral video on social media claims that since Narendra Modi assumed office in New Delhi, the Indian rupee has significantly depreciated against the UAE dirham. It suggests that under the UPA government led by Manmohan Singh, 1 dirham was equivalent to 13 rupees, whereas by 2024, this rate has reportedly climbed to 24 rupees per dirham. The video claims that this change is a result of a decline in the effectiveness of India’s foreign policy under Modi’s leadership, suggesting that the rupee’s devaluation signals a weakening of India’s international standing.

Ravi Nair while sharing the video asserted, ‘He is wrong. Completely wrong. The rupee did not fall, but the UAE Dirham became stronger.If you have any doubt, ask @nsitharaman’

He is wrong. Completely wrong.

— Ravi Nair (@t_d_h_nair) November 12, 2024

The rupee did not fall, but the UAE Dirham became stronger.

If you have any doubt, ask @nsitharaman pic.twitter.com/Im39izAwmb

Amoxicillin claimed, ‘Bro exposed very Brutally Modi’s Danka in the Airport. This must go viral now.‘

Bro exposed very Brutally Modi's Danka in the Airport 😂🔥

— Amoxicillin (@__Amoxicillin_) November 11, 2024

This must go viral now. pic.twitter.com/CARa21mHoI

Mohit Chauhan wrote, ‘Bro exposed Modi’s Danka.’

Bro exposed Modi's Danka😭 pic.twitter.com/AtIDH0mWYW

— Mohit Chauhan (@newt0nlaws) November 11, 2024

Soniye stated, ‘Now the money is in danger!! 1 dirham=23 Rs. Thank you Modi ji’

अब तो रुपया खतरे में हैं !!

— Soniye (@Soneva_24) November 12, 2024

1 dirham=23 Rs

धन्यवाद मोदी जी pic.twitter.com/B3tr3zitHI

Additionally, Vikas Bansal, Harmeet Kaur, and Janak Keshriya also shared these claims.

Also Read: Claim About Lok Sabha Speaker’s Daughter Anjali Birla Marrying a Muslim Is Misleading

Fact Check

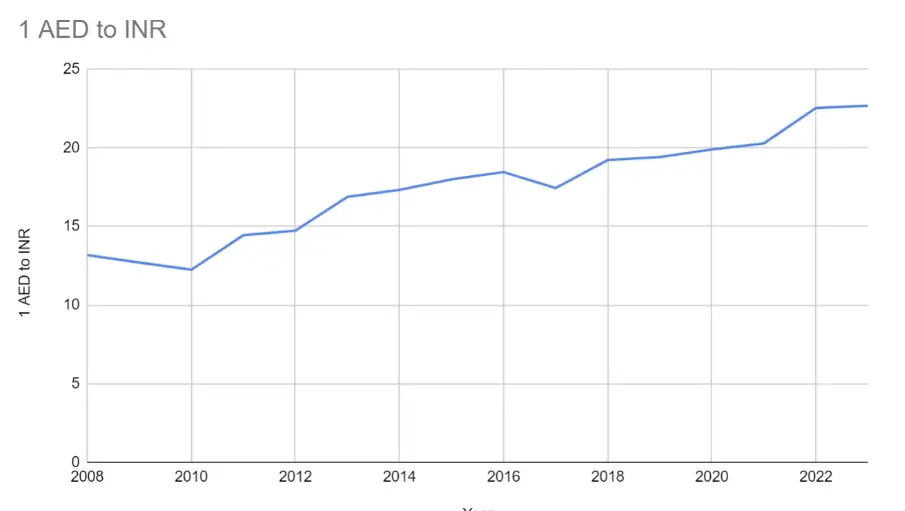

Our fact-checking began with a basic Google search to verify the value of the dirham (AED) just before the Congress-led government in India ended its term in May 2014. We found data of on Book My Forex indicating that in 2014, 1 AED was approximately 17 INR—not 13 INR, as some claims suggest. Today, a decade later, 1 AED is valued around 23 INR, confirming that in 2014, the dirham was indeed valued above 16 INR, not 13 INR as the video claims.

Looking back to when the Congress government took power in 2004, we noted that 1 AED was equal to 12 INR. This provides insight into how the dirham-INR exchange rate evolved over the Congress-led government’s ten-year tenure.

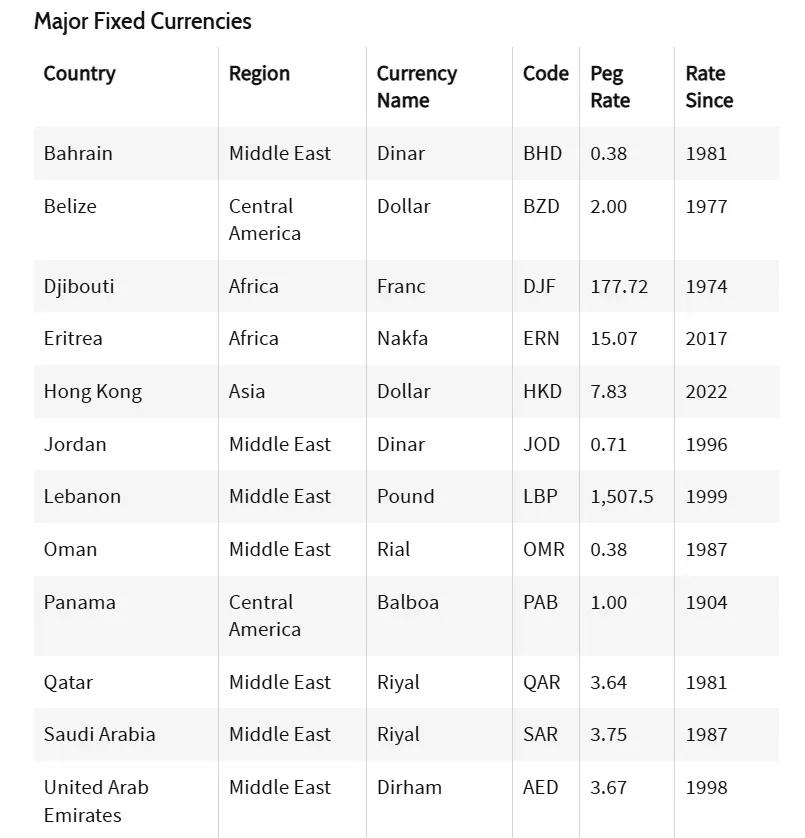

Our next step revealed that the UAE’s currency, the dirham, is pegged to the US dollar, as noted by financial data website OANDA. The UAE dirham has been set to a fixed exchange rate of 1 USD = 3.6725 AED since 1997. This peg to the dollar means that the dirham’s value moves with the dollar’s performance in international markets, keeping the exchange rate stable for trade and economic predictability.

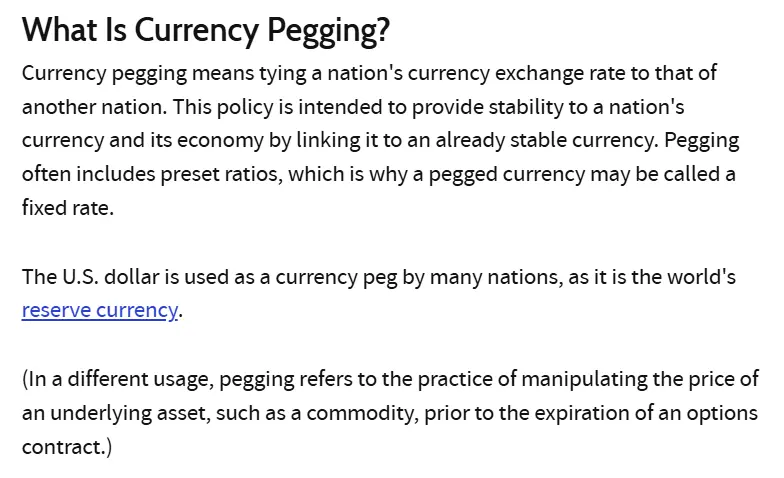

What is pegging of currency?

According to Investopedia, currency pegging links one country’s currency to another (often a stronger or more stable one) to help stabilize the currency and economy. Pegging also helps control currency fluctuations that could impact international trade. The US dollar is widely used as a peg due to its status as a global reserve currency. For countries reliant on exports, pegging to the dollar removes currency volatility, supporting smoother trade operations.

Other countries also peg their currencies to the dollar. Caribbean nations, for example, rely on tourism and maintain currency stability by pegging to the dollar. In the Middle East, nations like Jordan, Oman, Qatar, Saudi Arabia, and the UAE peg to the dollar, stabilizing their economies and facilitating major trade activities, especially in oil.

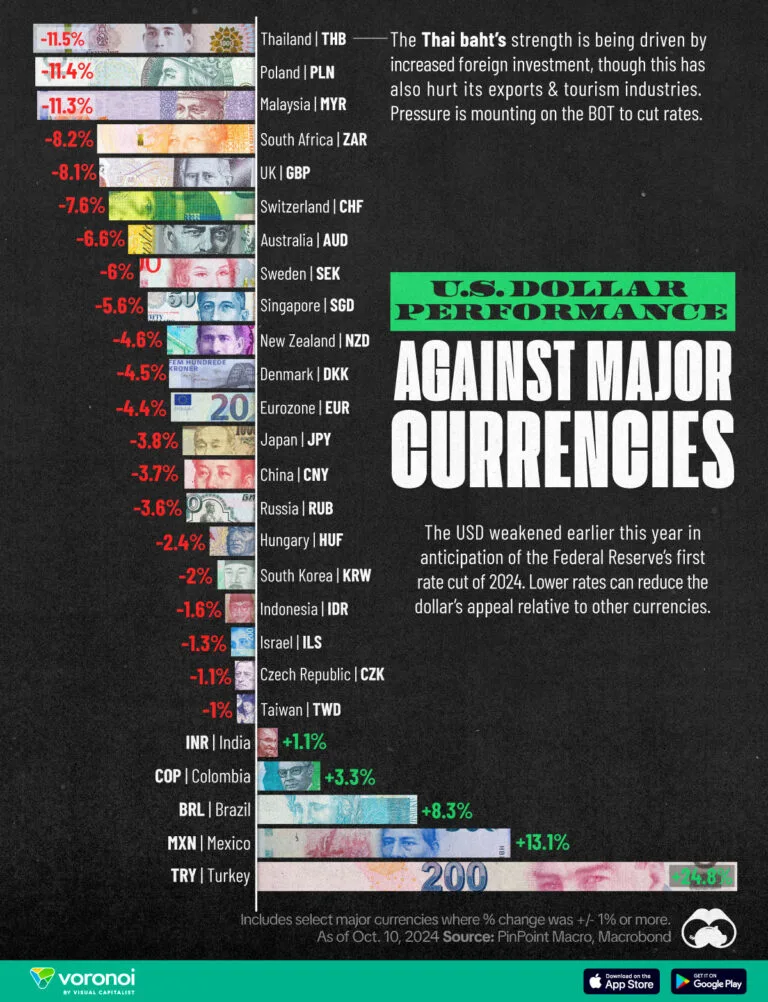

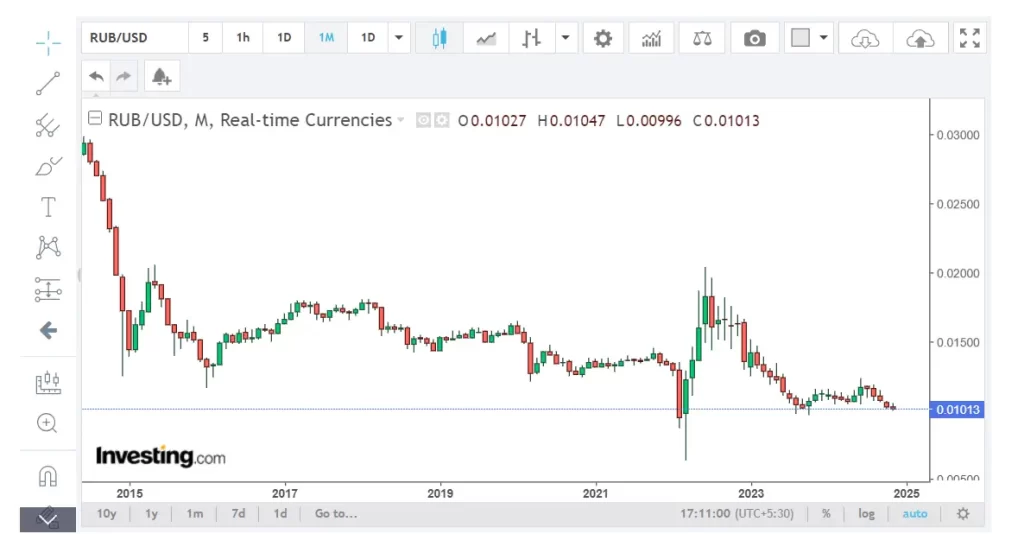

Since the dirham’s value is pegged to the USD, it fluctuates as the dollar strengthens or weakens. Over the past five years, the dollar has appreciated against most major currencies, reflecting its strong performance globally. For instance, the dollar-yen exchange rate went from 105 in 2014 to 154.94 today. Similarly, the dollar-ruble rate jumped from around 34 in 2014 to 98.55 now. This strong performance of the USD has likewise raised the dirham’s relative value. Notably, the value of the dirham has appreciated not only against the rupee but also against other major currencies. For example, in 2014, 1 dirham was approximately equal to 29 Japanese yen, whereas in 2024, it stands around 42 yen—an increase of 13 yen in last ten years. This reflects the strengthening of the dollar over this period, to which the dirham is pegged.

In fact, as shown in the chart above, the Indian rupee is among the few currencies—along with the Colombian peso, Brazilian real, Mexican peso, and Turkish lira—that have fared relatively well against the USD. In contrast, most global currencies have performed significantly worse against the dollar.

To illustrate this effect in 2004, 1 USD was about 45.32 INR, making 1 AED roughly 12 INR. By 2014, with the dollar at around 61 INR, 1 AED was approximately 16 INR. Today, with 1 USD at 84 INR, 1 AED is roughly 23 INR. This correlation underscores that the AED’s valuation is tied to the USD.

Did the rupee perform significantly worse under the NDA Government?

No. According to a June 2024 article in the Indian Express, from April 2014 to mid-2024, the rupee depreciated by 27.7% against the dollar. By comparison, during the previous UPA government’s decade-long tenure, the rupee had depreciated by 26.5%. This suggests that while the rupee’s value has indeed declined, this trend is not dramatically worse than in the previous decade.

Conclusion:

- In 2014, the dirham-INR rate was over 16 INR, not 13 INR.

2. The AED is a pegged currency with a fixed exchange rate to the USD, meaning its value rises or falls with the dollar.

3. Given the dollar’s strong performance in recent years, the rise in AED’s valuation against the INR is more a reflection of dollar strength than Indian foreign policy. Thus, attributing the dirham’s appreciation against the rupee to a decline in India’s foreign policy under NDA leadership lacks substantial basis.

Also Read: Indian States Outshine in GDP Per Capita Against Global Comparisons, Viral Infographic is Misleading