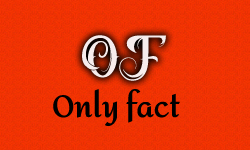

Dhruv Rathee, a propagandist known for his staunch advocacy and alignment with the INDI alliance, recently released a video containing several contentious assertions regarding the actions of the Modi government. Among these claims are allegations of preferential treatment towards certain businesses, such as the waiving of loans for businessmen, and the accusation that the government exerted pressure on electricity companies to procure a significant portion of imported coal from the Adani Group. Essentially, Rathee has accused PM Modi of engaging in crony capitalism by allegedly favouring the business groups.

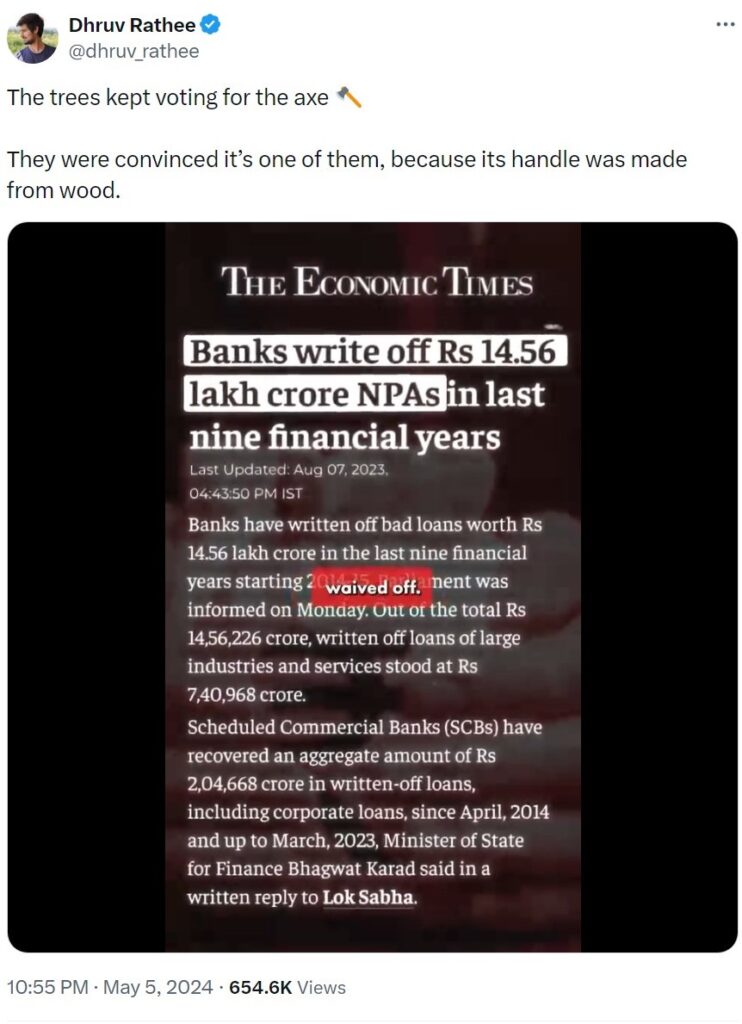

The trees kept voting for the axe 🪓

— Dhruv Rathee (@dhruv_rathee) May 5, 2024

They were convinced it’s one of them, because its handle was made from wood. pic.twitter.com/o7zFUv7rzw

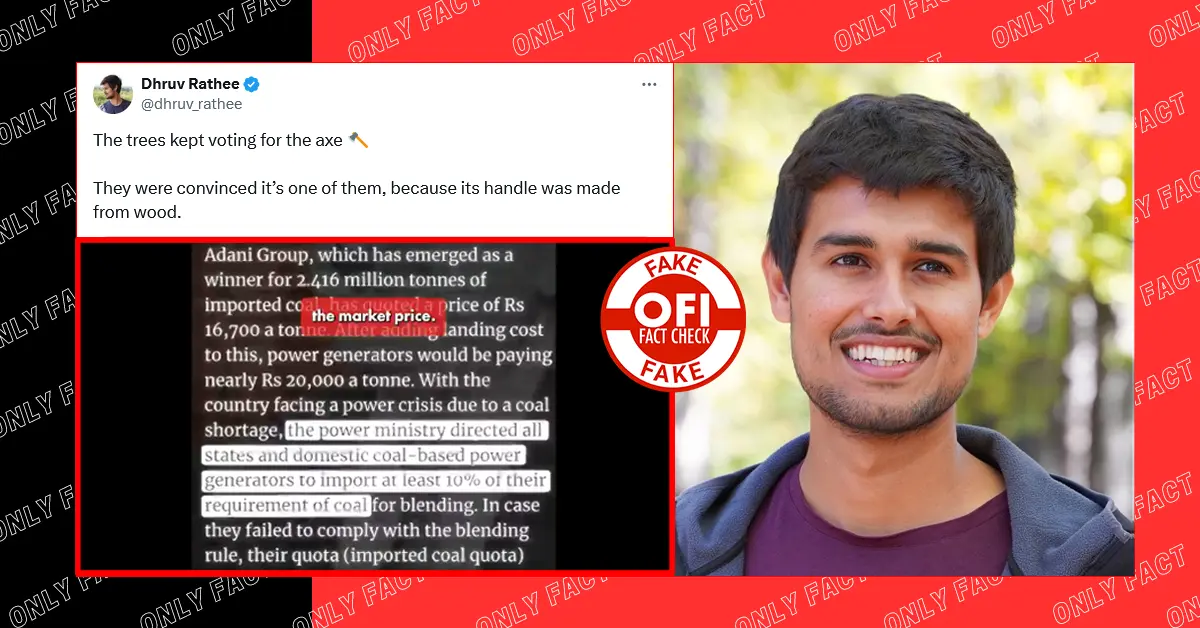

Also Read: CEAT Tyres Ad With Tagline “Modi Hatao” is Edited

Claim: An order was issued stating that government companies will exclusively import coal from Adani, with an additional 10% margin requirement.

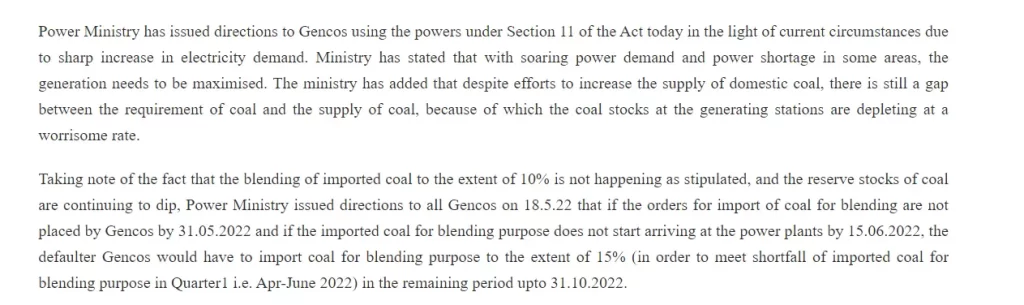

Fact: Following the initiation of our investigation, we uncovered a press release issued by the Press Information Bureau (PIB) on May 27, 2022. The press release outlines directives from the Ministry of Power, invoked under Section 11 of the Act, in response to the current circumstances marked by a significant surge in electricity demand. The Ministry emphasizes the urgent need to maximize power generation, acknowledging a persistent gap between the demand for coal and its domestic supply, leading to the alarming depletion of coal stocks at power stations.

In light of the observed shortfall in the blending of imported coal as mandated, coupled with declining coal reserves, the Ministry issued directives to all Generating Companies (Gencos) on May 18, 2022. These directives stipulated that if Gencos fail to place orders for coal imports for blending by May 31, 2022, and if the imported coal fails to arrive at power plants by June 15, 2022, the defaulting Gencos would be required to import coal for blending purposes to the extent of 15% to bridge the shortfall in Quarter 1 (April-June 2022) by October 31, 2022.

Section 11 of the Electricity Act, 2003, states that under extraordinary circumstances, the government can ask power-generating companies to operate and maintain output in accordance with the directions given. It also states that an appropriate commission may consider offsetting the adverse financial impact of the directions on any generating company in such a manner as it considers appropriate.

Government’s Strategy to Address Coal Shortages: Management and Imports

The government’s approach to managing electricity demand and coal imports has evolved over time, as highlighted in various reports. Initially, in May 2022, Gencos was mandated to blend 10 per cent of their coal requirement with imports. However, this requirement was later relaxed in August when power demand decreased.

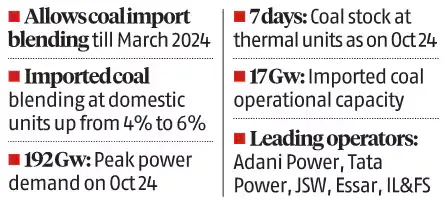

Subsequently, in January 2023, the mandate was reinstated at 6 per cent and then adjusted to 4 per cent in September to accommodate changes in domestic coal availability.

Following this, in October 2023, the threshold for coal imports was increased back to 6 per cent, with an extension until June 2024. The anticipated power demand during the summer months was expected to rise significantly.

This pattern illustrates the government’s responsiveness to fluctuating electricity demand and coal supply dynamics, aimed at ensuring uninterrupted power supply for the welfare of the people.

Contrary to assertions made by Dhruv Rathee, there is no indication of malice or corruption in these policy adjustments; rather, they are made in the best interest of providing quality living standards for the citizens of India.

Multiple Operators Are Involved in Importing Coal

According to the Business Standard report, Adani Power, Tata Power, JSW, Essar, and IL&FS are among the prominent coal operators in India, indicating that multiple companies besides the Adani Group are involved in coal imports.

No Wrongdoing Found in Awarding Coal Import Contract to Adani Group

Contrary to Dhruv Rathee’s portrayal in his video, recent reports from reputable sources reveal a more nuanced picture regarding coal imports and contracts involving the Adani Group. For instance, a report by The New Indian Express on July 16, 2022, disclosed that Adani Group had indeed secured a contract to supply coal, quoting Rs 4,033 crore for 2.416 million tonnes, competing with other companies like Bara Daya Energi. Notably, Coal India Limited (CIL) received orders from multiple state gencos and independent power producers for coal imports, indicating a competitive bidding process.

Similarly, a report by Live Mint on June 21, 2022, highlighted that Adani Enterprises, Mohit Minerals, and Chettinad Logistics were among several importers vying for coal import tenders led by Coal India.

Additionally, in an Indian Express report from July 5, 2022, Adani Enterprises emerged as the lowest bidder in Coal India’s tender for importing dry fuel, offering over Rs 4,000 crore for the supply of 2.416 million tonnes. However, Adani’s bid was Rs 900 crore higher than Coal India’s own estimate. Officials are considering further negotiations regarding the price quoted by the lowest bidder. The report also mentioned that Adani Group and ten other companies expressed interest in Coal India’s maiden coal import tender for supplying dry fuel on a freight-on-road (FOR) basis. Among them were Mohit Minerals, Chettinad Logistics, and a few coal exporting agencies from abroad.

These reports collectively indicate that Adani Group’s involvement in coal imports stemmed from a competitive tender process, rather than any impropriety, as suggested by Rathee.

Overall, Rathee’s video fails to provide a comprehensive and accurate understanding of the situation, presenting a deceptive portrayal of both the government’s policy decisions regarding coal imports and Adani Group’s participation in the process.

Claim: Dhruv Rathee also said in his video that the government waived off loans for businessmen, citing a report from the Economic Times indicating that banks “wrote off” Rs 14.56 lakh crore worth of Non-Performing Assets (NPAs) in the last financial year.

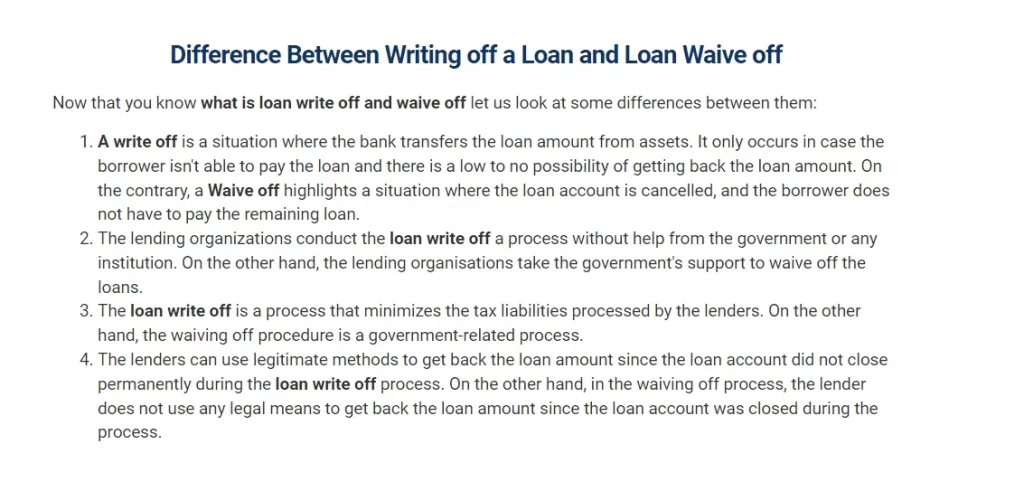

Fact: First it’s important to understand the difference between loan write-offs and loan waivers. A loan write-off occurs when a bank or lender removes a loan from its books, even if the entire amount is not cleared. This does not absolve the borrower of their obligation to repay, and the lender may still pursue recovery efforts in the future.

Conversely, a loan waiver is granted when the borrower is unable to repay the loan due to financial difficulties. In such cases, the borrower is relieved of the obligation to repay, and the lender cancels the debt entirely. It’s crucial for lenders to conduct thorough assessments before granting loan waivers to ensure the legitimacy of the borrower’s financial challenges.

Government Actions After Loan Write-Off: Exploring the Next Steps

In 2016, the Modi government introduced the Insolvency and Bankruptcy Code (IBC), which was enacted through parliamentary legislation and received Presidential assent in May of the same year. The IBC was implemented to address issues surrounding insolvent companies, providing a comprehensive solution to resolve insolvencies that were previously protracted and economically unviable. This legislation aims to safeguard the interests of small investors and streamline the business process, particularly by addressing the challenges posed by bad loans in the banking system.

The IBC has transformed the dynamics of the debtor-creditor relationship by establishing a time-bound process for insolvency resolution. Major cases have been successfully resolved within two years, with others progressing towards resolution. The code empowers creditors to take control of debtor assets upon default and make decisions to resolve insolvency. Both debtors and creditors have the option to initiate recovery proceedings under the IBC.

Under the IBC, companies are required to complete the entire insolvency process within 180 days. Extensions to this deadline are granted if creditors do not object, with smaller companies and startups with an annual turnover of Rs 1 crore mandated to complete insolvency proceedings within 90 days, extendable by 45 days. Failure to resolve debt results in liquidation of the company.

Recovery of Bad Loans Through IBC: Current Status

According to a report from The New Indian Express dated February 20, 2024, the Insolvency and Bankruptcy Code (IBC) has successfully resolved 891 cases of loan defaults involving bank loans totalling Rs 10 lakh crore by December 2023. These resolutions resulted in the recovery of Rs 3.2 lakh crore, equivalent to 32% of the total claims admitted by banks and financial institutions. Additionally, during this period, 2,376 defaulting companies were directed to undergo liquidation.

Conclusion:

In summary, Dhruv Rathee’s video presents a distorted and misleading narrative regarding the government’s policy decisions on coal imports and its interactions with the Adani Group. While the Ministry of Power initially mandated a 10 per cent coal import requirement for Generating Companies (Gencos) in response to power demand and coal availability concerns, subsequent adjustments were made as circumstances evolved, with the import ceiling being gradually reduced to zero and then to 4 and 6 per cent.

Furthermore, it is crucial to acknowledge that the Adani Group’s involvement in coal imports followed a competitive tender process, indicating fair and transparent procedures. Reports suggest that their contracts were secured through legitimate means, rather than any improper dealings.

Additionally, Dhruv Rathee’s allegations regarding the waiver of loans for Non-Performing Assets (NPAs) are unfounded. The government’s actions instead involved writing off these loans to facilitate the sale or liquidation of assets, aiming to recover owed funds. Rathee’s portrayal misleads his audience by inaccurately depicting the government’s measures, thus failing to provide a comprehensive understanding of the situation.

| Claim | The Modi government assists large business groups by forgiving their loans and procuring costly coal. |

| Claimed by | Dhruv Rathee |

| Fact Check | Fake |