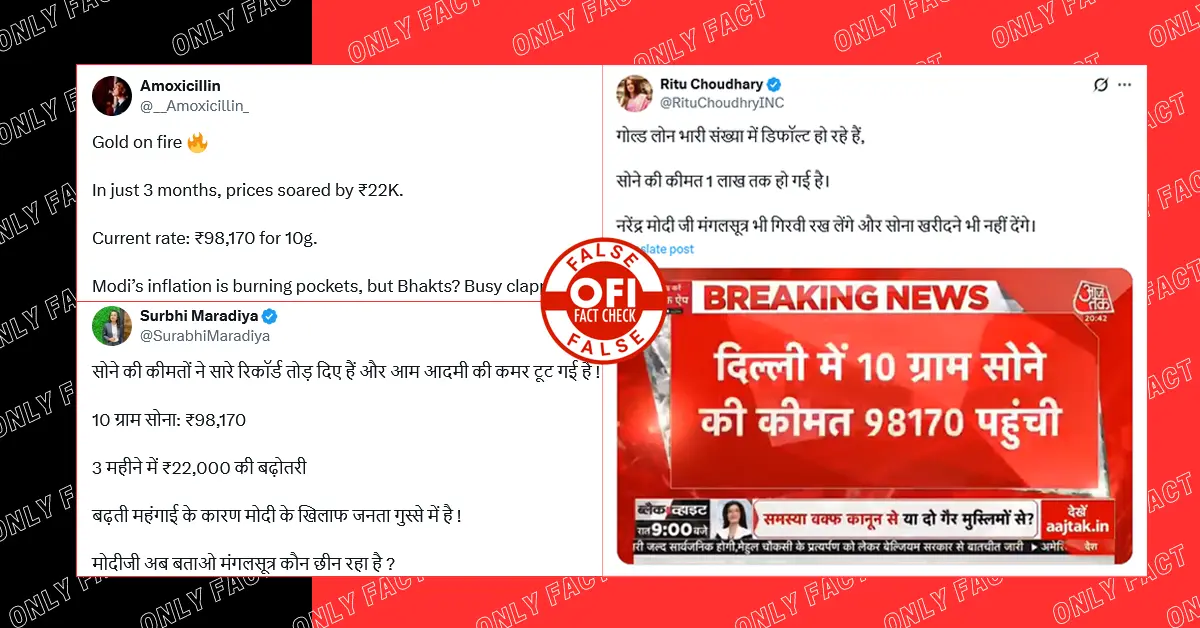

A claim circulating on social media suggests that inflation in India is at an all-time high, citing the rise in gold prices to ₹98,170 per 10 grams—an increase of ₹22,000 in just three months. Users are blaming the Modi government, alleging that the common man is being crushed by inflation. However, our fact-check finds these claims to be misleading.

Amock claimed, ‘The gold prices have broken all the records and back of common man. 10g gold : ₹98,170. Increased by ₹22,000 in 3 months. There is massive anger on ground against Modi due to skyrocket inflation. Sanghis will call it masterstroke.’

BREAKING NEWS 🚨

— Amock_ (@Amockx2022) April 18, 2025

The gold prices have broken all the records and back of common man

10g gold : ₹98,170

Increased by ₹22,000 in 3 months

There is massive anger on ground against Modi due to skyrocket inflation. 🔥

Sanghis will call it masterstroke 😂 pic.twitter.com/NmJLf42fYf

Amoxicillin wrote, ‘Gold on fire. In just 3 months, prices soared by ₹22K. Current rate: ₹98,170 for 10g. Modi’s inflation is burning pockets, but Bhakts? Busy clapping. Masterstroke? More like Disaster-stroke! Inflation is the real jumla.’

Gold on fire 🔥

— Amoxicillin (@__Amoxicillin_) April 18, 2025

In just 3 months, prices soared by ₹22K.

Current rate: ₹98,170 for 10g.

Modi’s inflation is burning pockets, but Bhakts? Busy clapping.

Masterstroke? More like Disaster-stroke!

Inflation is the real jumla. pic.twitter.com/5bXQxU1hUL

Surbhi Maradiya asserted, ‘Gold prices have broken all records and the common man is broke! 10 gram Gold: ₹ 98,170. Increase of ₹ 22,000 in 3 months People are angry against Modi due to rising inflation. Modiji, now tell me who is snatching the mangalsutra?’

सोने की कीमतों ने सारे रिकॉर्ड तोड़ दिए हैं और आम आदमी की कमर टूट गई है !

— Surbhi Maradiya (@SurabhiMaradiya) April 18, 2025

10 ग्राम सोना: ₹98,170

3 महीने में ₹22,000 की बढ़ोतरी

बढ़ती महंगाई के कारण मोदी के खिलाफ जनता गुस्से में है !

मोदीजी अब बताओ मंगलसूत्र कौन छीन रहा है ? pic.twitter.com/GNqSm7Rbvu

Ritu Choudhary, Anindya Das and Amar Singh Chauhan shared a similar claim.

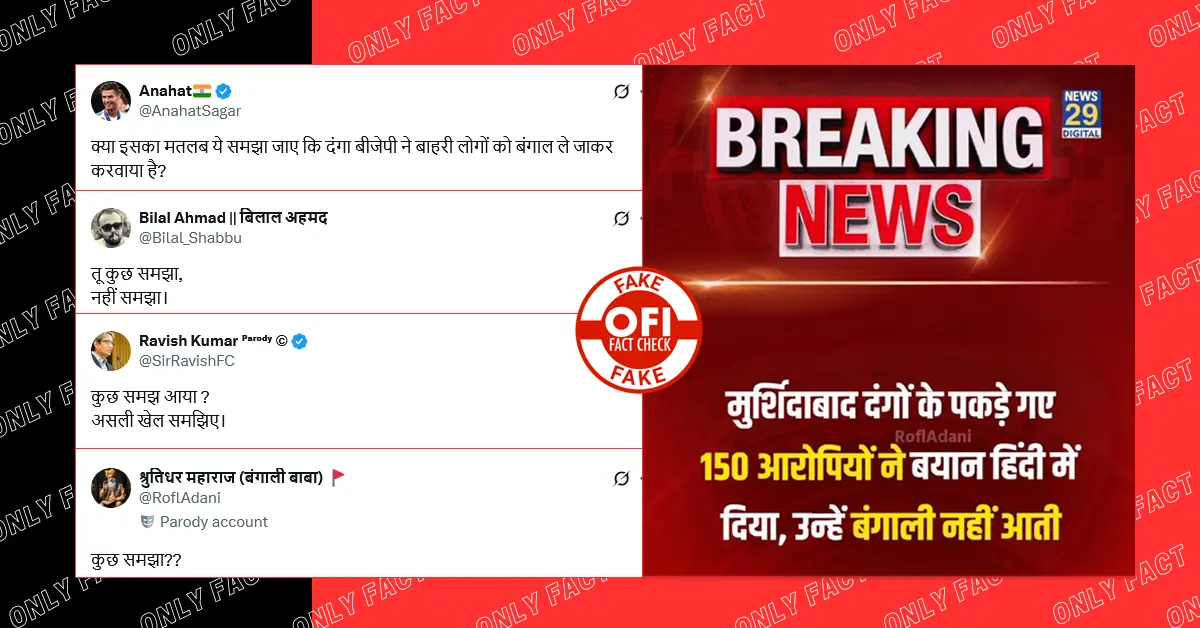

Also Read: Viral Graphic Falsely Claims 150 Accused in Murshidabad Violence Gave Statements in Hindi

Fact Check

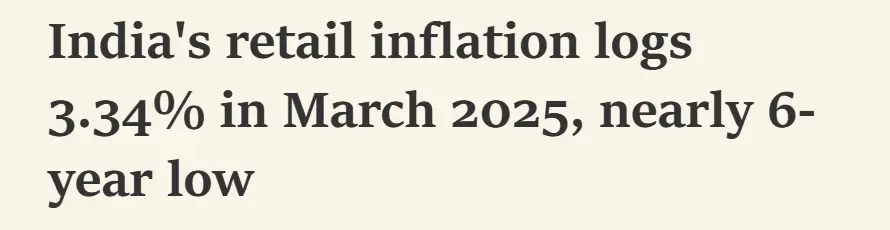

We began our fact-checking by reviewing relevant news articles on the topic. We found The Times of India article from April 15, 2025, which reported that India’s retail inflation dropped to a nearly six-year low of 3.34% in March, mainly due to cheaper vegetables and protein-rich foods. This decline comes after a recent interest rate cut by the Reserve Bank of India (RBI), which predicts an average inflation of 4% for the fiscal year 2025-26. Wholesale price inflation also fell to a six-month low of 2.05%, driven by lower prices for vegetables and essential food items.

The Times of India article further explained that retail inflation slightly decreased to 3.34% in March, the lowest in nearly six years, thanks to falling prices of vegetables and protein-rich foods. The Consumer Price Index (CPI)-based inflation was 3.61% in February and much higher at 4.85% in March the previous year. This is the lowest inflation rate since August 2019, when it was 3.28%. Food inflation, a major part of the CPI, also dropped to 2.69% in March from 3.75% in February. In comparison, food inflation was 8.52% in March 2024.

The top five items with the highest year-on-year price increases in March 2025 were coconut oil (56.81%), coconut (42.05%), gold (34.09%), silver (31.57%), and grapes (25.55%), according to the Ministry of Statistics & Programme Implementation. On the other hand, the items with the biggest price drops were ginger (-38.11%), tomato (-34.96%), cauliflower (-25.99%), jeera (-25.86%), and garlic (-25.22%).

We also found a press release from the Press Information Bureau (PIB) dated April 16, 2025. It stated that retail inflation in India, measured by the Consumer Price Index (CPI), which tracks the cost of everyday goods and services, fell to a notable 4.6% in the fiscal year 2024-25, the lowest since 2018-19. This achievement shows the success of the Reserve Bank of India’s growth-friendly policies, which have balanced economic growth with stable prices. The year-on-year inflation rate for March 2025 dropped to 3.34%, down 27 basis points from February 2025, marking the lowest monthly inflation since August 2019.

The PIB press release further noted, Food Inflation: The year-on-year food inflation, based on the Consumer Food Price Index (CFPI), was 2.69% in March 2025, the lowest since November 2021, down significantly from the previous month.

Rural food inflation: 2.82%

Urban food inflation: 2.48%

Reasons for the Drop: The decline in food prices was driven by lower inflation in categories like vegetables, eggs, pulses, meat, fish, cereals, and milk products.

Rural Inflation: Both overall and food inflation in rural areas saw significant declines.

Overall inflation fell from 3.79% in February to 3.25% in March.

Food inflation dropped from 4.06% to 2.82%.

Urban Inflation: Overall inflation in urban areas slightly increased to 3.43% in March from 3.32% in February, but food inflation fell significantly from 3.15% to 2.48%.

Housing Inflation: In urban areas, housing inflation rose slightly to 3.03% in March from 2.91% in February.

Fuel & Light: Inflation in this category increased to 1.48% in March from -1.33% in February, for both rural and urban areas.

Education Inflation: Education-related inflation rose slightly to 3.98% from 3.83% the previous month.

Health Inflation: Health-related prices increased mildly, with inflation at 4.26% in March, up from 4.12% in February.

Transport & Communication: Inflation in this category rose to 3.30% in March from 2.93% in February.

Items with Highest Inflation: In March 2025, the top five items with the biggest price increases were coconut oil (56.81%), coconut (42.05%), gold (34.09%), silver (31.57%), and grapes (25.55%).

Items with Lowest Inflation: The items with the largest price drops were ginger (-38.11%), tomato (-34.96%), cauliflower (-25.99%), jeera (-25.86%), and garlic (-25.22%).

Retail inflation in India has been steadily decreasing over the past three years, dropping from 6.7% in 2022–23 to 5.4% in 2023–24, and further to 4.6% in 2024–25. This consistent decline reflects the Reserve Bank of India’s careful monetary policies and the Government of India’s efforts to address supply issues and stabilize prices of essential goods. This downward trend has helped reduce the cost-of-living burden and created a more stable environment for economic growth.

We also found a Press Information Bureau (PIB) press release dated April 9, 2025. It reported that the Monetary Policy Committee (MPC), in its 54th meeting and the first of the financial year 2025–26, unanimously agreed to cut the policy repo rate by 25 basis points, lowering it to 6% effective immediately. The repo rate is the interest rate at which the Reserve Bank of India (RBI) lends money to commercial banks, and reducing it aims to encourage more lending and investment. This decision was made during a period of growing global economic uncertainty, with trade tensions causing lower crude oil prices, a weaker US dollar, falling bond yields, and corrections in stock markets. While central banks worldwide are tweaking their policies to address local issues, they are proceeding carefully.

The MPC meeting also forecasted CPI inflation for the year 2025-26. According to the PIB press release, the projected CPI inflation is 3.6% in the first quarter, 3.9% in the second quarter, 3.8% in the third quarter, 4.4% in the fourth quarter, and an average of 4% for the full year.

Given this forecast, the March 2025 inflation rate of 3.34% indicates a strong start to the financial year 2025-26, especially considering the global challenges of ongoing wars and market uncertainties due to trade disputes between the United States, China, and Europe.

Are gold prices skyrocketing due to inflation?

No. As mentioned earlier, India’s retail inflation is at a historic low of 3.34% in March. According to a Live Mint report from April 17, 2025, gold prices in India and worldwide have hit record highs due to global tensions, fears of stagflation (slow growth with high inflation), and a weaker US dollar. Investors are turning to gold as a safe investment amid trade disputes and central banks increasing their gold reserves, driving prices to ₹97,310 per 10 grams in India.

Rising global conflicts have created economic uncertainty, making gold a popular choice for investors. Additionally, concerns about slow economic growth and persistent inflation have boosted demand for gold, which doesn’t generate income but holds value. Central banks worldwide are also buying more gold to reduce reliance on the US dollar, supporting the metal’s long-term demand.

The Live Mint report highlighted four key reasons for the rise in gold prices:

1. Weaker US Dollar and Trade War Fears: A declining US dollar, driven by recession risks and trade disputes, makes gold more appealing. New US tariffs and China’s counteractions have further shaken markets, boosting gold’s value.

2. Central Banks Buying Gold: Asian central banks, in particular, are purchasing large amounts of gold to protect against dollar fluctuations. The World Gold Council reported that global central banks bought 1,037 tonnes of gold in 2024, one of the highest amounts ever, due to concerns about inflation and global risks.

3. US Recession Fears: Growing worries about a US recession, with Goldman Sachs estimating a 45% chance, are pushing investors toward gold. Falling confidence in US government bonds and lower interest rates also make gold a safer bet.

4. Global Tensions and Stagflation Risks: The US Federal Reserve has warned of stagflation, where prices stay high while economic growth slows. This, combined with conflicts in regions like the Middle East and Eastern Europe, is driving investors to gold as a hedge against uncertainty and rising costs.

Hence, India’s retail inflation is at a historic low of 3.34% in March 2025, reflecting a stable economic environment. However, global uncertainties are driving gold prices to record highs. Typically, when US stock markets decline, investors shift money to bonds for safety. But ongoing trade disputes and tariff wars have disrupted both US bond and stock markets, making them less reliable. As a result, investors are turning to gold as a safer option, boosting its demand and prices.

| Claim | In India, Gold Prices Are Skyrocketing Due to High Inflation Rate Inflicted by the Modi Government |

| Claimed by | Amock, Amoxicillin, Surbhi Maradiya, and others |

| Fact Check | The claim is false. India’s retail inflation is at a six-year low of 3.34%, and the rise in gold prices is due to global market uncertainties, trade disputes, and increased demand for gold as a safe investment, not high inflation caused by the Modi government. |

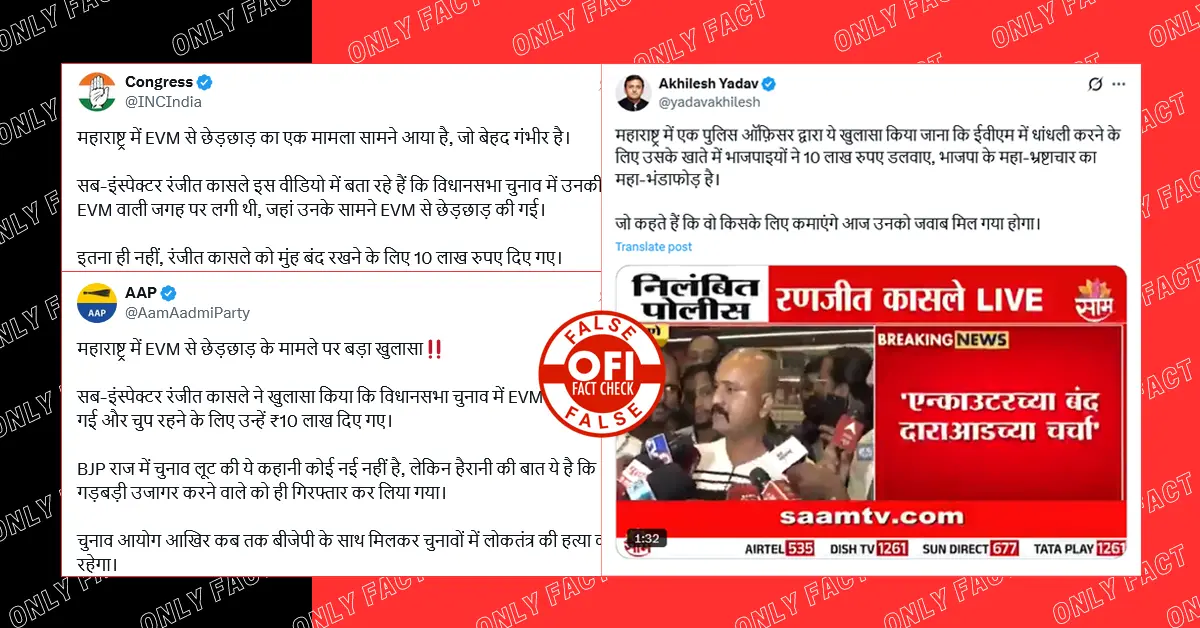

Also Read: Fact Check: Gandhis’ Role in National Herald Takeover Under Guise of Charity