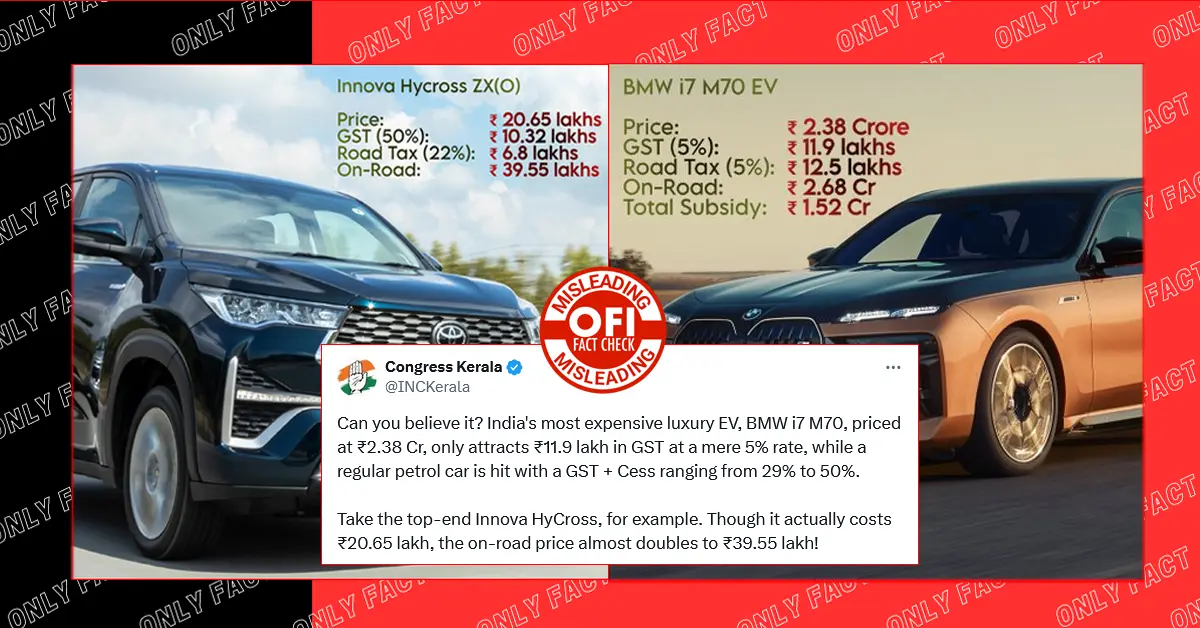

While the world enthusiastically embraces the latest eco-friendly electric vehicle models, the Congress party appears to be stuck in the past. Recently, Congress Kerala shared a post with an infographic comparing the tax rates of the fully electric BMW i7 M70 with the Toyota Innova Hycross, a hybrid model.

In the post, Congress Kerala claimed the following:

| BMW i7 M70 EV | Innova Hycross ZX(O) | |

| Price | ₹2.38 crore | ₹20.65 lakh |

| GST | 5% ₹11.9 lakh | 50% ₹10.32 lakh |

| Road Tax | 5% ₹12.5 lakh | 22% ₹6.8 lakh |

| On Road Price | ₹2.68 crore | ₹39.55 lakh |

| Total Subsidy | ₹1.52 crore | 0 |

Congress Kerala tweeted, ‘Can you believe it? India’s most expensive luxury EV, BMW i7 M70, priced at ₹2.38 Cr, only attracts ₹11.9 lakh in GST at a mere 5% rate, while a regular petrol car is hit with a GST + Cess ranging from 29% to 50%. Take the top-end Innova HyCross, for example. Though it actually costs ₹20.65 lakh, the on-road price almost doubles to ₹39.55 lakh. Even the world’s richest countries don’t hand out such massive tax breaks. IN this case ₹1.52 Cr, for ultra-luxury EVs. Each i7 sold could have put 6 buses on our roads instead. And there’s more. Customisations and upgrades like mag wheels are also taxed at just 5%, if we got it right. What a lucrative deal for the ultra-rich at the expense of the taxpayer! This is nsitharaman’s tax policy and nitin_gadkari’s EV policy in a nutshell.’

Can you believe it? India's most expensive luxury EV, BMW i7 M70, priced at ₹2.38 Cr, only attracts ₹11.9 lakh in GST at a mere 5% rate, while a regular petrol car is hit with a GST + Cess ranging from 29% to 50%.

— Congress Kerala (@INCKerala) September 16, 2024

Take the top-end Innova HyCross, for example. Though it… pic.twitter.com/voECFBdNzX

Also Read: Broken Bridge in Viral Photo is From Bangladesh, Not India

Fact Check

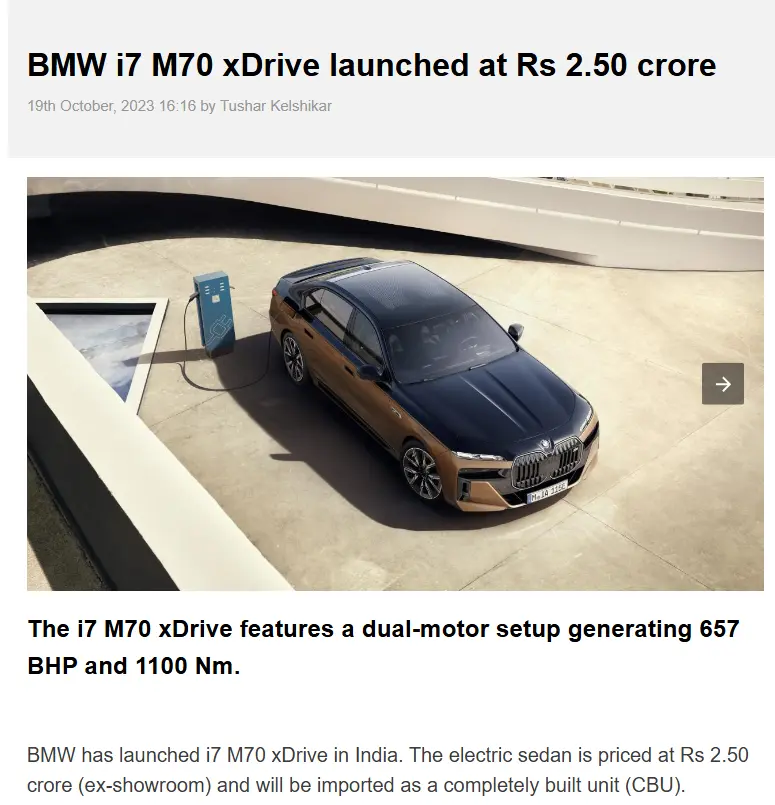

We began our fact-checking process by researching the claims made by the Congress party. First, we found that the BMW i7 M70 is imported into India. According to an article published on Team-BHP.com on October 19, 2023, BMW launched the i7 M70 xDrive in India, an electric sedan priced at ₹2.50 crore (ex-showroom). The car is imported as a completely built unit (CBU), which confirms that import duties are applied to this model.

Additionally, an article from The Hindu published on March 15, 2024, reported, ‘The government announced reduced import duty of 15% for electric vehicles (EVs) imported as a completely built unit (CBU), from the present 70% to 100% applicable for vehicles imported in CBU form, provided the EV maker sets up a local commercial manufacturing unit within three years.’

The report further said, ‘The reduced import duty would be offered if the EV manufacturer meets certain pre-conditions, including a minimum investment of ₹4,150 crore (or $500 million), starts a local manufacturing plant within three years and reaches at least 25% domestic value addition in that time. The auto manufacturer will also have to reach 50% domestic value addition within five years, the Ministry of Commerce and Industry said in a release. The customs duty of 15% on completely built units would be applicable on cars priced at a minimum value of $35,000 (about ₹29 lakh) including cost, insurance and freight charges. The duty relief will be applicable for a total period of five years.’

Thus, it is established that car import duties can range from 70% to 100%.

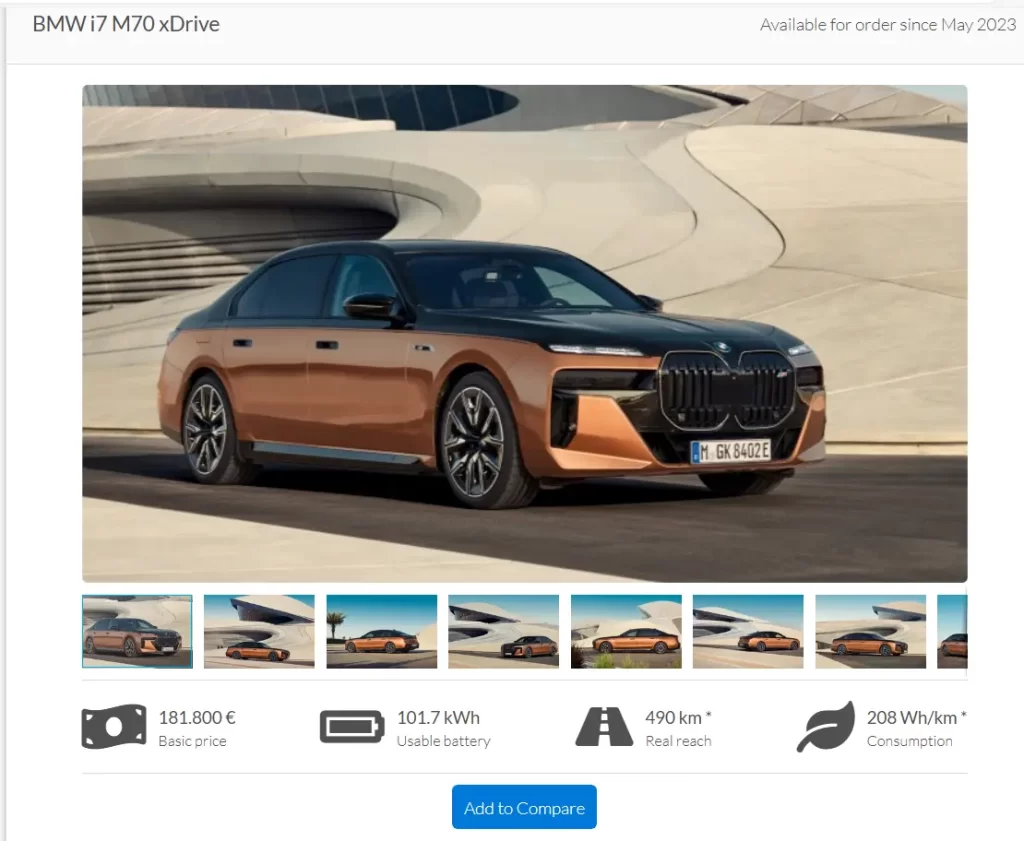

Next, we looked at the on-road price of the BMW i7 M70 in Germany. According to the Electric Vehicle Database, the price, including taxes, is €181,800. Converting this to Indian rupees, the price is approximately ₹1.69 crore.

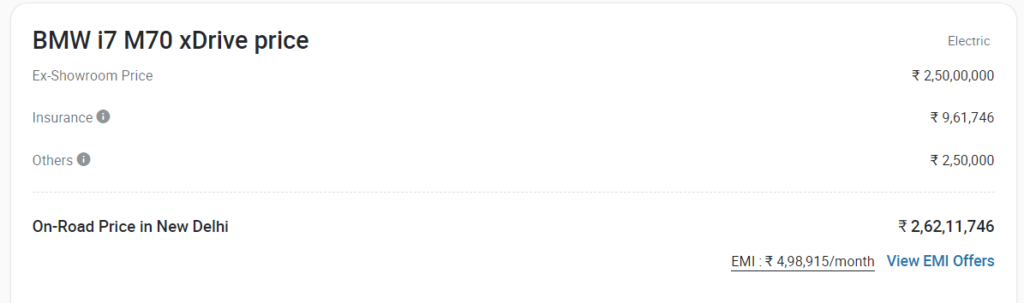

We also checked the ex-showroom price of the BMW i7 M70 in New Delhi, India. According to CarDekho, the ex-showroom price is ₹2.50 crore, and the on-road price is ₹2.62 crore. This indicates that while the price in Germany is approximately ₹1.69 crore, the same car costs ₹2.62 crore in India, mainly due to the 100% import duty and 5% GST.

Thus, the claim that luxury EVs imported into India are taxed at lower rates compared to Indian-made cars is false. The Indian government imposes about 100% import duty on cars like the BMW i7 M70. Therefore, the pre-import duty price of the BMW i7 M70 is approximately ₹1.25 crore.

Now, let’s consider the Toyota Innova Hycross. As a hybrid car (electric plus petrol), it attracts about 50% GST, whereas all electric vehicles in India are taxed at 5%.

An article from The Economic Times published on May 16, 2024, stated that electric vehicles in India are taxed at 5%, whereas hybrids are taxed as high as 43%, just below the 48% tax imposed on petrol cars.

Nitin Gadkari had previously argued that EVs should continue to be taxed at 5%, but the higher tax on hybrid cars (up to 48%) should be rationalized to promote the use of climate-friendly vehicles to combat climate change and decrease air pollution.

In conclusion, the notion that imported luxury EVs are taxed less than Indian-made EVs is completely false. The Indian government imposes a significant import duty of around 100% on luxury EVs like the BMW i7 M70.

| Claim | In Modi’s regime, India-made petrol cars are taxed at around 100%, while luxury imported EVs are taxed at only 5%. |

| Claimed by | Congress Kerala |

| Fact Check | The Indian government imposes an import duty of around 70 to 100% on imported cars. |

Also Read: Saket Gokhale’s Claim of 50% Cost Increase in Vande Bharat Trains is Misleading