The relentless efforts to undermine India’s growing economic trajectory seem to know no bounds. Recently, Hindenburg, a U.S.-based short-seller, published a report accusing Madhabi Puri Buch, the chairperson of the Securities and Exchange Board of India (SEBI), of corporate corruption. This report emerged just days after the U.S. allegedly orchestrated the ousting of Bangladesh’s democratically elected Prime Minister, Sheikh Hasina. The U.S. short seller has alleged that SEBI’s chairperson refrained from taking action against the Adani Group because she and her husband, Dhaval Buch, had invested in an offshore company associated with the Adani Group. The report also includes other fabricated allegations, which will be discussed later in the article.

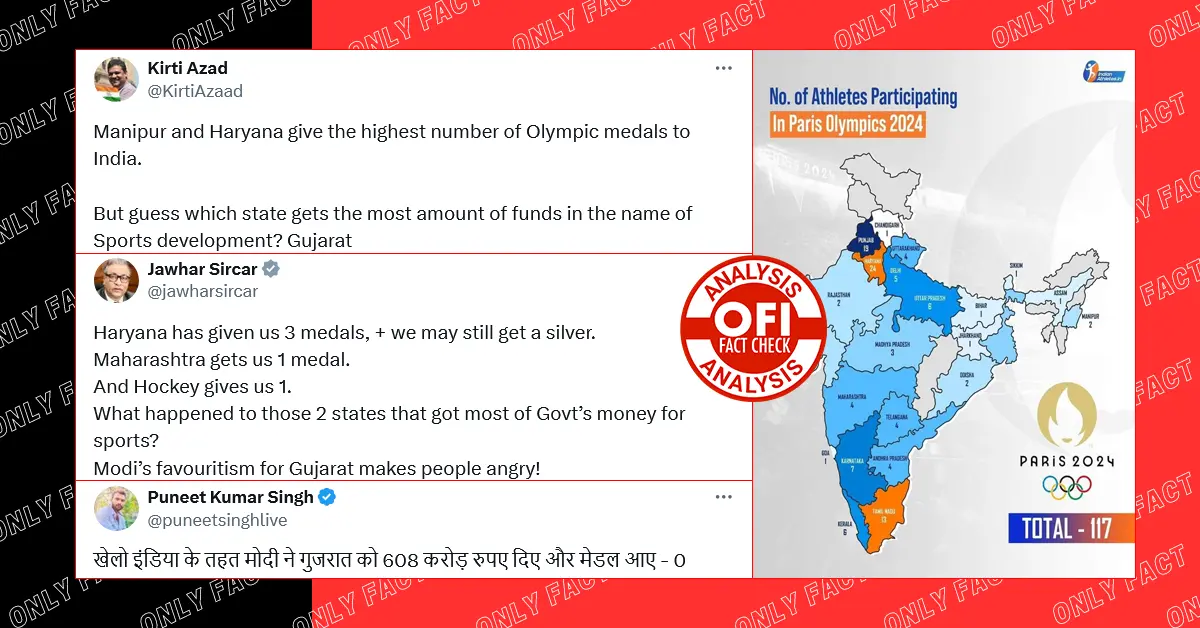

Hindenburg Research is a short seller, betting on the decline of companies. However, this is not something Indian politicians, who have sworn to protect the nation’s interests, should celebrate. Unfortunately, this is not the case. In India, opposition leaders often seize opportunities to tarnish the country’s image and make political gains, even if it comes at the cost of harming the nation’s economic prospects. Below are some tweets that illustrate the flawed mindset of India’s opposition leaders.

Leader of the opposition Rahul Gandhi in a video message said, ‘…It is my duty as Leader of Opposition to bring to your notice that there is a significant risk in the Indian stock market because the institutions that govern the stock market is compromised…A very serious allegation against the Adani group was illegal share ownership and price manipulation using offshore funds. It has now emerged that SEBI chairwoman Madhabi Buch and her husband had an interest in one of those funds. This is an explosive allegation because it alleges that the umpire herself is compromised…Honest investors across the country have pressing questions for the government- why hasn’t SEBI Chairperson Madhabi Puri Buch resigned yet? If investors lose their hard-earned money, who will be held accountable- PM Modi, the SEBI Chairperson, or Gautam Adani?… New and very serious allegations have surfaced, will the Supreme Court look into this matter suo moto once again? It is now abundantly clear why Prime Minister Modi is against the JPC looking into this matter”

#WATCH | Lok Sabha LoP and Congress MP Rahul Gandhi says, "…It is my duty as Leader of Opposition to bring to your notice that there is a significant risk in the Indian stock market because the institutions that govern the stock market is compromised…A very serious allegation… pic.twitter.com/YcqKwkaNXI

— ANI (@ANI) August 11, 2024

The Congress party shared a statement on X.

Here is the statement by Shri @Jairam_Ramesh, MP, General Secretary (Communications), AICC,

— Congress (@INCIndia) August 10, 2024

on the latest Hindenburg Research revelations. pic.twitter.com/FMpFIuvYgu

Congress president Mallikarjun Kharge asserted, ‘SEBI had previously cleared Adani, a close associate of PM Modi, before the Supreme Court following the January 2023 Hindenburg Report revelations. However, new allegations have surfaced regarding a quid-pro-quo involving the SEBI Chief. The small & medium investors belonging to the Middle Class who invest their hard-earned money in the stock market need to be protected, as they believe in the SEBI. A Joint Parliamentary Committee (JPC) inquiry is imperative to investigate this massive scandal. Until then, concerns persist that PM Modi will continue to shield his ally, compromising India’s Constitutional institutions, painstakingly built over seven decades.’

SEBI had previously cleared Adani, a close associate of PM Modi, before the Supreme Court following the January 2023 Hindenburg Report revelations.

— Mallikarjun Kharge (@kharge) August 11, 2024

However, new allegations have surfaced regarding a quid-pro-quo involving the SEBI Chief.

The small & medium investors belonging…

UBT Shiv Sena leader Priyanka Chaturvedi claimed, ‘The revelations by Hindenburg Research show the extent of support given to PawPaw’s favourite industrialist friend that even institutions like SEBI were diluted by appointing allegedly compromised people. The quid pro quo circle gets wider and the modus operandi more sinister.’

The revelations by @HindenburgRes show the extent of support given to PawPaw’s favourite industrialist friend that even institutions like SEBI were diluted by appointing allegedly compromised people.

— Priyanka Chaturvedi🇮🇳 (@priyankac19) August 11, 2024

The quid pro quo circle gets wider and the modus operandi more sinister.

Communist propaganda news portal The Wire wrote on X, ‘Hindenburg Alleges SEBI Chief, Spouse Held Stake in Offshore Funds ‘Linked to Adani Group’

Hindenburg Alleges SEBI Chief, Spouse Held Stake in Offshore Funds 'Linked to Adani Group'#PoliticalEconomy https://t.co/FEAcxpNFjP

— The Wire (@thewire_in) August 11, 2024

Propagandist Ravish Kumar stated, ‘If the SEBI chief does not resign, how will the investigation take place? This is also necessary to reject the Hindenburg report. Now doubts arise, is this the reason why the Parliament session has been concluded so quickly? So that there is no uproar in the House. The Waqf Board Bill must have been sent to the JCP quickly so that it can be wrapped up quickly.’

सेबी की चीफ़ अगर इस्तीफ़ा नहीं देंगी तो जाँच कैसे होगी ? हिडंनबर्ग की रिपोर्ट को नकारने के लिए भी ये करना ज़रूरी है। अब संदेह हो रहा है, क्या इसीलिए जल्दी-जल्दी संसद का सत्र निपटाया गया है? ताकि सदन में हंगामा न हो। वक़्फ़ बोर्ड बिल को जल्दी से जेसीपी में भेजा गया होगा कि जल्दी…

— ravish kumar (@ravishndtv) August 10, 2024

Lawyer Prashant Bhushan claimed, ‘Explosive! Whistleblower Documents Reveal SEBI’s Chairperson Had Stake In Obscure Offshore Entities Used In Adani Money Siphoning Scandal – Hindenburg Research.’

Explosive! Whistleblower Documents Reveal SEBI’s Chairperson Had Stake In Obscure Offshore Entities Used In Adani Money Siphoning Scandal – Hindenburg Research https://t.co/K5dvEdIl6G

— Prashant Bhushan (@pbhushan1) August 10, 2024

In this article, we will assess the degree to which the story has been fabricated and explore whether any truth underlies the claims. Additionally, we will present the responses and clarifications provided by the various parties implicated in the Hindenburg report.

Analysis

Before getting into the new story, let’s quickly recap the events of the past year and a half. In February 2023, U.S. short-seller Hindenburg published a report accusing the Adani Group of various corporate scandals. Following this, the Supreme Court of India and SEBI launched investigations, both of which found no evidence of wrongdoing on Adani’s part. However, these investigations were not fully concluded. On June 27th, SEBI issued a show-cause notice to Hindenburg regarding their allegations, effectively putting the short-seller on the defensive. In response, a disgruntled Hindenburg recently published an article attacking SEBI’s chairperson in an apparent attempt to save face.

Below are the allegations made by Hindenburg in its report. In this analysis, we will fact-check and examine each allegation.

1- “IPE Plus Fund” is a small offshore Mauritius fund established by an Adani director via India Infoline (IIFL), a wealth management firm linked to the Wirecard scandal. Vinod Adani, brother of Gautam Adani, allegedly used this structure to invest in Indian markets with funds siphoned from over-invoicing of power equipment to the Adani Group.”

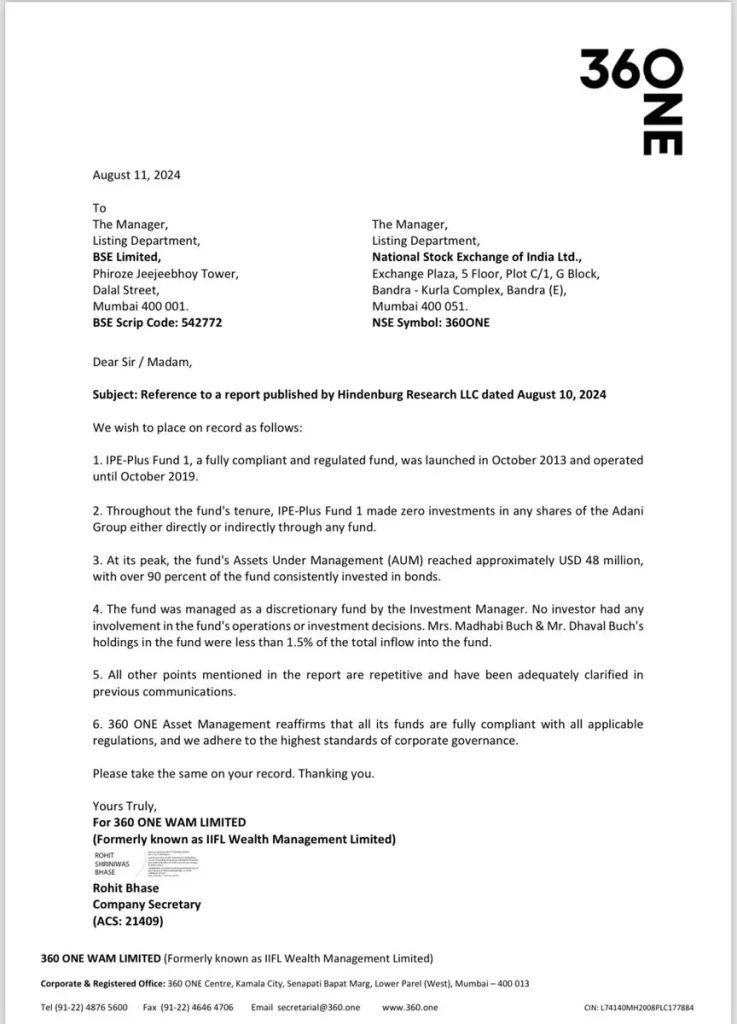

In response to these accusations, IPE Plus Fund issued a statement refuting each claim. The statement reads:

“We wish to place on record the following:

1. IPE-Plus Fund 1, a fully compliant and regulated fund, was launched in October 2013 and operated until October 2019.

2. Throughout the fund’s tenure, IPE-Plus Fund 1 made zero investments in any shares of the Adani Group, either directly or indirectly, through any fund.

3. At its peak, the fund’s Assets Under Management (AUM) reached approximately USD 48 million, with over 90 per cent consistently invested in bonds.

4. The fund was managed as a discretionary fund by the Investment Manager. No investor had any involvement in the fund’s operations or investment decisions. Mrs. Madhabi Buch and Mr. Dhaval Buch’s holdings in the fund were less than 1.5% of the total inflow into the fund.

5. All other points mentioned in the report are repetitive and have been adequately clarified in previous communications.

6. 360 ONE Asset Management reaffirms that all its funds are fully compliant with all applicable regulations, and we adhere to the highest standards of corporate governance.”

This statement clarifies two key points: first, that IPE Plus Fund never invested in any shares of the Adani Group, either directly or indirectly, through any fund; and second, that no investor had any involvement in the fund’s operations or investment decisions. The holdings of Mrs. Madhabi Buch (SEBI chairperson) and Mr. Dhaval Buch in the fund were less than 1.5% of the total inflow.

2- “Whistleblower documents reveal that Madhabi Buch, the current SEBI Chairperson, and her husband, Dhaval Buch, held hidden stakes in the same obscure offshore Bermuda and Mauritius funds used by Vinod Adani in the money siphoning scandal.”

The IPE Plus Fund issued a statement categorically denying any investment in the Adani Group, directly or indirectly. They also provided transparency regarding the Buchs’ investments. Given that the IPE Plus Fund has no connection with the Adani Group, the allegation that the SEBI chairperson invested in Adani through this fund is baseless. However, the Buchs went further to provide a detailed response to these recent accusations.

The Buchs stated, “ In the context of allegations made by Hindenburg on 10th Aug 2024 against us, and in line with our commitment to complete transparency, we are issuing a detailed statement as below.

There are certain allegations made against SEBI which would be addressed by the institution independently. We would like to address the issues pertaining to us in our personal capacity.

We would like to state the following:

1. Madhabi is an alumnus of IIM Ahmedabad and has had a corporate career of over two decades in banking and financial services, largely in the ICICI Group.

2. Dhaval Buch is an alumnus of IIT Delhi and has had a corporate career of 35 years in Hindustan Unilever Limited in India and then in Unilever globally as part of its senior management team. During this long period, Madhabi and Dhaval have accrued their savings through their salaries, bonuses and stock options. Insinuations about their net worth and investments referencing Madhabi’s current government salary is malicious and motivated.

3. From 2010 to 2019, Dhaval lived and worked in London and Singapore – both with Unilever.

4. From 2011 to March 2017, Madhabi lived and worked in Singapore, initially as an employee of a Private Equity firm and subsequently as a consultant.

5. The investment in the fund referred to in the Hindenburg report was made in 2015 when they were both private citizens living in Singapore and almost 2 years before Madhabi joined SEBI, even as a Whole Time Member.

6. The decision to invest in this fund was because the Chief Investment Officer, Mr Anil Ahuja, is Dhaval’s childhood friend from school and IIT Delhi and, being an ex-employee of Citibank, J.P. Morgan and 3i Group plc, had many decades of a strong investing career. The fact that these were the drivers of the investment decision is borne out by the fact that when, in 2018, Mr. Ahuja, left his position as CIO of the fund, we redeemed the investment in that fund.

7. As confirmed by Mr. Ahuja, at no point in time did the fund invest in any bond, equity, or derivative of any Adani group company.

8. Dhaval’s appointment, in 2019, as Senior Advisor to Blackstone Private Equity was on account of his deep expertise in Supply Chain management. Thus his appointment pre-dates Madhabi’s appointment as SEBI Chairperson. This appointment has been in the public domain ever since. At no time has Dhaval been associated with the Real Estate side of Blackstone.

9. On his appointment, the Blackstone Group was immediately added to Madhabi’s recusal list maintained with SEBI.

10. Over the last two years, SEBI has issued more than 300 circulars (including “Ease of Doing Business” initiatives in line with the developmental mandate of SEBI) across the entire market eco-system. All regulations of SEBI are approved by its Board (and not by its Chairperson) after extensive public consultation. Insinuations that a handful of these matters related to the REIT industry were favours to any specific party are malicious and motivated.

11. The two consulting companies set up by Madhabi during her stay in Singapore, one in India and one in Singapore, became immediately dormant on her appointment with SEBI. These companies (and her shareholding in them) were explicitly part of her disclosures to SEBI.

12. After Dhaval retired from Unilever in 2019, he started his own consultancy practice through these companies. Dhaval’s deep expertise in Supply Chain allowed him to work with prominent clients in the Indian industry. Thus, linking accruals in these companies to Madhabi’s current government salary is malicious.

13. When the shareholding of the Singapore entity moved to Dhaval, this was once again disclosed, not just to SEBI, but also to the Singapore authorities and the Indian tax authorities.

14. SEBI has strong institutional mechanisms of disclosure and recusal norms as per the code of conduct applicable to its officers. Accordingly, all disclosures and recusals have been diligently followed, including disclosures of all securities held or subsequently transferred.

15. Hindenburg has been served a show cause notice for a variety of violations in India. It is unfortunate that instead of replying to the Show Cause Notice, they have chosen to attack the credibility of the SEBI and attempt character assassination of the SEBI Chairperson.”

SEBI Chief Madhabi Puri Buch and her husband Dhaval Buch releases a statement in the context of allegations made by Hindenburg on 10th Aug 2024 against them.

— ANI (@ANI) August 11, 2024

"The investment in the fund referred to in the Hindenburg report was made in 2015 when they were both private citizens… pic.twitter.com/g0Ui18JVNT

The IPE Plus Fund has effectively refuted the allegations made by U.S. Short seller Hindenburg regarding any association, with the Adani Group. They have clearly stated that they have never invested in Adani Group shares. Additionally the Buchs have provided a transparent account of their investments noting that these were made during their time as individuals living in Singapore. Their choice to invest in the IPE Plus Fund was based on a friend’s recommendation. It is important to highlight that Madhabi Buch’s investment predates her involvement with SEBI. The Buchs have confirmed that their financial choices were autonomous and fully disclosed to the authorities.

3- “Whistleblower documents reveal that Madhabi Buch and her husband, Dhaval Buch, first opened an account with IPE Plus Fund 1 in 2015. Later, Dhaval Buch moved the assets solely under his control before Madhabi’s politically sensitive SEBI appointment, and during her tenure, she used her private Gmail to redeem fund units through her husband’s name.”

The third accusation by the U.S. short seller is even more absurd than the previous ones. The report itself includes an alleged letter from Dhaval Buch requesting sole management of the assets, asking for exclusive ownership of the account. Yet, the same report later claims that in 2018, Madhabi Buch was somehow managing the IPE Plus Fund account herself. This contradiction is baffling—how could Madhabi Buch be handling the account when the report clearly shows Dhaval Buch asking for sole custody years earlier? These baseless claims seem designed purely to undermine the credibility of the Securities and Exchange Board of India (SEBI) and erode trust in front of billions of investors, potentially shaking the very foundations of India’s economy.

However, SEBI decided to strike back at the US-based short seller and issued a statement. The excerpt from the statement, ‘“Lastly, it is emphasized that SEBI has adequate internal mechanisms for addressing issues relating to conflict of interest, which include disclosure framework and provision for recusal. It is noted that relevant disclosures required in terms of holdings of securities and their transfers have been made by the Chairperson from time to time. The chairperson has also recused herself in matters involving potential conflicts of interest. SEBI, over the years, has built a robust regulatory framework that not only aligns with best global practices but also ensures protection of investors. SEBI remains committed to ensuring the integrity of India’s Capital markets and its orderly growth and development.”

#SEBI releases statement on #HindenburgResearch’s report.

— NDTV Profit (@NDTVProfitIndia) August 11, 2024

For the latest news and updates, visit: https://t.co/NKSVSeJ1VB pic.twitter.com/nirctFIZXJ

The Hindenburg report lacks logic and substance and makes a weak claim that SEBI was hesitant to act on its previous report about the Adani Group because SEBI Chairperson Ms. Buch and her husband Dhaval Buch had investments in offshore funds supposedly linked to Adani. Dhaval Buch invested in offshore funds in 2015, but Ms. Buch joined SEBI in 2017 and only became SEBI Chairperson in 2022. Given their high-level corporate careers and time spent in Singapore, it’s normal for them to have invested abroad.

This latest attempt by Hindenburg to involve the SEBI Chairperson in the Adani controversy seems like a desperate move to destabilize India’s markets and create fear and uncertainty among investors.

4- “The Supreme Court Said That SEBI Had “Drawn A Blank” In Its Investigations Into Who Funded Adani’s Offshore Shareholders and SEBI has yet to take Action Against Adani group.”

The reality is quite different from what was reported by the publication. The Supreme Court expert committee observed:

1. Stock Manipulation: The expert panel found no evidence of stock manipulation by the Adani Group, despite SEBI’s thorough monitoring. While 849 alerts were generated, only four reports were made to SEBI—two before and two after the Hindenburg report.

2. Market Volatility: After the Hindenburg report, Adani stocks showed high volatility, but the overall market remained stable. Retail investors continued to buy Adani stocks, and the market eventually adjusted to new price levels.

3. Related-Party Transactions: SEBI is investigating 13 transactions related to the Adani Group to determine if they were fraudulent, even if they aren’t legally considered “related party transactions.”

4. Investor Interest/Awareness: The panel agreed with SEBI’s efforts to ensure informed investor decisions but noted concerns about information overload for average investors. Retail investment in Adani stocks increased significantly after the Hindenburg report.

5. Overseas Entity Ownership: SEBI’s 2020 investigation into foreign ownership of Adani stocks struggled to identify the ultimate owners, raising concerns about regulatory compliance.

6. Regulatory Failure: The panel found no evidence of regulatory failure regarding the Adani case and noted SEBI’s ongoing efforts to improve market regulations.

7. Minimum Public Shareholding: SEBI is examining whether the Adani Group complied with the rule requiring at least 25% public ownership in a listed company, focusing on the disclosure of beneficial owners by foreign portfolio investors (FPIs).

8. FPI Declarations: The panel highlighted that FPIs have declared their beneficial owners according to regulations, but the requirement to disclose the ultimate owner was removed in 2018.

9. Short Positions: SEBI discovered that some entities profited from short positions taken before the Hindenburg report, and a detailed investigation is underway.

10. Strengthening Regulatory Mechanism: The panel believes SEBI already has strong regulatory powers and does not see a need for additional authority at this time.

To counter the claim that SEBI has never taken any action against the Adani Group, it’s important to note the following:

Firstly, the Honourable Supreme Court of India has not found any grounds to take action against the Adani Group. However, under the tenure of Madhabi Buch in May 2024, six Adani Group companies received show-cause notices from SEBI for alleged violations related to party transactions and non-compliance with listing regulations, as disclosed in their regulatory filings. Adani Enterprises, the group’s flagship company, reported receiving two show-cause notices during the quarter ending March 31. Adani Ports & Special Economic Zone, Adani Power, Adani Energy Solutions, Adani Wilmar, and Adani Total Gas also reported recent SEBI inquiries to the stock exchanges.

Moreover, SEBI initiated an investigation in October 2020 into the shareholding structures of Adani Group companies after its internal surveillance system raised concerns about the high concentration of foreign holdings in the group’s listed entities. The regulator sought to determine whether these overseas investors were acting as fronts for promoters or were genuine public shareholders. This investigation was concluded last year.

The Hindenburg report later referenced SEBI’s 2020 investigation into the Adani Group, presenting it as their own discovery. When SEBI found no wrongdoing in the Adani Group’s accounts, the U.S. short-seller accused SEBI Chairperson Madhabi Buch of colluding with Gautam Adani—based solely on the baseless claim that Buch and Adani had once met.

5- “During Madhabi Buch’s tenure as a Whole-Time Member at SEBI, her husband, Dhaval Buch, was appointed as a Senior Advisor to Blackstone in 2019. While he held this role, SEBI approved significant REIT regulation changes. Madhabi Buch, now SEBI Chairperson, has publicly endorsed REITs as her “favourite products for the future” and encouraged investors to view the asset class positively.”

In 2014, the Securities and Exchange Board of India (SEBI) introduced Infrastructure Investment Trusts (InvITs) and Real Estate Investment Trusts (REITs) as alternative investment options. These are special investment vehicles that let investors put money into infrastructure and real estate without having to own the properties outright. The main goal of creating REITs and InvITs was to turn typically hard-to-sell investments in these assets into more liquid, easily tradable investments that offer good returns.

The Economic Times reported, ‘At March 31, 2023, there were 20 InvITs and 5 REITs registered with SEBI 5 across various sectors like energy, transport & logistics, communications, social and commercial Infrastructure, real estate, etc. The current market cap of listed REITs/ InvITs is approximately INR 1.0 tn. Significant investment in infrastructure, favorable government policies, attractive returns and interest of global investor have driven fund mobilization through listed REITs/ InvITs to INR 18,658 cr in H1FY24 as compared to INR 2,596 cr raised in FY23. Further, several new issuers are planning to tap the market. Global investors such as Blackstone, KKR, Brookfield, CPPIB, Actis, GIC, ADIA have been increasingly investing in infrastructure sector in India through REITs/ InvITs. Now there is an increased interest from domestic mutual funds and corporates as well.’

The report further elaborated, ‘The evolution of REITs/ InvITs has led to innovation in the financial products. For example, NSE launched REITs and InvITs indices to track performance of listed REITs/ InvITs. Further, domestic mutual funds have requested the market regulator to allow mutual fund houses to have schemes dedicated to REITs/ InvITs. SEBI has been proactive in taking various steps to facilitate ease of doing business while ensuring the highest standards for governance and transparency are upheld to protect the interests of stakeholders. It is also looking to develop the REITs/ InvITs market through various policy measures. To facilitate higher governance and uniformity to sponsors and unitholders of REITs/ InvITs, SEBI has recently issued various circulars and consultative papers on framework for issuance of subordinate unit and computation of net distributable cash flows. It has also envisaged board representation for retail and institutional investors, follow-on offers, etc.’

When a U.S. short seller accused the SEBI Chairperson of promoting REITs due to her husband’s employment at a major REIT company, both the Chairperson and SEBI firmly denied these baseless allegations in their statements.

Madhabi Buch and Dhaval Buch in their joint statement said, “Dhaval’s appointment, in 2019, as Senior Advisor to Blackstone Private Equity was on account of his deep expertise in Supply Chain management. Thus his appointment pre-dates Madhabi’s appointment as SEBI Chairperson. This appointment has been in the public domain ever since. At no time has Dhaval been associated with the Real Estate side of Blackstone. On his appointment, the Blackstone Group was immediately added to Madhabi’s recusal list maintained with SEBI.”

The State Exchange Board of India in its statement said, “ The report has also stated that the implementation of the SEBI (REIT) Regulations 2014 as well as changes in such regulations had resulted in significant benefit to a large multinational financial conglomerate. In this regard, it may be noted that the SEBI (REIT) Regulations, 2014 has been amended from time to time.

As with all cases involving introduction of a new regulation or amendment to an existing regulation, a robust consultation process for seeking inputs and feedback of the industry, investors, intermediaries, relevant Advisory Committee and the public at large is in place. Only after consultation, a proposal for introduction of a new regulation or change in the existing regulation is placed for the consideration of and deliberation of the SEBI Board. Regulations are notified after approval of the SEBI Board. As a measure of transparency, the agenda papers for Board meetings and outcomes of Board discussions are also published on SEBI website. Hence, claims that such regulations, changes to regulations or circulars issued related to REITs were to favour one large multinational financial conglomerate, are inappropriate.

For the development of the Indian securities market, SEBI has at various times underscored the potential of REITs, SM REITs, InvITs and Municipal Bonds amongst other asset classes for democratization of markets, financialisation of household savings and for capital formation through the capital markets. These are also highlighted in the latest SEBI Annual Report, as part of Chairperson’s Statement (see paragraphs titled ‘Financial Inclusion and Democratization of Markets’ and ‘New Avenues for Capital Formation’). Therefore, the claim that promoting REITs and SM REITs among various other asset classes by SEBI was only for benefitting one large multinational financial conglomerate, is inappropriate.”

#SEBI releases statement on #HindenburgResearch’s report.

— NDTV Profit (@NDTVProfitIndia) August 11, 2024

For the latest news and updates, visit: https://t.co/NKSVSeJ1VB pic.twitter.com/nirctFIZXJ

After SEBI issued a show-cause notice to Hindenburg, the U.S. short seller seemed caught off guard, unsure of how to respond. It appears they hastily prepared a report without conducting proper due diligence. Had there been even a shred of honesty in their work, they would have known that Dhaval Buch works in the supply chain department at Blackstone, not in a REIT-related role. Furthermore, SEBI Chairperson Madhabi Buch had already recused herself from any matters involving Blackstone. Additionally, with India’s improved ease of doing business, SEBI and other financial institutions are actively promoting new business models and attracting fresh investments. Thus, SEBI’s efforts to promote REITs and make regulatory amendments are driven by broader economic goals, not by any personal or familial interests.

6- Madhabi Buch’s Appointment as SEBI Chairperson

Conspiracy theorists like Nate Anderson and Rahul Gandhi must have speculated that Madhabi Buch received preferential treatment in her appointment as SEBI Chairperson. Many have hastily concluded, based on the U.S. short seller’s report, that because she is allegedly close to Gautam Adani, who in turn is close to Indian Prime Minister Modi, her appointment must have been influenced. However, to dispel these unfounded theories, tax expert Ajay Rotti shared the public advertisement that called for candidates to apply for the SEBI Chairperson position. Rotti explained on X that the Financial Sector Regulatory Appointments Search Committee (FSRASC), chaired by the Cabinet Secretary, shortlists candidates. This is the same committee responsible for selecting RBI Governors and Deputy Governors. The FSRASC includes three external experts, and based on its recommendations, the Appointments Committee of the Cabinet ultimately approves the appointment.

This is the advertisement calling candidates to apply for the post of SEBI Chairman. After this, the Financial Sector Regulatory Appointments Search Committee (FSRASC) headed by cabinet secretary shortlists the candidates. It is the same Committee which also choses RBI Governors… pic.twitter.com/fP3Swk0Ga1

— Ajay Rotti (@ajayrotti) August 11, 2024

7- Adani Group statement on the latest Hindenburg report

Since, it was Adani Group shoulder from where the US short seller tried to do hit job against SEBI. It’s important to bring in light what Adani group haa to say on the said matter. Adani group called the latest Hindenburg report a, ‘ Red Herring’ it means, piece of information that is, or is intended to be, misleading or distracting.

The Adani group termed the report malicious intent for personal profetering. The Adani group also made it very clear that the group has no personal relationship with Buchs, mentioned in the report.

The Adani group statement reads, “It is reiterated that our overseas holding structure is fully transparent, with all relevant details disclosed regularly in numerous public documents. Furthermore, Anil Ahuja was a nominee director of 3i investment fund in Adani Power (2007-2008) and, later, a director of Adani Enterprises until 2017.

The Adani Group has absolutely no commercial relationship with the individuals or matters mentioned in this calculated deliberate effort to malign our standing. We remain steadfastly committed to transparency and compliance with all legal and regulatory requirements.”

Hindenburg Report – A Red Herring

— Adani Group (@AdaniOnline) August 11, 2024

Read more: https://t.co/cNMEnSvym4 pic.twitter.com/eWXDH3COrl

Conclusion:

At the time of Madhabi Buch’s appointment as SEBI chairperson, she was not an investor in Anil Ahuja’s fund. Additionally, Mr. Ahuja’s fund did not hold shares in any Adani company, nor was he ever on the board of any Adani company. On a positive note, confidence in India’s investment and business ecosystem is far stronger than the influence of a minor short seller. Despite the Sensex closing 56.99 points down (0.07%) at 79,648.92, and the Nifty dropping 20.50 points (0.08%) to 24,347, the Indian stock market has once again demonstrated its resilience in the face of Western short sellers and their allies. Meanwhile, an X post revealed that Hindenburg anticipated a 3.6% drop in the Nifty, equating to roughly 880 points, with a best-case scenario predicting a 10% drop, or approximately 2,500 points, in the Nifty.

#Hindenberg bought puts of MSCI India ETF! Currently it’s trading at $55

— Adlytick Stock Market Research & Analytics (@ArrushAdityadev) August 11, 2024

1) There base case expectation is $53 , which means 3.6% downside or roughly 880 points in Nifty

2) Best Case $50 , which means 10% downside or roughly 2500 points downside in #nifty

I personally think… pic.twitter.com/QHk413IlQN

It’s safe to say that India has successfully thwarted this attack. However, it is disappointing that the Congress party was quick to endorse the Hindenburg report without critical examination. Rahul Gandhi went so far as to declare the Indian stock market compromised. Yet, on Monday, Indian investors proved the worthlessness of both Hindenburg and Rahul Gandhi by standing firm. The Hindenburg report failed to achieve its intended outcome, and instead, it has exposed those who stand against India’s interests.

The Indian stock market plays a crucial role in the country’s economic growth. It has shown strength, continuing to rise despite global challenges. This trust in the economy drives investment, business, and growth. Because of this importance, the market becomes a target. If it collapses, the consequences would be severe—recovery would take years, and the political landscape would shift. The aim is to slow down India’s growth. However, in today’s political climate, it’s difficult to cause widespread panic in the markets because investors remain confident in India’s future.