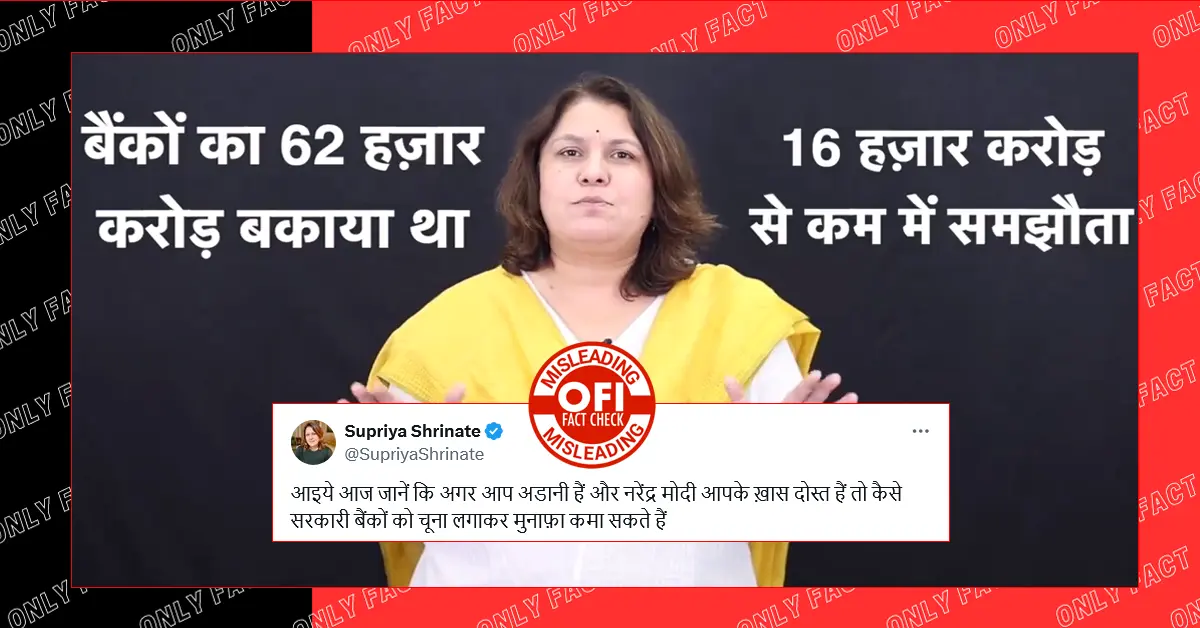

In its latest attempt to discredit the Indian financial system, the Congress party has launched an attack on the Indian banking system. Congress spokesperson Supriya Shrinate posted a video on social media claiming that Indian banks have sold at least 10 companies to the Adani Group, despite incurring losses of over ₹46,000 crore.

Shrinate contended that these 10 companies were in debt to the tune of approximately ₹62,000 crore. However, in order to secure a better deal for the Adani Group, the banks allegedly sold all 10 companies to the Adani Group for less than ₹16,000 crore. She further claimed that a “haircut” of more than 74% suggests collusion between Prime Minister Narendra Modi and the banks, allowing the companies to be sold at a significantly lower price to benefit Gautam Adani.

Congress-affiliated media outlet, National Herald, also made similar claims, quoting Congress leader Jairam Ramesh.

Supriya Shrinate shared a video on X and claimed, ‘Let us know today that if you are Adani and Narendra Modi is your best friend then how can you make profit by defrauding government banks

▪️ 10 companies were in financial trouble

▪️ They owed about Rs 62,000 crore to public sector banks

▪️ Then Adani bought these companies

▪️ Banks settled for Rs 16,000 crore only

▪️ In economic terms this is called a ‘haircut’ of 74%

▪️ The simple fact is that banks were defrauded of Rs 46,000 crore in the name of Adani ji

▪️ Companies bought by Adani:

1. HDIL (Project BKC)

2. Radius Estates & Developers

3. National Rayon Corporation

4. Essar Power MP Ltd

5. Dighi Port Limited

6. Lanco Amarkantak Power

7. Coastal Energy Ltd

8. Aditya Estates

9. Karaikal Port

10.Korba West Power Company

▪️ Government banks handed over the companies to Adani Group after bearing 74% loss

▪️ These are the same banks that make your life miserable, insult you and send goons to your home for recovery if you don’t pay Rs. 10,000 instalment for two months

▪️ By the way, the government has invested 3.5 lakh crore rupees in these public sector banks in 4 years, which has been recovered by breaking your back and imposing taxes through GST

Let’s see what the Modi-Adani duo is up to!’

आइये आज जानें कि अगर आप अडानी हैं और नरेंद्र मोदी आपके ख़ास दोस्त हैं तो कैसे सरकारी बैंकों को चूना लगाकर मुनाफ़ा कमा सकते हैं

— Supriya Shrinate (@SupriyaShrinate) September 8, 2024

▪️10 कंपनियाँ आर्थिक मुश्किल में थीं

▪️सरकारी बैंकों का क़रीब 62,000 करोड़ रुपए इनपर बकाया था

▪️फिर अडानी ने इन कंपनियों को ख़रीदा

▪️बैंकों ने… pic.twitter.com/9qv486jWbP

National Herald asserted, ‘Banks face unprecedented 74 per cent ‘haircut’ on claims of 10 companies after acquisition by Adani ’

In this article, we will examine each of the 10 companies that Congress leaders have claimed were taken over by the Adani Group. We will also shed light on the process behind these takeovers. Was the process legitimate, or was there any wrongdoing? Let’s find out!

Also Read: Viral Letter Claiming Adani Group Admitted to Paying Bribes to Kenyan Officials is Fake

Fact Check

Before we dive in, let’s break down the Corporate Insolvency and Bankruptcy Code (IBC) in simple terms. The IBC is a set of rules that helps creditors (those who are owed money) recover their dues from companies or partnerships that are in financial trouble, like when they can’t pay back their loans.

What is the Corporate Insolvency Resolution Process (CIRP)?

The CIRP is the method used to help creditors recover money from a company or Limited Liability Partnership (LLP) that owes them. This is how the process works:

1. Who is a Corporate Debtor?

A company or LLP that owes money and can’t pay it back is called a “corporate debtor.”

2. What is Insolvency?

Insolvency happens when a company can’t pay its debts. In such cases, the creditors (people or businesses owed money) or the company itself can start the CIRP.

3. Who can start the CIRP?

– Financial creditors: These are people or institutions, like banks, to whom the company owes money, usually with interest.

– Operational creditors: These are people or businesses owed money for services or goods, like suppliers.

– The company itself (corporate debtor): The company can also initiate the process if it can’t pay its debts.

4. Minimum Debt Requirement:

The CIRP can only begin if the company owes at least ₹1 crore.

How is the CIRP started?

1. Financial Creditor:

A financial creditor can apply to the National Company Law Tribunal (NCLT), which is a legal body that handles these cases.

2. Operational Creditor:

An operational creditor must first send a demand notice to the company, asking for payment. If they don’t get paid within 10 days, they can apply to the NCLT to start the process.

3. Corporate Debtor:

A company’s partner, member, or person in charge of its finances can also ask the NCLT to start the CIRP.

The NCLT has 14 days to decide whether to start the process. Once the CIRP begins, it must be completed within 180 days, though this can be extended by 90 more days if needed.

What Happens After the CIRP Starts?

1. Moratorium:

Once the NCLT approves the start of the CIRP, a “moratorium” is declared. This means that during the process:

– No legal actions or suits can be filed against the company.

– The company cannot sell or transfer its assets.

– Creditors cannot seize the company’s property.

2. Public Announcement:

A public notice is made to invite claims from creditors. This includes:

– The company’s name and details.

– The deadline for creditors to submit claims.

– Information about the professional appointed to handle the process.

3. Interim Resolution Professional (IRP):

NCLT appoints an IRP to temporarily manage the company. The IRP takes control of the company’s operations and financial records.

Committee of Creditors (CoC)

After gathering all the claims, the IRP forms a Committee of Creditors (CoC), which includes all the financial creditors of the company. The CoC makes major decisions about the company’s future, including:

– Deciding whether to keep the IRP as the Resolution Professional (RP) or appoint a new one.

– Approving a plan to resolve the company’s financial troubles (the “resolution plan”).

Resolution Plan

A “Resolution Applicant,” which could be a person or company, submits a plan to rescue the debtor. This plan must include:

– How the debts will be paid, especially to creditors.

– How the company will be managed after the process.

The CoC reviews and votes on the plan. To approve it, at least 66% of the creditors must agree. If the plan is approved, it’s sent to the NCLT for final approval.

What if the Resolution Plan is Rejected?

If the plan is rejected by either the CoC or NCLT, the company might face liquidation. This means the company’s assets will be sold off to repay creditors.

Liquidation

If the NCLT orders liquidation:

– A liquidator is appointed to sell off the company’s assets.

– The money from the sale is distributed among creditors according to the law.

In summary, the CIRP is a legal way to either rescue a financially troubled company or, if that’s not possible, sell its assets to pay off its debts. The process is strictly monitored by the NCLT to ensure fairness to all parties involved.

Now let’s look at how the 10 companies went through insolvency.

1- HDIL (Project BKC)

According to an article published by Hindustan Times on November 16, 2022, the Committee of Creditors, consisting of lenders from the HDIL Group, approved resolution plans for six real estate projects. Adani Properties Pvt Ltd was selected for the BKC project, while a consortium of Khyati Realtors and Dosti Realty was chosen for Majestic Towers in Nahur, Whispering Towers in Mulund, and Premier Residences in Kurla.

Hindustan Times further reported that the committee also approved Adani Properties’ resolution plan for HDIL’s Shahad Maharal Lands, while Dev Land and Housing Pvt Ltd was selected for HDIL Towers. During the resolution process, the decision was made to invite resolution plans for 10 separate projects. The corporate insolvency resolution process has been ongoing before the National Company Law Tribunal (NCLT) since 2019.

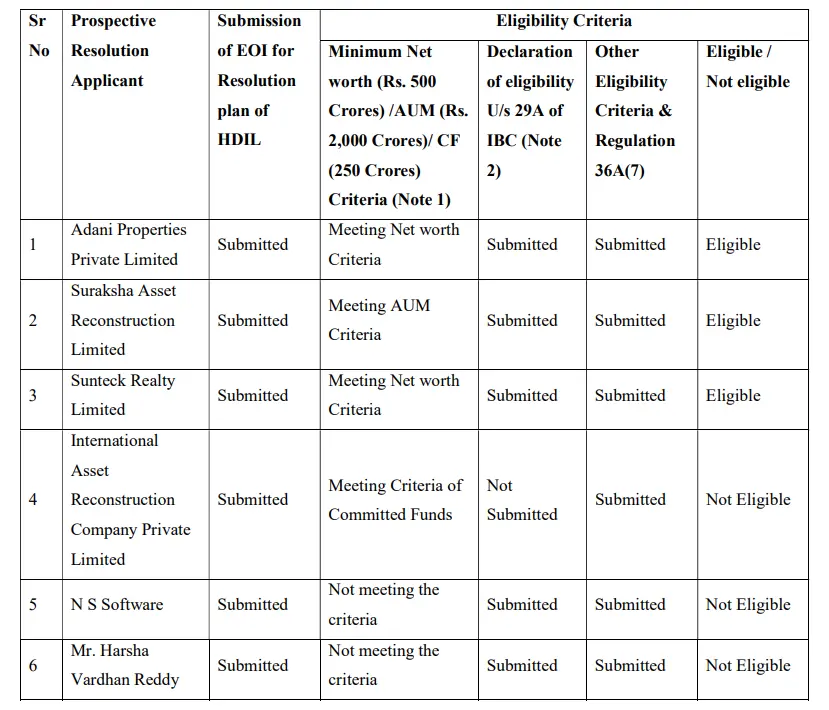

Additionally, documents from the HDIL website, including a provisional list of prospective resolution applicants dated August 3, 2020, reveal that Adani Properties Private Limited, Suraksha Asset Reconstruction Limited, Sunteck Realty Limited, International Asset Reconstruction Company Private Limited, NS Software, and Mr. Harsha Vardhan Reddy were listed as potential applicants.

This information confirms a key point: HDIL applied for the insolvency process in 2019, and by August 2020, Adani Group, along with five other potential applicants, had expressed interest in acquiring HDIL.

Based on the Hindustan Times report and the available documents, it can be concluded that Adani Group takeover of the HDIL BKC project was a fair and transparent deal.

2- Radius Estates & Developers

The issue regarding Radius Estates & Developers is still pending resolution in the Supreme Court of India. However, according to a LiveMint article published on September 6, 2024, the Supreme Court declined to stay the resolution plan of Adani Goodhomes, a subsidiary of Adani Infrastructure and Developers, which aims to acquire the insolvent real estate company Radius Estates. A bench comprising Justices Sanjiv Khanna and Sanjay Kumar issued a notice to Adani Goodhomes and other involved parties, including the dissenting creditor Beacon Trusteeship, which challenged the plan in the Supreme Court after it was upheld by the NCLAT. Beacon Trusteeship claimed that the plan imposed an approximately 93% reduction (haircut) on its claims.

LiveMint further reported that the case underscores the broader issue of significant haircuts taken by lenders in insolvency resolutions. On May 27, the National Company Law Appellate Tribunal (NCLAT) upheld Adani Goodhomes’ plan to acquire Radius Estates, rejecting the objections raised by dissenting creditors, including ICICI Prudential Venture Capital Fund and Beacon Trusteeship. This decision reaffirmed an earlier ruling by the Mumbai bench of the National Company Law Tribunal (NCLT), which had approved the plan and dismissed allegations of collusion.

The dissenting creditors, including Beacon Trusteeship, accused the resolution professional (RP), Jayesh Sanghrajka, and HDFC Ltd, the largest creditor, of colluding to ensure that only one bid was submitted. They called for the insolvency process to be restarted, but the NCLT Mumbai approved Adani Goodhomes’ bid in December 2022, citing a lack of evidence to support these claims.

Moreover, the resolution plan received support from over two-thirds of the creditors, including nearly all of the 700 homeowners and major financial creditors such as HDFC, Yes Bank Ltd, Piramal Capital & Housing Finance Ltd, Infinite Buildcon Private Ltd, and ICICI Bank Ltd. ICICI Prudential Venture Capital Fund and Beacon Trusteeship were the only dissenting creditors who challenged the plan, alleging misconduct. Their challenges were rejected by both the NCLT and NCLAT, leading them to escalate the matter to the Supreme Court.

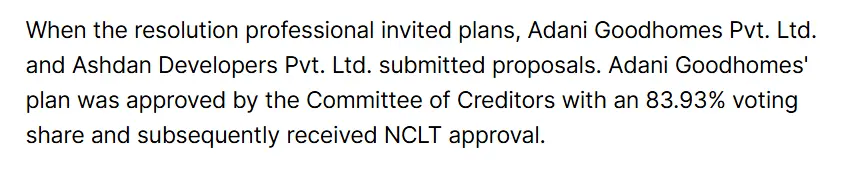

Additionally, both Adani Goodhomes and Ashdan Developers submitted proposals, but Adani Goodhomes’ plan was approved by the Committee of Creditors with an 83.93% voting share and was subsequently endorsed by the NCLT. Adani Goodhomes also committed to completing the residential project in Mumbai without additional cost to homeowners. Following the approval, Adani Goodhomes infused ₹450 crore as interim finance by December 31, 2021, which was used to settle dues, pay FSI premiums to the Municipal Corporation of Greater Mumbai (MCGM), and initiate construction.

The LiveMint report highlights three key points:

1. The Supreme Court supported the resolution process.

2. Adani Goodhomes’ plan was approved by the Committee of Creditors with 83.93% support, including backing from homeowners and major financial institutions such as HDFC Bank, Yes Bank, Piramal Capital & Housing Finance Ltd, Infinite Buildcon Private Ltd, and ICICI Bank Ltd.

3. Two companies, Adani Goodhomes and Ashdan Developers, submitted proposals.

3- National Rayon Corporation

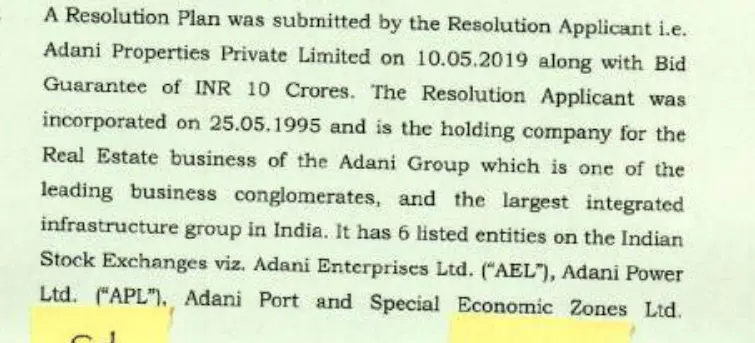

From the Insolvency and Bankruptcy Board of India website, we discovered a document dated 13.03.2020 related to the National Rayon Corporation (NRC) insolvency process. The document confirmed that the Adani Group was the sole bidder to take over NRC. It stated, *”A Resolution Plan was submitted by the Resolution Applicant, i.e., Adani Properties Private Limited, on 10.05.2019, along with a Bid Guarantee of INR 10 Crores. The Resolution Applicant was incorporated on 25.05.1995 and is the holding company for the real estate business of the Adani Group, which is one of the leading business conglomerates and the largest integrated infrastructure group in India. It has six listed entities on the Indian stock exchanges, viz., Adani Enterprises Ltd. (‘AEL’), Adani Power Ltd. (‘APL’), Adani Port and Special Economic Zones Ltd. (‘APSEZ’), Adani Transmission Ltd. (‘ATL’), Adani Green Energy Ltd. (‘AGEL’), and Adani Gas Ltd. (‘AGL’), with a combined market cap of over INR 154,674,00,00,000. The Resolution Applicant is part of the promoter group holding strategic investments in AEL, APSEZ, APL, AGEL, and ATL.”

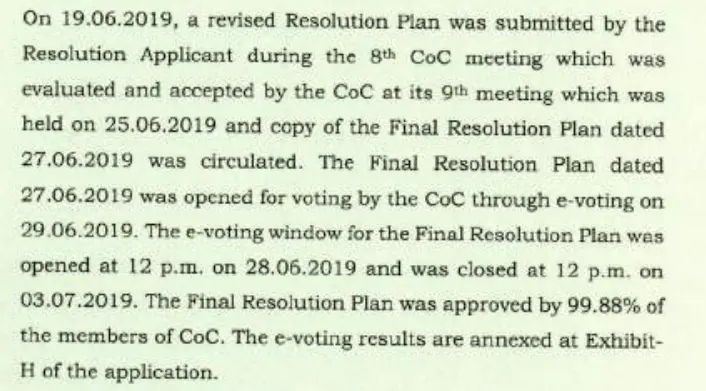

The document further stated, “An affidavit affirming its eligibility under Section 29A of the Code was issued by the Resolution Applicant on 12.03.2019. On 19.06.2019, a revised Resolution Plan was submitted by the Resolution Applicant during the 8th CoC meeting, which was evaluated and accepted by the CoC at its 9th meeting, held on 25.06.2019. A copy of the Final Resolution Plan, dated 27.06.2019, was circulated. The Final Resolution Plan, dated 27.06.2019, was opened for voting by the CoC through e-voting on 29.06.2019. The e-voting window for the Final Resolution Plan was opened at 12 p.m. on 28.06.2019 and closed at 12 p.m. on 03.07.2019. The Final Resolution Plan was approved by 99.88% of the CoC members. The e-voting results are annexed at Exhibit-H of the application.”

Moreover, “The Resolution Plan, which was proposed by the Resolution Applicant, was approved by the CoC with a 99.88% vote share. No voters abstained, and only 0.12% of the CoC rejected the plan. Through this plan, the Resolution Applicant proposes to make payments to various stakeholders.”

Additionally, we found an article from Live Mint, published in November 2018. The article reported, “The bank approached the court to recover Rs. 270 crore from NRC, which manufactures viscose filament yarn, nylon tyre cord fabric, and chemicals including caustic soda and sulphuric acid. The bank proposed Vikas Gupta, an independent consultant, as the interim resolution professional (IRP) to initiate the corporate insolvency resolution process (CIRP) of the company. NRC was declared a non-performing asset (NPA) in May 2010 and was later admitted to the Board for Industrial and Financial Reconstruction (BIFR). However, after the BIFR was dissolved following the introduction of the Insolvency and Bankruptcy Code (IBC), the lenders approached the Mumbai bench of the National Company Law Tribunal in 2017.”

Thus, it is confirmed that the Adani Group took over the National Rayon Corporation with an overwhelming 99.88% approval. It is also evident that NRC went bankrupt in 2010.

4- Essar Power MP Ltd

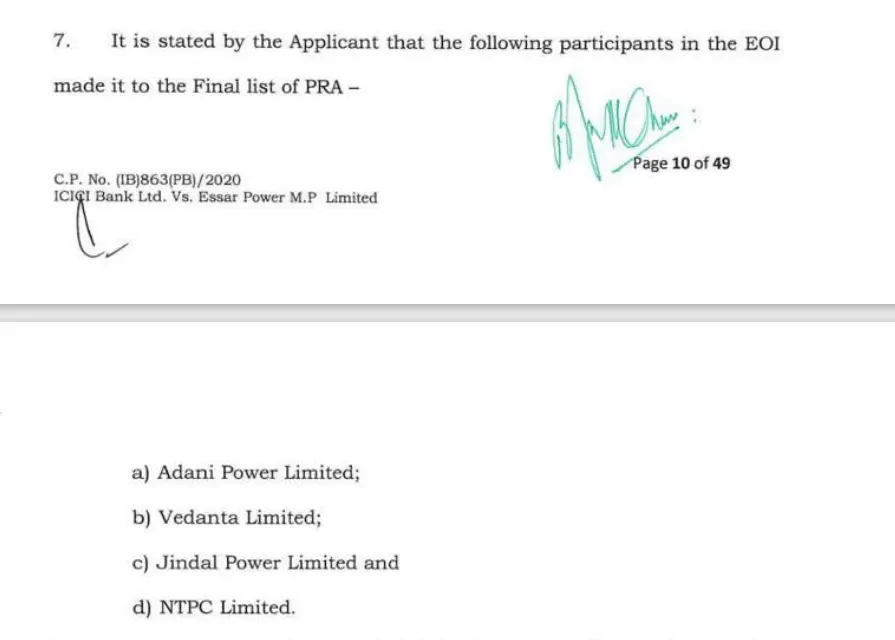

From the Insolvency and Bankruptcy Board of India website, we found a document related to the Essar Power insolvency process. The document mentioned:

“The following participants in the Expression of Interest (EOI) made it to the final list of Potential Resolution Applicants (PRA):

a) Adani Power Limited;

b) Vedanta Limited;

c) Jindal Power Limited; and

d) NTPC Limited.”

The final list of these participants was submitted by the applicant on 27.12.2020 in accordance with Regulation 36A (12) of the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016.

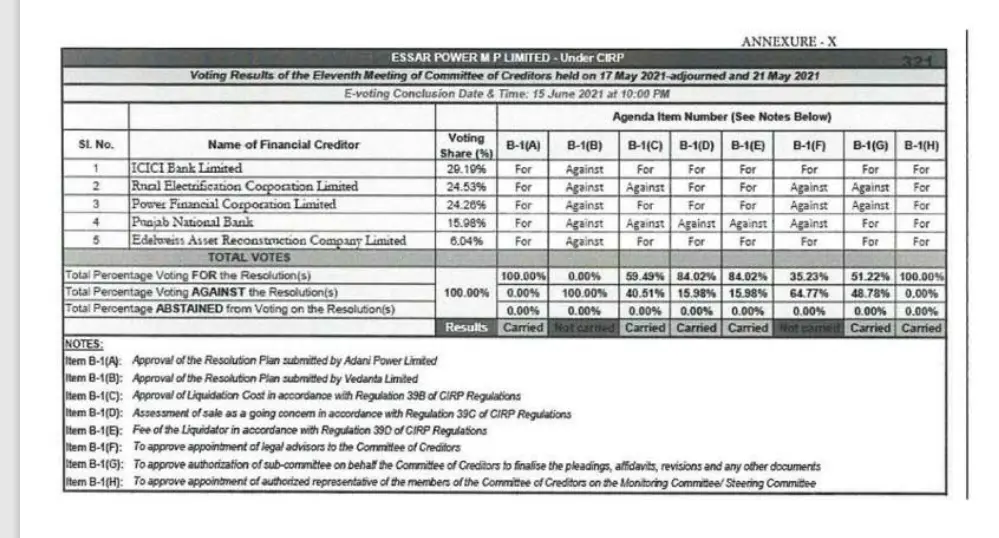

Further, it was stated that of the four PRAs, only two—Vedanta Limited and Adani Power Limited—submitted their Resolution Plans. Both PRAs made revisions to their respective plans and submitted addendums. Voting for the approval of the resolution plans took place during the 11th meeting of the Committee of Creditors (CoC) on 21.05.2021. The CoC approved Adani Power’s plan with 100% of the vote.

Additionally, a report from MoneyControl, published on March 16, 2022, stated that Adani Power completed the acquisition of Essar Power’s 1,200 MW thermal power project in Mahan, Madhya Pradesh. The acquisition cost was over Rs 4,250 crore, which included the estimated cost for compliance with environmental and emission norms. According to the article, Adani Power acquired 100% of the paid-up share capital and management control of Essar Power M P Ltd (EPMPL), which owns the 1,200 MW thermal power plant in the Singrauli District of Madhya Pradesh. Adani Power had been declared the successful bidder for the project in June 2021.

In conclusion, the document from the Insolvency and Bankruptcy Board of India confirms that four companies—Adani Power Limited, Vedanta Limited, Jindal Power Limited, and NTPC Limited—expressed interest in acquiring Essar Power MP. However, only Adani Power and Vedanta submitted resolution plans, and Adani Power’s bid was unanimously approved by the CoC with 100% of the votes.

5- Dighi Port Limited

According to a report by Business Standard published on March 9, 2020, the National Company Law Tribunal (NCLT) approved a resolution plan worth Rs 650 crore submitted by Adani Ports & Special Economic Zone (APSEZ) for the debt-ridden Dighi Port, located south of Mumbai. This resolution came with a significant 79.2% haircut for the lenders, who had originally made claims amounting to Rs 3,098 crore.

The successful bid grants the Adani Group access to Maharashtra, where it previously had no presence, despite operating 11 ports across the country’s coastline and constructing a transshipment terminal at Vizhinjam in southern Kerala. Notably, Dighi Port was the first port to enter bankruptcy proceedings in April 2018. The 16-member Committee of Creditors (CoC), led by the Bank of India and holding 99.68% of voting shares, approved APSEZ’s revised offer of an upfront cash payment of Rs 650 crore, as stated in the NCLT order dated March 5.

The report further highlights that Dighi Port, promoted by industrialist Vijay Kalantri, owed Rs 3,098 crore to lenders. Kalantri had submitted an offer of Rs 720 crore, which was rejected by the lenders. Initially, bids from Jawaharlal Nehru Port Trust (JNPT), APSEZ, and the Veritas Consortium were considered by the CoC, but APSEZ, the flagship company of the Adani Group, emerged as the highest bidder.

In October 2019, the National Company Law Appellate Tribunal (NCLAT) directed the NCLT Mumbai to rule on APSEZ’s bid for Dighi Port. The resolution process had been delayed as Kalantri, the promoter, made a counteroffer with a higher upfront payment of Rs 720 crore. However, the amended bankruptcy code prohibits defaulters from bidding on assets they had initially promoted. The lenders voted in favor of APSEZ and rejected the promoter’s offer to settle the dues under Section 12A of the bankruptcy code.

In November 2018, JNPT, Adani Ports, and a consortium of Veritas India and UV Asset Reconstruction Company had all submitted bids to acquire Dighi Port. However, in July 2019, JNPT withdrew its bid after the NCLT suggested modifications. Ultimately, the 16-member CoC voted in favor of Adani Ports to take over the operations of Dighi Port.

6- Lanco Amarkantak Power

Several companies, including Vedanta, Jindal Power, Adani Power, and a Hyderabad-based firm, initially expressed interest in acquiring Lanco Amarkantak Power. As time passed, additional companies joined the bidding process for the debt-ridden power company. Ultimately, however, Adani Group emerged as the highest bidder.

According to a report on the Power Technology website, the Competition Commission of India (CCI) granted approval for Adani Power to acquire Lanco Amarkantak Power, a 1.92GW power plant. This acquisition followed Lanco Amarkantak Power’s entry into the corporate insolvency resolution process (CIRP) in September 2019.

The website further stated that the auction for Lanco Amarkantak Power saw limited competition, as Reliance Industries and a consortium led by the Power Finance Corporation (PFC) chose not to participate. Although Jindal Power had previously outbid Adani Power, it withdrew its interest in early 2024 and formally requested to retract its petition through the Amravati National Company Law Tribunal, leaving only three bidders in the auction.

The Economic Times, in an article published on August 22, 2024, reported that Adani Power’s resolution plan to acquire Lanco Amarkantak Power Ltd (LAPL) had been approved by the Hyderabad bench of the National Company Law Tribunal (NCLT). Adani Power plans to pay Rs 4,101 crore to take over the distressed company, which has liabilities of Rs 15,633 crore.

The Economic Times also reported that, in January 2022, lenders rejected a sole offer of Rs 3,000 crore from Twin Star Technologies, a company owned by metals magnate Anil Agarwal, deeming it too low. When the sale process restarted, both Adani Power and Reliance Industries, along with the PFC-led consortium, showed interest in acquiring LAPL. However, Adani and Reliance opted not to participate in the auction, citing concerns over the sale process, leaving the PFC-led consortium as the sole bidder with an offer of Rs 3,020 crore. In January 2023, 95% of lenders by value voted in favor of the PFC-led consortium’s plan, but the NCLT did not approve it for several months. Later, Adani Power made an unsolicited higher offer of Rs 3,650 crore, which it further increased to Rs 4,101 crore in December 2023, ultimately securing the acquisition.

In summary, four key facts stand out regarding Lanco Amarkantak Power Ltd:

1. More than four companies, including Adani Power, Jindal, Vedanta, a Hyderabad-based company, PFC, and Twin Star Technologies, participated in the bid to acquire the debt-ridden power company.

2. In January 2022, lenders rejected Twin Star Technologies’ sole offer of Rs 3,000 crore.

3. The PFC-led consortium was the sole bidder offering Rs 3,020 crore, and in January 2023, 95% of lenders voted in favor of the consortium’s plan, though it was not immediately endorsed by the NCLT.

4. In December 2023, Adani Group made the highest offer of Rs 4,101 crore, surpassing all previous bids, and took over the operations of Lanco Amarkantak Power.

7- Coastal Energen Ltd.

According to a Live Mint report published on 12 September 2024, ‘the Supreme Court permitted a consortium, including Adani Power Ltd, to operate the power plant of Coastal Energen Pvt Ltd, a bankrupt company that Adani successfully bid for. This decision overturned an interim order from the National Company Law Appellate Tribunal (NCLAT), which had directed the resolution professional to take control of the plant. A three-judge bench, led by Chief Justice DY Chandrachud, restored the status quo ante, meaning the situation was reverted to what it was prior to the NCLAT’s 6 September order, where Adani had been in charge of the plant after its takeover plan for the insolvent company was approved.

Live Mint further reported that Senior Advocate Mukul Rohatgi, representing Adani Power, argued that the company had the legal right to run the plant since the committee of creditors—comprising banks that had lent to Coastal Energen—had approved the consortium’s resolution plan on 31 August. A sum of ₹3,335 crore was paid to 16 creditors, and possession of the plant was taken. “They paid ₹3,300 crore to the committee of creditors. The committee has approved the plan with 97%. Their commercial wisdom ought to prevail,” Chief Justice Chandrachud noted, allowing Adani to continue operating the plant.

Sherisha Technologies Pvt Ltd and Jindal Power Ltd were also bidders for the 1,200 MW thermal power plant.

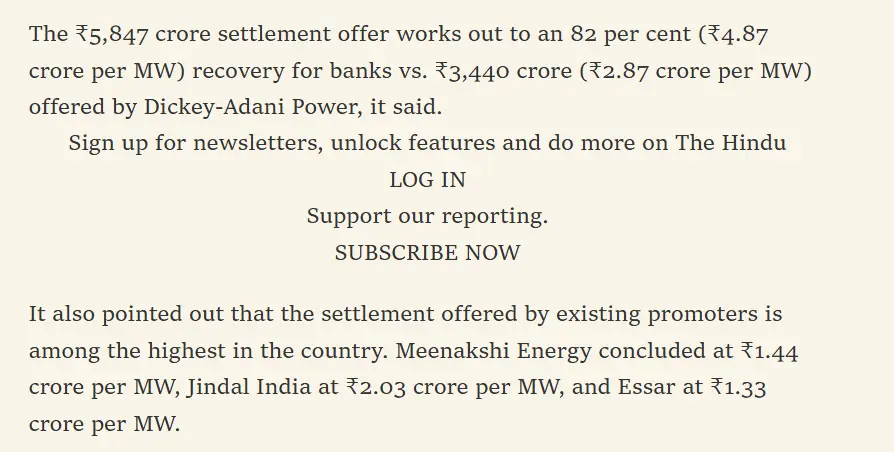

A February 2022 report by Hindu Business Line highlighted that Mutiara & Precious Energy Holdings, the existing promoters of Coastal Energen Pvt Ltd, which was undergoing Corporate Insolvency Resolution Process, had proposed a total settlement of ₹5,847 crore, including 15% equity, amid news that Adani Power had emerged as the successful bidder for the troubled company. The settlement offer amounted to an 82% recovery for banks, working out to ₹4.87 crore per MW, compared to Adani Power’s ₹3,440 crore offer (₹2.87 crore per MW). The report also pointed out that this was one of the highest settlement offers in the country, with other comparable bids from Meenakshi Energy (₹1.44 crore per MW), Jindal India (₹2.03 crore per MW), and Essar (₹1.33 crore per MW).

However, under Section 29A of the Insolvency and Bankruptcy Code (IBC), promoters are not allowed to bid for insolvent companies, making Mutiara & Precious Energy Holdings’ settlement offer of ₹5,847 crore irrelevant. Since Adani Group offered the most competitive price of ₹2.87 crore per MW in comparison to other bidders, they naturally won the bid, a point that Chief Justice Chandrachud also emphasized in the September ruling.

8- Aditya Estates

Adani Group won the bid to acquire Aditya Estates Pvt Ltd, which holds a prime 3.4-acre residential property near Mandi House in the heart of the national capital, through an insolvency process for a total deal value of ₹400 crore. Live Mint reported on 23 February 2020, “The Delhi-based Principal Bench of the National Company Law Tribunal (NCLT) has approved Adani Properties’ resolution plan to acquire Aditya Estates for ₹265 crore. An additional ₹135 crore would be allocated towards statutory charges, bringing the total deal value to ₹400 crore. The Committee of Creditors (CoC) of Aditya Estates, led by ICICI Bank PLC, had already approved Adani’s ₹400 crore offer with a 93.01% vote share, which includes an upfront payment of ₹265 crore.”

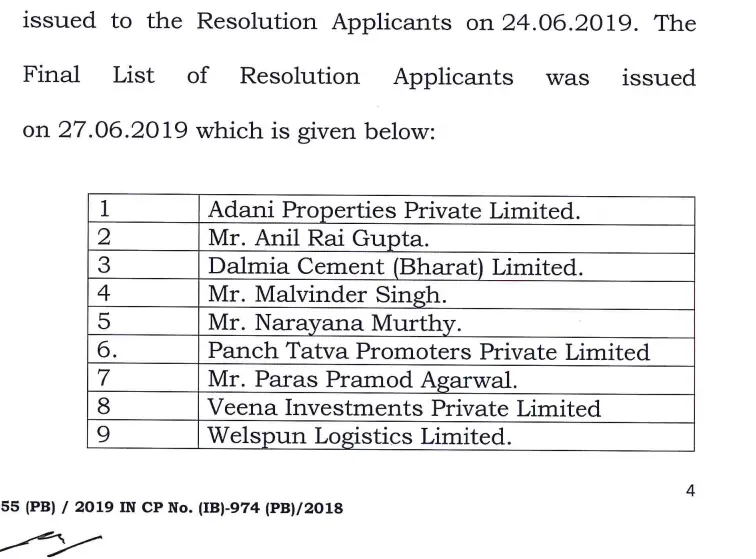

Live Mint further reported that, according to the list of resolution applicants submitted on 27 June 2019, nine entities had shown interest in the property. These included Narayana Murthy, Malvinder Singh, Anil Rai Gupta, Paras Pramod Agarwal, as well as Dalmia Cement (Bharat), Veena Investments, Welspun Logistics, Adani Properties, and Panch Tatva Promoters. However, only two—Adani Properties and Veena Investments—submitted resolution plans. Later, the CoC rejected Veena Investments’ ₹225 crore offer, deeming it non-compliant and conditional, as it did not account for potential liabilities that could arise from NDMC for house tax, sales tax, and income tax in the future.

Additionally, the IBBI website confirmed Live Mint’s report, stating that the final list of applicants included nine companies: Adani Properties Private Limited, Mr. Anil Rai Gupta, Dalmia Cement (Bharat) Limited, Mr. Malvinder Singh, Mr. Narayana Murthy, Panch Tatva Promoters Private Limited, Mr. Paras Pramod Agarwal, Veena Investments Private Limited, and Welspun Logistics Limited. The document also noted, “It is submitted that from the final list of Resolution Applicants, only two—Adani Properties Private Limited (APPL) and Veena Investments Private Limited (VIPL)—submitted their Resolution Plans on 07.08.2019.”

Thus, while nine companies made it to the final list of applicants eligible to bid for Aditya Estates, Adani Group ultimately outbid the others. Moreover, Adani’s bid received overwhelming approval from 93% of the CoC members.

9- Karaikal Port

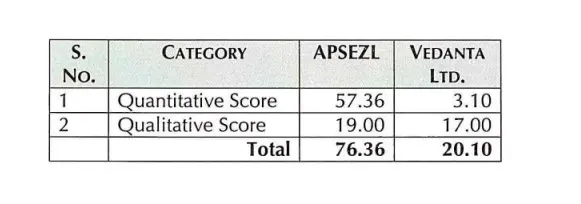

We obtained a document from the National Company Law Appellate Tribunal (NCLAT) stating that Adani Ports and Vedanta made it to the final list of applicants to bid for Karaikal Port. The document also revealed the Qualitative and Quantitative scores of Adani Ports (APSEZL) and Vedanta Ltd. Adani Ports received a Quantitative score of 57.36, while Vedanta Ltd. scored only 3.10. The Qualitative score for Adani Ports was 19.00, whereas Vedanta Ltd. received 17.00.

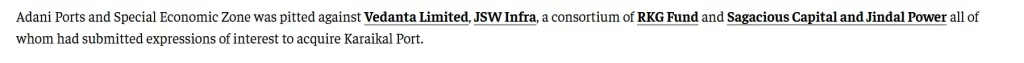

Additionally, we found a news article published by The Economic Times, which reported that the National Company Law Tribunal (NCLT) had approved Adani Ports and Special Economic Zone Limited’s Rs 1,485 crore offer for Karaikal Port, submitted under the Insolvency and Bankruptcy Code (IBC) process. As per the NCLT order, Adani Ports was competing against Vedanta Limited, JSW Infra, a consortium of RKG Fund and Sagacious Capital, and Jindal Power, all of whom had submitted expressions of interest to acquire Karaikal Port.

The article further stated that Karaikal Port had a debt of Rs 2,960 crore that it was unable to repay. According to the NCLT order, the fair value of the company, as determined by external valuers, was Rs 1,215 crore, while its liquidation value was placed at Rs 822 crore.

In conclusion, although several companies, including Vedanta Limited, JSW Infra, RKG Fund and Sagacious Capital, and Jindal Power expressed interest in acquiring Karaikal Port, only Adani Ports and Vedanta Ltd. made it to the final list. Adani Ports ultimately won the bid against Vedanta Ltd.

10- Korba West Power Company

According to the Insolvency and Bankruptcy Board of India (IBBI), three companies submitted resolution plans for Korba West Power Company: (a) Adani Power Limited, (b) Worlds Window Impex India Private Limited, and (c) Lakshdeep Investments and Finance Private Limited. During the 6th meeting of the Committee of Creditors (CoC), each applicant presented their plans. However, Lakshdeep Investments and Finance Private Limited’s plan was deemed non-responsive as it did not include the required earnest money deposit.

The IBBI further reported that on 19.03.2019, the Process Advisor evaluated the resolution plans, and Adani Power Limited’s plan was identified as the best, in accordance with Regulation 38(3) of the CIRP Regulations. In the 10th CoC meeting on 01.04.2019, Adani Power’s plan was presented and approved by 69.08% of the CoC members.

In a report by The Economic Times on 25 November 2024, it was confirmed that Adani Power, owned by Gautam Adani, had purchased the Avantha Group’s Korba West Power Company (KWPCL) for Rs 4,200 crore. KWPCL operates a 600-megawatt coal-fired power plant in Chhattisgarh and is expanding capacity by an additional 600 MW. The deal was confirmed by an Avantha Group spokesperson, owned by Gautam Thapar.

To summarize, three companies—Adani Power, Worlds Window Impex India, and Lakshdeep Investments—reached the final resolution process for bidding on Korba West Power Company, with Adani Power ultimately winning the bid and acquiring the company for Rs 4,200 crore.

Conclusion:

Over the past eight years since the introduction of the Insolvency and Bankruptcy Code (IBC), the Adani Group has acquired numerous non-performing assets that had accumulated significant debt, largely during the tenure of the Congress-led government. By taking over these struggling companies, the Adani Group has revitalized them, giving them a fresh lease on life. However, claims from the Congress party that the group received large haircuts while acquiring 10 such companies, allegedly due to undue influence within the government, are both misleading and mischievous.

Both the Supreme Court and the National Company Law Appellate Tribunal (NCLAT) have repeatedly emphasized that the IBC was never intended to serve as a tool for recovering dues in full. The Congress party’s argument that if a company owed a debt of Rs 600 crore but was acquired for Rs 300 crore, it implies a Rs 300 crore loss to the exchequer, is not only flawed but also naïve. Such claims ignore the fundamental purpose of the IBC, which is to keep companies operational, ensuring that employees, creditors, and stakeholders are not unduly harmed by complete liquidation or closure. The goal is to revive businesses, preserve jobs, and maintain economic stability—not to pursue unrealistic recovery of debt at the expense of the companies’ survival.