If there’s one constant alongside the impressive rise in Adani stocks, it’s the unwavering attention the group attracts from around the globe. After a series of criticisms from Western media and fictional storywriters, the latest attack has come from Africa, specifically Kenya. Social media users from the ‘Mother Continent’ have expressed concerns and made claims about the Adani Group’s latest venture: operating Jomo Kenyatta International Airport in Nairobi, Kenya. X user Nelson Amneya has been sharing documents for a couple of days, claiming that the Adani Group is in talks with the Kenya Airports Authority to develop and operate the nation’s capital airport.

Unfortunately, even after gaining independence from the British in 1963, some social media users in Kenya have not yet achieved complete mental freedom from the West. This is evident in their parroting of statements from sources such as Hindenburg Research, the Financial Times, and The Guardian. True independence requires independent thought. Here are some allegations made by Nelson Amneya and other social media users from Kenya.

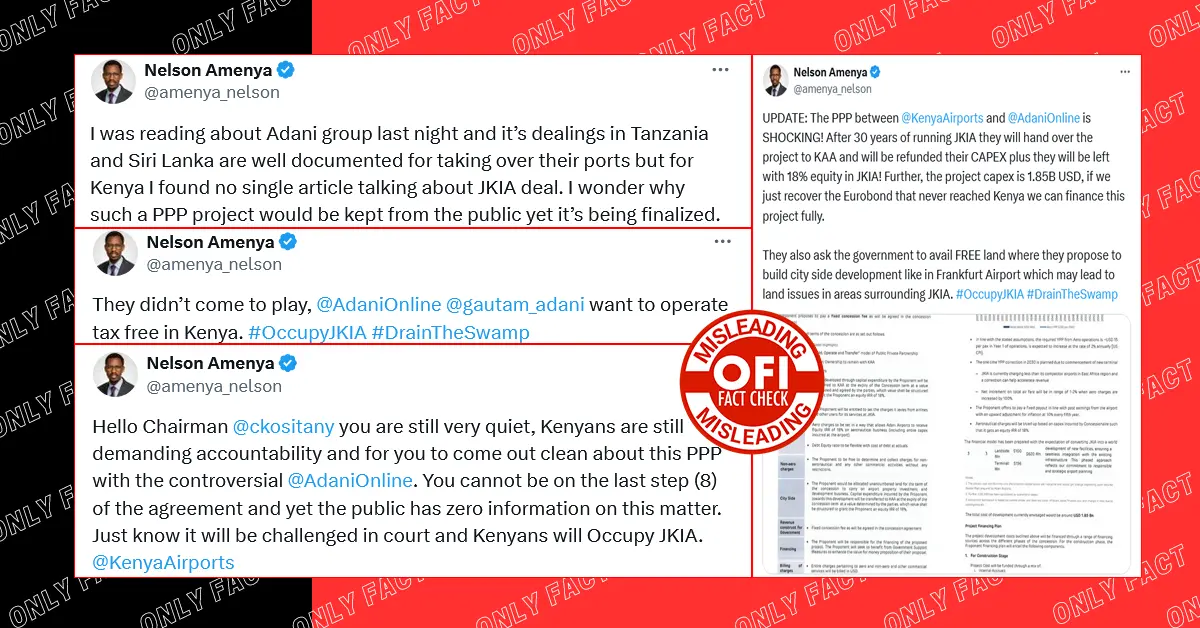

Nelson Amneya on 14th July claimed, ‘The PPP between @KenyaAirports and @AdaniOnline is SHOCKING! After 30 years of running JKIA they will hand over the project to KAA and will be refunded their CAPEX plus they will be left with 18% equity in JKIA! Further, the project capex is 1.85B USD, if we just recover the Eurobond that never reached Kenya we can finance this project fully. They also ask the government to avail FREE land where they propose to build city side development like in Frankfurt Airport which may lead to land issues in areas surrounding JKIA.’

UPDATE: The PPP between @KenyaAirports and @AdaniOnline is SHOCKING! After 30 years of running JKIA they will hand over the project to KAA and will be refunded their CAPEX plus they will be left with 18% equity in JKIA! Further, the project capex is 1.85B USD, if we just recover… pic.twitter.com/iGBHcWdrwT

— Nelson Amenya (@amenya_nelson) July 14, 2024

Nelson Amneya on 13th July claimed, ‘Hello Chairman @ckositany you are still very quiet, Kenyans are still demanding accountability and for you to come out clean about this PPP with the controversial @AdaniOnline. You cannot be on the last step (8) of the agreement and yet the public has zero information on this matter. Just know it will be challenged in court and Kenyans will Occupy JKIA.’

Hello Chairman @ckositany you are still very quiet, Kenyans are still demanding accountability and for you to come out clean about this PPP with the controversial @AdaniOnline. You cannot be on the last step (8) of the agreement and yet the public has zero information on this… https://t.co/NOpPf6zzw0 pic.twitter.com/8y5VMkX3uy

— Nelson Amenya (@amenya_nelson) July 13, 2024

Nelson Amneya in another tweet on 13 July asserted, ‘They didn’t come to play, @AdaniOnline @gautam_adani want to operate tax free in Kenya.’

They didn’t come to play, @AdaniOnline @gautam_adani want to operate tax free in Kenya. #OccupyJKIA #DrainTheSwamp pic.twitter.com/z75eTmOqLz

— Nelson Amenya (@amenya_nelson) July 13, 2024

Nelson Amneya stated on July 12, ‘More documents showing the agreement between Adani and KAA for a 30 year lease of JKIA. The company that @kipmurkomen was using to receive kickbacks is called “Consortium Company Holoco Abu Dhabi” in UAE (more details loading). This deal was done without any public participation.’

More documents showing the agreement between Adani and KAA for a 30 year lease of JKIA. The company that @kipmurkomen was using to receive kickbacks is called “Consortium Company Holoco Abu Dhabi” in UAE (more details loading). This deal was done without any public participation. https://t.co/1MLhT7OHd8 pic.twitter.com/i8y8t3sZ2h

— Nelson Amenya (@amenya_nelson) July 11, 2024

Stephen Mutoro on 12th July made accusations saying, ‘Why @EACCKenya @DCI_Kenya should be summoning former Roads & Transport CS Kipchumba Murkomen to explain the shady PIP proposal by con @AdaniOnline of India meant to take over #JKIA @gautam_adani.’

Why @EACCKenya @DCI_Kenya should be summoning former Roads & Transport CS Kipchumba Murkomen to explain the shady PIP proposal by con @AdaniOnline of India meant to take over #JKIA @gautam_adani pic.twitter.com/2MQkcvi8t0

— Stephen Mutoro (@smutoro) July 11, 2024

Here are the rest of the tweets on the matter

Uuuuuuuiiii!!! Amkeni tunaibiwa JKIA Murkomen was in the final stages of leasing our airport for 30 years to a corrupt company from India and has received massive kickbacks. Check some documents I’ve received below, more coming. pic.twitter.com/fl9gQFaw9v

— Nelson Amenya (@amenya_nelson) July 11, 2024

I was reading about Adani group last night and it’s dealings in Tanzania and Siri Lanka are well documented for taking over their ports but for Kenya I found no single article talking about JKIA deal. I wonder why such a PPP project would be kept from the public yet it’s being… https://t.co/wbDgIoAyZG

— Nelson Amenya (@amenya_nelson) July 13, 2024

‼️ JE UNAJUA ⁉️

— Maria Sarungi Tsehai (@MariaSTsehai) July 13, 2024

Kampuni ya Adani Ports iko Tanzania specifically bandari ya Dar es Salaam? Sasa wamenunua TICTS kwa kushirikiana na Abu Dhabi Special Economic Zone – wameunda kampuni ya East Africa Gateway Limited

Haya nimeyaleta maana kuna maneno kwa jirani 🇰🇪 kuhusu Adani… pic.twitter.com/WQCQYzQA20

The Adani Group has been involved in several high-profile corruption and fraud allegations. Key controversies include:

— Kones. (@BCherich) July 14, 2024

1. Hindenburg Research Report: In January 2023, Hindenburg Research published a report accusing the Adani Group of stock manipulation and accounting fraud…

Also Read: Exposing Hindenburg: Baseless Accusations and Malicious Agendas Against SEBI

Fact Check

In our quest to fully understand the situation in Nairobi, we contacted the Adani Group. The group confirmed that they are currently in negotiations with the Kenya Airports Authority to develop, build, and operate Jomo Kenyatta International Airport.

Moreover, we inquired about Nelson’s accusations regarding the deal. Here is the group’s response:

1. Comparing this structured investment to the Eurobond issue is misleading. This public-private partnership (PPP) ensures accountability and structured returns, unlike the vague implications of Eurobond funds.

2. A 30-year tenure ensures long-term commitment and sustainable development.

3. A fixed concession fee and additional payments adjusted for inflation ensure the government benefits financially over the 30-year term.

4. The projected year-on-year increase in the asset block and aeronautical yield per passenger (YPP) demonstrates the project’s long-term financial sustainability.

5. Adani Airports is expected to get an 18% Internal Rate of Return (IRR) from the aeronautical business, making the project financially attractive for investors.

6. All charges for aeronautical and non-aeronautical services will be billed in USD, providing a stable revenue stream.

7. The Capital Expenditure (CAPEX) will be refunded at the end of the term, so Kenya Airports Authority (KAA) won’t have to pay upfront costs, making it a smart financial move for Kenya.

8. The project’s CAPEX of USD 1.85 billion is essential for transforming Jomo Kenyatta International Airport (JKIA) into a world-class facility, boosting Kenya’s aviation and tourism sectors.

9. The investment includes building a new terminal, apron, and taxiway systems, improving operational efficiency and capacity.

10. Proper planning and community engagement can address concerns about land issues.

11. Allocating unencumbered land for development around the airport is crucial for the project’s success. This can create an airport city, generating jobs and economic growth, similar to Frankfurt Airport.

12. The “Build, Operate, and Transfer” (BOT) model is commonly used for airport projects worldwide. It allows private companies to develop and manage airport infrastructure while the public sector retains ownership.

13. Adani’s experience in managing and improving airports will bring operational excellence to JKIA, making it competitive in East Africa.

Nelson Amenya was so focused on attacking the Kenya Airports Authority and the Adani Group that he missed some logical points. For example, Amneya tweeted that the public has zero information about the deal, claimed that the Adani Group wants to operate tax-free in Kenya, and asserted that the deal was finalized without public participation and spans three decades. He also incorrectly equated leasing with buying. Other X users, such as Stephen Mutoro, mistakenly described the takeover of the airport’s operations as equivalent to owning the entire airport.

Adani Group has responded humbly, emphasizing the thoroughness of the PPP process, which involves several rigorous stages from pre-feasibility studies to final contract negotiations. The process ensures that only credible and capable partners are considered, enhancing the project’s chances of success.

Key steps include:

- Detailed pre-feasibility study

- Sponsor review

- Financial and legal due diligence

These steps ensure that the project is thoroughly evaluated and feasible before moving forward. Proposal evaluation and project development phases assess public interest, feasibility, technical and financial aspects, and comprehensive risk factors. This ensures the project’s benefits and sustainability.

Public interest and affordability assessments are crucial during proposal evaluations, ensuring alignment with national infrastructure plans and value for money. The transparency in the PPP process ensures that all stakeholders, including the public, are informed as the project progresses.

The project is currently in the final contract negotiations stage, involving detailed financing and concession agreements. This stage is crucial for finalizing terms that protect public interests and ensure project viability. Ongoing communication with the public and stakeholders ensures accurate and comprehensive information sharing.

The partnership with Adani Airports will bring substantial investment, modernize JKIA, and enhance its capacity and efficiency, aligning with global best practices and benefiting Kenya’s aviation sector. The BOT (Build, Operate, Transfer) model ensures that JKIA remains under KAA’s ownership while leveraging Adani’s expertise and investment for development.

The PPP is conducted under stringent regulatory frameworks to ensure compliance with all legal and procedural requirements. Any legal challenges will be met with a robust defense based on the thoroughness and legality of the process.

In conclusion, the PPP with Adani Airports follows a transparent, detailed, and legally compliant process designed to enhance JKIA and benefit Kenya’s economy. Rather than resorting to alarmist rhetoric, it is important to recognize the structured and strategic approach being undertaken.

In his July 13 tweet, Amenya claimed that the Adani Group intends to operate tax-free in Kenya and that the government would provide significant financial support, including concession rights, tax considerations, infrastructure, and direct agreements. Amenya portrayed these arrangements as unethical. However, those familiar with multinational business practices understand that governments often offer incentives to attract foreign investment. For instance, in 2020, India launched Production Linked Incentives (PLI) to encourage foreign enterprises.

When we asked the Adani Group about the serious allegations made by Nelson Amenya, they provided a detailed response. The group responded, ‘ The Government of Kenya (GoK) is providing a letter of support to mitigate risks of termination and non-performance, a common practice in PPPs to ensure project stability and confidence.

Adani Airports is granted exclusive concession rights to develop, manage, and operate JKIA for 30 years, ensuring a clear management structure and operational continuity.

Favorable tax policies are crucial for the success of large infrastructure projects. The GoK is considering tax exemptions on corporate income from the concession for specific years to attract substantial investment and ensure the project’s financial viability.

These measures aim to make the investment more attractive and enable JKIA to compete with other regional hubs.

The GoK is committed to providing external infrastructure like roads, water, electricity, and telecom to support the project and ensure its seamless operation.

Direct agreements with lenders and substitution agreements offer additional financial security and confidence for all stakeholders.

The Adani Airports project will bring significant investment, job creation, and economic growth to Kenya. It will modernize JKIA, making it a premier aviation hub in Africa.

The BOT (Build, Operate, Transfer) model ensures that the airport remains under KAA’s ownership while benefiting from Adani’s expertise and capital.

The entire PPP process is conducted under stringent regulatory frameworks, ensuring transparency, accountability, and compliance with all legal requirements.

Public disclosures and stakeholder engagements are integral to the process, ensuring that all relevant information is appropriately shared.

In conclusion, Nelson and his supporters, lacking a basic understanding of the matter, have made unfounded accusations. The deal with the Government of Kenya is still in the negotiation phase, yet Nelson has preemptively accused the Adani Group and his government of corruption. However, the reality is quite different. The strategic partnership with Adani Airports is a well-structured, transparent, and beneficial move for JKIA and Kenya’s economy. It’s time to focus on the facts and the long-term benefits rather than spreading baseless allegations.