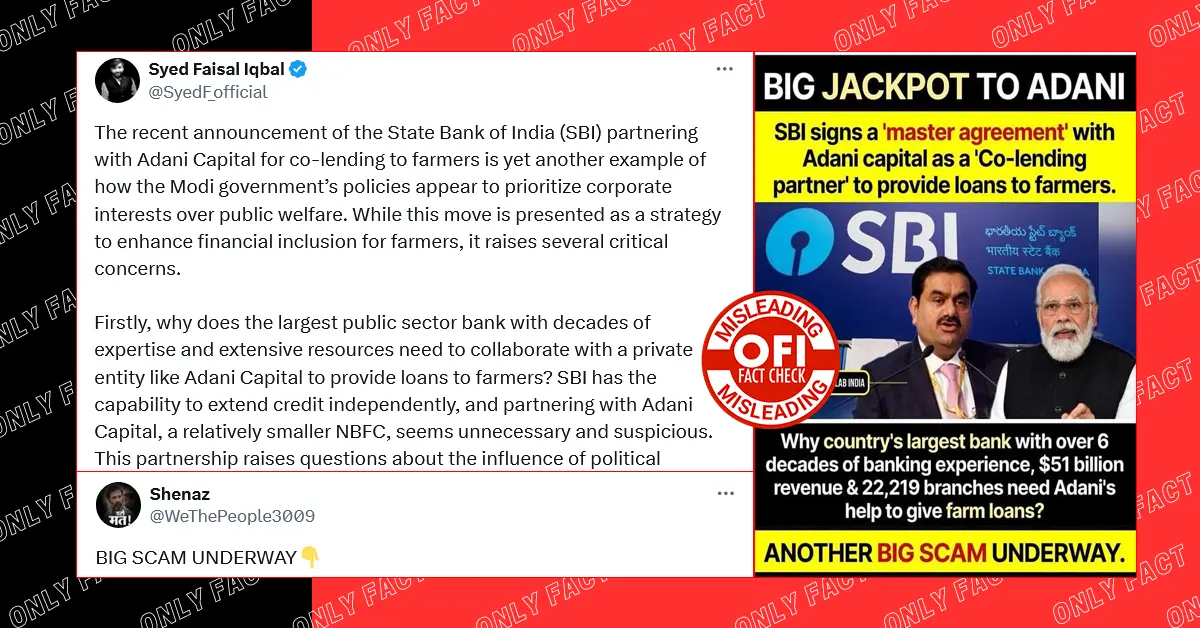

An infographic image circulating on X claims that the Adani Group has recently signed a deal with the State Bank of India (SBI) to disburse loans to farmers. Social media users claim that this arrangement shows significant corruption, stating it is unusual for SBI to partner with another private financial institution in such a way. Supporters of the INDI alliance have labeled this alleged deal as a major scam orchestrated by the Modi government and the Adani Group.

Congress supporter Shenaz claimed by sharing an infographic image, ‘BIG SCAM UNDERWAY’

BIG SCAM UNDERWAY👇 pic.twitter.com/LxS20ouzod

— Shenaz (@WeThePeople3009) July 28, 2024

Trinamool Congress leader Syed Faisal Iqbal asserted, ‘The recent announcement of the State Bank of India (SBI) partnering with Adani Capital for co-lending to farmers is yet another example of how the Modi government’s policies appear to prioritize corporate interests over public welfare. While this move is presented as a strategy to enhance financial inclusion for farmers, it raises several critical concerns. Firstly, why does the largest public sector bank with decades of expertise and extensive resources need to collaborate with a private entity like Adani Capital to provide loans to farmers? SBI has the capability to extend credit independently, and partnering with Adani Capital, a relatively smaller NBFC, seems unnecessary and suspicious. This partnership raises questions about the influence of political connections in financial decisions, given the Adani Group’s well-known proximity to the Modi administration…’

The recent announcement of the State Bank of India (SBI) partnering with Adani Capital for co-lending to farmers is yet another example of how the Modi government’s policies appear to prioritize corporate interests over public welfare. While this move is presented as a strategy… pic.twitter.com/MWPeQjZp6J

— Syed Faisal Iqbal (@SyedF_official) July 28, 2024

Fact Check

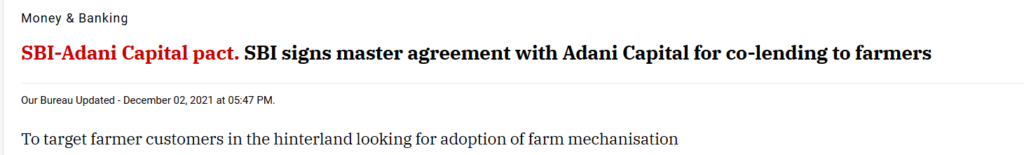

We began our investigation by examining the details of the purported financial deal between the Adani Group and the State Bank of India (SBI). We found a news report from The Hindu Business Line, published on December 2, 2021, stating, ‘State Bank of India (SBI) has signed a master agreement with Adani Capital for co-lending to farmers for the purchase of tractors and farm implements, aimed at increasing efficiency in farm operations and crop productivity.’

The report further noted, ‘Adani Capital is the non-banking finance company (NBFC) arm of the Adani Group. SBI, in a statement, said that this partnership would enable it to target farmers in the interior hinterlands of the country who are looking to adopt farm mechanization to enhance crop productivity.’

Additionally, The Hindu Business Line reported that ‘India’s largest bank underscored that it is actively seeking co-lending opportunities with multiple NBFCs to finance farm mechanization, warehouse receipt finance, Farmer Producer Organizations (FPOs), etc., to enhance credit flow and double farmers’ income.’

We also found a report from The Economic Times, published on December 2, 2021, stating, ‘The country’s largest lender, SBI, has partnered with Adani Capital as a co-lending partner to provide loans to farmers. SBI has signed a master agreement with Adani Capital Private Ltd (Adani Capital), the NBFC arm of the Adani Group, for co-lending to farmers for the purchase of tractors and farm implements, to increase efficiency in farm operations and crop productivity.’

The Economic Times further quoted Dinesh Khara, Chairman of SBI, saying, “We will continue to work with more NBFCs to reach maximum customers in far-flung areas and provide last-mile banking services.”

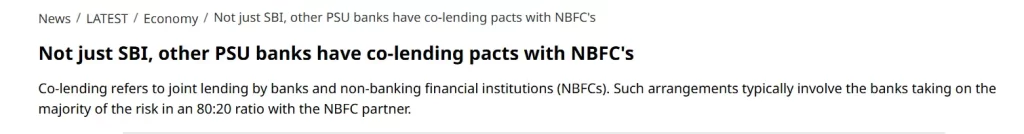

To determine whether it is uncommon for SBI to sign deals with private entities, we found a report from Business Today, published on December 9, 2021. The report stated, ‘Not just the State Bank of India (SBI), but other public sector banks, including Punjab National Bank (PNB), Central Bank of India (CBI), Bank of India (BOI), and Bank of Baroda (BOB), have agreements for co-lending, underscoring the potential of partnerships that address the 2018 regulatory mandate for priority sector loans. The arrangement received a further boost with the recent tie-up of SBI with Adani Capital. Earlier, India’s largest commercial bank had signed similar agreements with Vedika Credit, Save Microfinance, Paisalo Digital, and ECL Finance, a subsidiary of Edelweiss Financial Services. Similar co-lending pacts exist, including those of PNB and CBI with IIFL Home Finance, BOI with MAS Financial Services, and BOB with U GRO Capital. Even private sector banks have co-lending tie-ups, including ICICI Bank, IndusInd Bank, and Standard Chartered Bank, among others.’

Co-lending refers to joint lending by banks and non-banking financial institutions (NBFCs). Such arrangements typically involve the banks taking on the majority of the risk in an 80:20 ratio with the NBFC partner.

Moreover, we found another report from The Economic Times, published in 2021, stating that banks in India are also now signing deals with Fintechs. For example, DBS Bank and CredAble partnered for trade financing, helping pump liquidity and offer financing options to India Inc. Similarly, Kotak Mahindra Bank tied up with Pine Labs in October to expand its point-of-sale (PoS) services to more merchants, especially retailers. Additionally, Federal Bank signed a deal with Cred Avenue, HDFC Bank with Paytm, ICICI Bank with Niyo, Axis Bank with Bharat Pe, Punjab National Bank with Lendingkart, IDBI Bank with U GRO Capital, and SBM Bank India with Drip Capital.

In conclusion, the viral infographic image claiming that Adani Capital recently signed a deal with SBI and that such an arrangement is unusual is blatant misinformation. First, the deal was signed back in 2021. Furthermore, it is neither uncommon nor unusual for public sector banks to sign contracts with private financial institutions, as evidenced by the numerous examples of such collaborations for wider and more efficient coverage of banking services.

Also Read: Exposing Hindenburg: Baseless Accusations and Malicious Agendas Against SEBI