Amid the ongoing general elections, leaders of the INDI alliance are intensifying their efforts to critique the incumbent Modi government. Allegations span from raising concerns about the integrity of democracy to alleged alterations to the constitution. In a similar vein of criticism, TMC Rajya Sabha MP Saket Gokhale recently highlighted a news article from 2023 discussing Micron chip investments in India. Gokhale underscored a perceived bias towards Narendra Modi’s home state of Gujarat, insinuating that investment incentives and subsidies disproportionately favour Gujarat at the expense of other opposition-led states, which he claimed are being neglected in allocating funds.

Saket Gokhale tweeted, “How Modi deprives other states while pumping govt money into Gujarat? Last year, US semiconductor firm Micron announced that it was setting up a facility in Gujarat. The cost of the facility – $2.75 billion (₹2085 crores) But wait – of this, Micron is investing only $825 million. A total of 50% of project cost which is $1.3 billion is being provided through a subsidy by the Govt of India. Which means that the Modi Govt is giving ₹1100 crores to Micron just for setting up the facility in Gujarat. At the same time, forget subsidies, Opposition states like West Bengal, Karnataka, Kerala, and many others are being deprived of their own pending dues from the Modi Govt. Over ₹7000 crores dues of West Bengal have been withheld by the Modi Govt thus depriving the people of Bengal of their rightful money. Therefore, while crores of public money goes as “subsidy” to Modi’s state while Opposition states are cut off from their own dues.

Modi & BJP will get their answer on 4th June when the election results are declared. Because in the process of shamelessly targeting Opposition parties, they have actually deprived & targeted the people of states who chose not to vote for Modi & BJP.”

How Modi deprives other states while pumping govt money into Gujarat 👇

— Saket Gokhale MP (@SaketGokhale) May 2, 2024

Last year, US semiconductor firm Micron announced that it was setting up a facility in Gujarat.

Cost of the facility – $2.75 billion (₹2085 crores)

But wait – of this, Micron is investing only $825… pic.twitter.com/fe3N6x9AZS

Also Read: PM Modi’s Photo Removal From Vaccination Certificate Tied to Election MCC Rules, Not Covishield Row

Fact Check

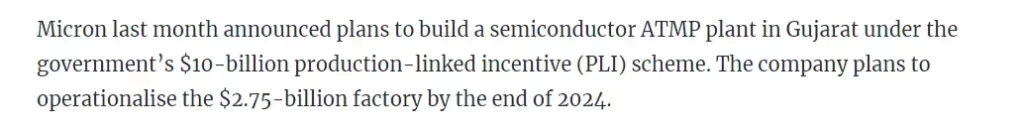

Initially, we aim to ascertain the nature of the investment made by the Indian Central government into the Gujarat facility of the US semiconductor company Micron. According to a report from Business Standard in July 2023, Micron disclosed intentions to construct a semiconductor ATMP (Assembly, Testing, Marking, and Packaging) plant in Gujarat as part of the government’s $10-billion Production Linked Incentive (PLI) scheme. The company intends to make the $ 2.75 billion factory operational by the conclusion of 2024.

A Brief Overview of the Production Linked Incentive (PLI) Initiative

The Production Linked Incentive (PLI) Scheme for Large Scale Electronics Manufacturing is a government initiative geared towards promoting domestic manufacturing and attracting substantial investments in mobile phone manufacturing and specific electronic components, including Assembly, Testing, Marking, and Packaging (ATMP) units. This scheme offers a production-linked incentive to eligible companies, providing a boost to the electronics manufacturing sector and positioning India as a global player in the industry.

Under the PLI scheme, companies can receive incentives ranging from 4% to 6% on incremental sales of goods manufactured in India within target segments, over a period of five years following a defined base year. The scheme aims to spur investment, create employment opportunities, and enhance the competitiveness of Indian products in both domestic and international markets.

Implemented through a designated Nodal Agency acting as a Project Management Agency (PMA), the scheme offers support and oversight throughout its duration. The PLI scheme has garnered significant interest, with 746 applications approved across 14 sectors, indicating an expected investment of over Rs. 3 lakh crore. Notably, 176 Micro, Small, and Medium Enterprises (MSMEs) have benefited from the scheme, particularly in sectors like Bulk Drugs, Medical Devices, Pharma, Telecom, White Goods, Food Processing, Textiles, and Drones. Many of these MSMEs serve as investment partners or contract manufacturers for larger corporations, contributing to the scheme’s overarching goal of stimulating economic growth and bolstering India’s manufacturing capabilities.

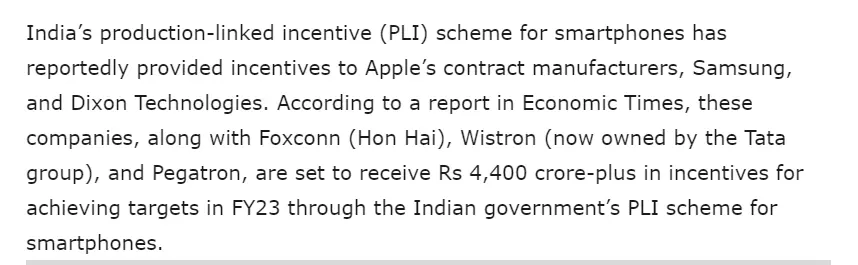

The question arises: Are BJP-ruled states the sole beneficiaries of the PLI scheme?

The resounding answer is no. Regardless of the political affiliation of the ruling party in a state, the PLI scheme is designed to foster growth across all regions of India. According to reports from the Times of India, Apple’s contract manufacturers, Samsung, and Dixon Technologies have all received incentives under the PLI scheme for smartphones. The report further elaborates that these companies, alongside Foxconn (Hon Hai), Wistron (now part of the Tata group), and Pegatron, are expected to receive over Rs 4,400 crore in incentives for meeting targets in FY23 through India’s PLI scheme for smartphones.

Examining the locations of these companies reveals a diverse spread across various states. Apple India is situated in Congress-ruled Bangalore, Karnataka, while Foxconn India’s establishment is planned in the same location. Wistron operates in Bangalore, Karnataka, and Pegatron is based in Chennai, Tamil Nadu, governed by the DMK. Furthermore, companies like Kaynes Technology India in Mysore, Mitsubishi India with offices across India, Swaminathan Industries in Chennai, Saharasa Semiconductor in Rajasthan under Congress rule till March 2023, Lumens Aircom in Karnataka, and Esko Casting and Electronics in Kolkata, have all benefited from the PLI scheme.

The examples provided underscore the fact that the PLI scheme extends its benefits nationwide, irrespective of the political landscape in each state.

Is the Centre withholding funds from West Bengal, Kerala, and Karnataka because the people of these states decided to vote against the BJP?

Saket Gokhale’s claim suggesting that the Central government is withholding funds from states like West Bengal, Karnataka, and Kerala due to their political stance against the BJP is highly deceptive. In the case of West Bengal, discussions between state officials and the Central government are ongoing to resolve any issues regarding fund disbursement. Regarding Karnataka, the Finance Minister, Nirmala Sitharaman, has explicitly refuted any claims of fund withholding, affirming that the state receives its allocated funds in full.

As for Kerala, the state is facing economic challenges, partly due to its communist policies. However, the situation regarding fund allocation is distinct. Kerala’s government exceeded its borrowing limit, prompting the Central government to deny the requested amount. This led to legal recourse, with the Kerala government appealing to the Supreme Court. After prolonged negotiations, the Supreme Court urged the Centre to provide a one-time financial package to assist Kerala in addressing its immediate fiscal shortfall. Eventually, the Centre agreed to allocate Rs. 13,000 crore to the state, demonstrating a resolution to the matter through legal and administrative processes.

Conclusion:

TMC MP Saket Gokhale disseminated inaccurate information regarding the Central government’s investment in the semiconductor firm Micron. Contrary to his claims, the Central government has provided funds and subsidies to companies for domestic manufacturing through the PLI scheme, regardless of the ruling party in the states. Gokhale’s insinuation that the Modi government is showing bias towards opposition-ruled states undermines the integrity and federal structure of India.

| Claim | The Modi government favors BJP-ruled states with investment while depriving opposition-led states of funds. |

| Claimed by | Saket Gokhale |

| Fact Check | Misleading |

Also Read: Analyzing Corporate and Individual Tax Policies under NDA and UPA Government