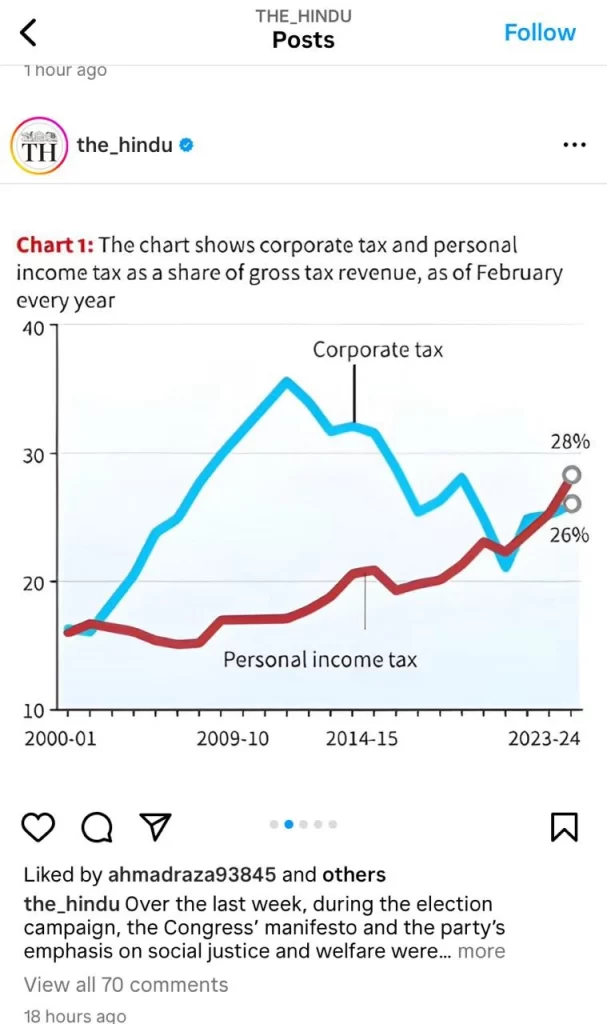

Recently, The Hindu shared an infographic illustrating the tax revenue dynamics between February 2023 and 2024. According to the data, there has been a notable 28% increase in the personal income tax share within the gross tax revenue during this period. Conversely, the corporate tax share within the gross tax revenue accounts for 26 per cent.

This revelation has sparked discussions on X, where individuals with a communist inclination have criticized the Modi government. They argue that the government’s policies seem to favor businessmen, as evidenced by the decline in corporate tax contributions. Meanwhile, they highlight a perceived burden on the hard-earned income of the middle class, as reflected in the significant rise in personal income tax contributions.

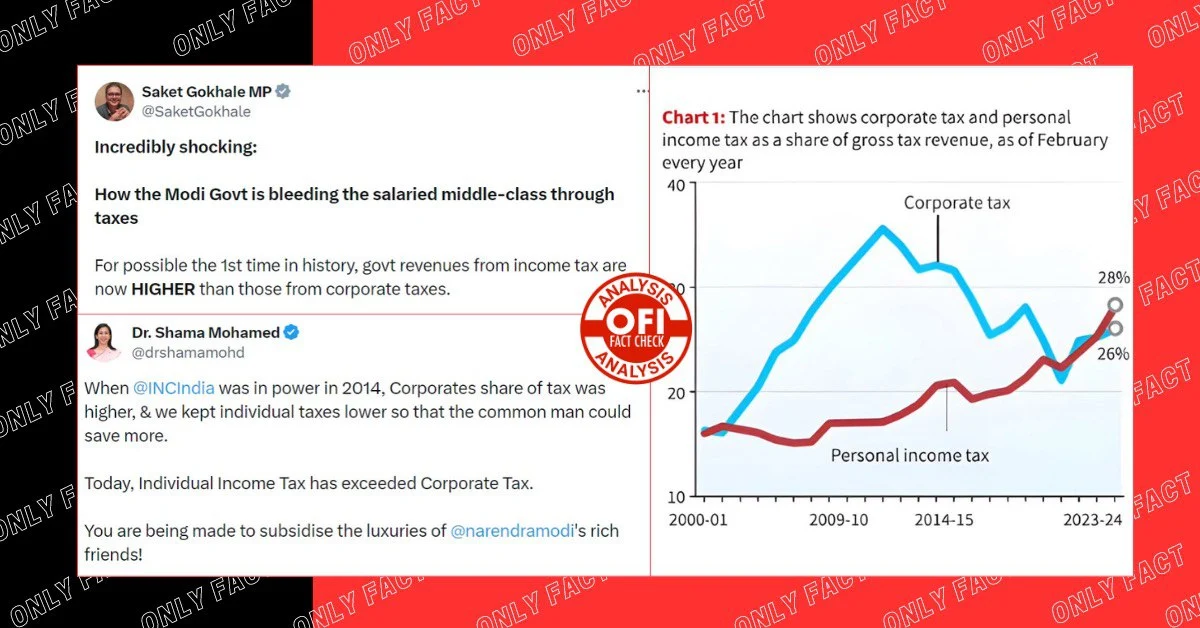

Trinamool Congress Rajya Sabha MP Saket Gokhale tweeted, “How the Modi Govt is bleeding the salaried middle-class through taxes. For possibly the 1st time in history, govt revenues from income tax are now HIGHER than those from corporate taxes. Until Modi’s 2nd term which started in 2019, corporate tax revenue exceeded that from income tax. But due to the tax terrorism unleashed by Modi Govt on the middle class in the last 5 years, that has changed. Now, govt revenue from taxes paid by multi-million dollar corporations is LESS than the income tax paid by an average Indian. Therefore, while corporates earn billions, the average middle-class salaried person is struggling to meet expenses and pay EMIs after being sucked of all money through income tax. Modi has broken India’s middle class. Salaries are not growing while taxation has gone through the roof. Plus, along with income tax, you also have to pay indirect taxes in the form of ridiculous GST on EVERYTHING. Modi & BJP take the middle-class for granted. In the last 10 years, Modi has done NOTHING for the middle-class except taxing them & giving nothing in return. And guess what? Even after taxing you ridiculously, funds are being held back by Modi Govt from Opposition states & they’re being deprived of their rightful dues.”

Incredibly shocking:

— Saket Gokhale MP (@SaketGokhale) May 1, 2024

How the Modi Govt is bleeding the salaried middle-class through taxes

For possible the 1st time in history, govt revenues from income tax are now HIGHER than those from corporate taxes.

Until Modi's 2nd term that started in 2019, corporate tax revenue… pic.twitter.com/AKTkgzrIlz

More figures, such as Dr. Shama Mohammad, Sidd Sharma, Mini Nair, Sushant Singh, and Mohd Abdul Sattar have shared The Hindu’s infographic, echoing similar sentiments.

When @INCIndia was in power in 2014, Corporates share of tax was higher, & we kept individual taxes lower so that the common man could save more.

— Dr. Shama Mohamed (@drshamamohd) May 1, 2024

Today, Individual Income Tax has exceeded Corporate Tax.

You are being made to subsidise the luxuries of @narendramodi's rich… pic.twitter.com/hCg0XhsEMS

𝚂𝚊𝚕𝚊𝚛𝚒𝚎𝚍 𝙲𝚕𝚊𝚜𝚜 – 𝙹𝚞𝚖𝚙 𝚒𝚗 𝙹𝚘𝚢!!!

— 𝐒𝐢𝐝𝐝 (@sidd_sharma01) May 1, 2024

𝙳𝚊𝚗𝚌𝚎 𝚝𝚘 𝚝𝚑𝚎 𝚝𝚞𝚗𝚎𝚜 𝚘𝚏 #𝙶𝚊𝚛𝚋𝚊🕺💃

🔸For the first time in #IndependentIndia = Income Tax Collections surpass Corporate Tax Collections!!!

🔸Closely look at that trend line since 2014-15, narrating the… pic.twitter.com/RP7R4eHmEV

In 2014, Corporate Tax was double of the Income Tax collection.

— Mini Nair (@minicnair) April 30, 2024

After 10 Yrs, Individual Income Tax is more than Corporate Tax. pic.twitter.com/11RUXP6K4e

What regressive tax policies look like. Rising share of personal incomes and indirect tax, even as collections from corporate taxes have reduced, as has share of direct tax. pic.twitter.com/gaMThM5BZH

— Sushant Singh (@SushantSin) April 30, 2024

⚪In 2014, Corporate Tax was DOUBLE the Income Tax collection

— Mohd Abdul Sattar (@SattarFarooqui) May 1, 2024

⚪ After 10 Yrs, Individual Income Tax is MORE than Corporate Tax.

⚪ See how rich is getting RICHER & the public…..??!!!..Happy #LabourDay 😀 #MayDay2024 #ModiKiGuarantee #InternationalWorkersDay #RahulGandhi… pic.twitter.com/OPkwYsCFeb

However, this article, is a comprehensive examination of the intricate components of the contemporary Indian tax system. Our analysis will meticulously explore both corporate taxation and personal income tax, aiming to address the pressing query: does the burden of taxation disproportionately fall on the middle class while corporations benefit from reduced tax liabilities?

Analysis

1- Are Middle-Class Income paying more taxes in the Modi regime?

In India, defining the middle class is a nuanced task, as criteria vary. According to a 2020-21 survey by the Indian think tank PRICE, households earning between INR 5 lakh and INR 30 lakh annually are considered middle class, although this is not universally agreed upon. Within this category, distinctions exist between the lower middle class, middle class, and upper middle class.

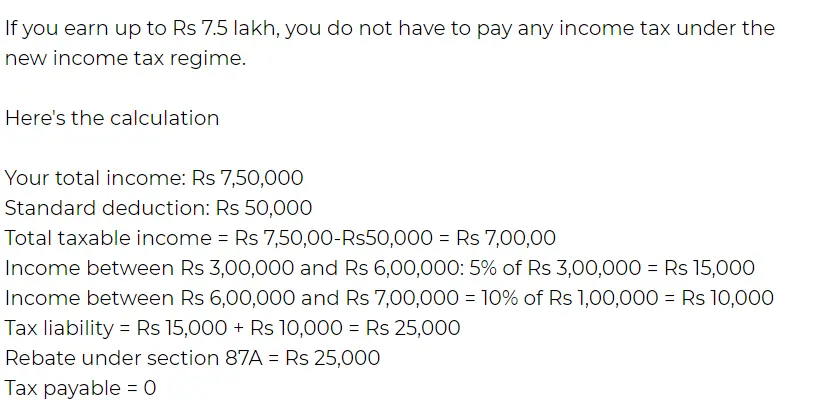

Transitioning to the taxation system, an Economic Times report from February 2023 highlights a significant development. Individuals earning an annual income of 7 lakh 50 thousand rupees are exempt from paying taxes. Budget 2023 introduced an extension of the standard deduction under the new income tax regime, allowing salaried employees and pensioners to claim a standard deduction of Rs 50,000. Consequently, individuals earning up to Rs 7.5 lakh are not liable to pay any income tax under the new regime. To illustrate, consider the following calculation: Total income: Rs 7,50,000.

Standard deduction: Rs 50,000

Total taxable income = Rs 7,50,00-Rs50,000 = Rs 7,00,00

Income between Rs 3,00,000 and Rs 6,00,000: 5% of Rs 3,00,000 = Rs 15,000

Income between Rs 6,00,000 and Rs 7,00,000 = 10% of Rs 1,00,000 = Rs 10,000

Tax liability = Rs 15,000 + Rs 10,000 = Rs 25,000

Rebate under section 87A = Rs 25,000

Tax payable = 0

For individuals earning 8 lakh per annum, their income tax liability amounts to 31,200 rupees.

Examining the current tax slabs in India reveals the following structure: Income ranging from Rs 3 lakh to Rs 5 lakh is taxed at 5%, while income from Rs 6 lakh to Rs 9 lakh incurs a 10% tax rate. Further, income between Rs 12 lakh and Rs 15 lakh is taxed at 20%, and any income above Rs 15 lakh is subject to a 30% tax rate.

This clarifies that individuals falling within the lower middle-income class, earning up to 7.5 lahks annually, are exempt from income tax. However, those classified as upper middle-income earners, with salaries exceeding 15 lakh per year, face a 30% income tax obligation.

Now, addressing the pivotal issue of personal income tax during the UPA rule, a comparison reveals notable differences. In the fiscal year 2013-14, tax slabs were structured such that individuals paid zero tax on incomes up to 2 lakhs, 10% tax on incomes between 2 lakhs and 5 lakhs, 20% tax on incomes from 5 lakhs to 10 lakhs, and those earning above 10 lakhs faced a 30% tax rate.

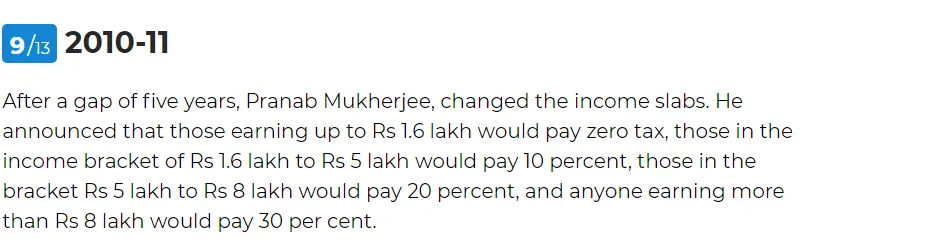

Similarly, in the fiscal year 2010-11, the tax structure included zero tax on incomes up to Rs 1.6 lakh, 10% tax on incomes between Rs 1.6 lakh and Rs 5 lakh, 20% tax on incomes from Rs 5 lakh to Rs 8 lakh, and a 30% tax rate for incomes exceeding Rs 8 lakh.

These comparisons highlight that during the Congress regime, salaried middle-class individuals bore a heavier income tax burden compared to the current government. As recently said by Congress leader Sam Pitroda regarding taxation, “The middle class should not be selfish and have a big heart.”

2- Rising Middle-Class Contribution: Exploring the Paradox of Increased Gross Revenue

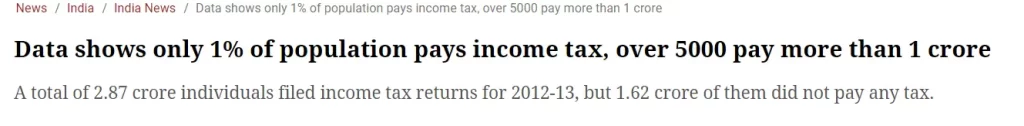

The explanation is straightforward: more individuals are now contributing to income tax payments compared to before. According to a report by The Indian Express in 2012-13, out of 2.87 crore individuals who filed income tax returns, 1.62 crores didn’t pay any tax, leaving only about 1.25 crore taxpayers, roughly one per cent of the country’s population at the time.

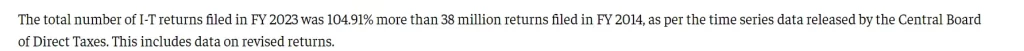

In contrast, a report by The Economic Times in January 2024 reveals a significant shift. Over the past decade, the number of individuals filing income tax returns more than doubled to 77.8 million in 2022-23, resulting in a rise in the direct tax-to-GDP ratio from 5.62% to 6.11%. The Central Board of Direct Taxes released time series data showing that in FY 2023, 104.91% more returns were filed compared to FY 2014, with income taxpayers increasing from 52.6 million to 93.7 million.

Additionally, The Hindu Business Line reported that in FY 2023, a staggering 7.4 crore people filed income tax returns, but 70% of these were zero tax returns, leaving 2.23 crore contributors. This contrasts with FY 2020, where 6.47 crore people filed returns, but only 45% were zero tax returns, resulting in 3.57 crore contributors. This increase indicates a 60% rise in taxpayers since FY 2020.

These statistics underscore a reality: during the Modi government’s tenure, efficient management of the taxation system and increased public trust have led to more individuals willingly stepping forward to pay income taxes. The doubling of filed income tax returns since 2014, coupled with the fact that taxes on the middle class haven’t been raised, reinforces the conclusion that more people are now honestly contributing to income tax payments compared to the UPA era.

3- What about the Corporate Tax?

Corporate Tax, commonly referred to as Corporation Tax, is a direct tax imposed on the net income or profits generated by corporate entities in their business operations. Governed by the provisions of the Income Tax Act, of 1961, this tax is levied at a predetermined rate. Companies, whether public or private, registered under the Companies Act 1956, fall within its purview. Currently, domestic companies are taxed at a rate of 30%.

Additionally, the Income Tax Act mandates a surcharge of 7% on net income ranging from Rs. 1 crore to Rs. 10 crore, and a 12% surcharge on income exceeding Rs. 10 crore.

In 2019, the Government of India introduced Section 115BAA through the Taxation (Amendment) Ordinance, which brought about significant changes to the Income Tax Act, including a reduction in corporate tax rates for domestic companies. Section 115BAA offers domestic businesses the option to pay tax at a reduced rate of 25.168%.

Foreign companies are liable to pay corporate income tax on income earned within a specified time frame. Royalties or fees received by foreign companies are taxed at a rate of 50%, while other income or the remainder is taxed at 40%. Surcharge rates of 2% and 5% apply to foreign companies with net incomes ranging from Rs. 1 crore to Rs. 10 crore and exceeding Rs. 10 crore, respectively.

4- Has Corporate Tax Collection Declined Under Modi’s Administration?

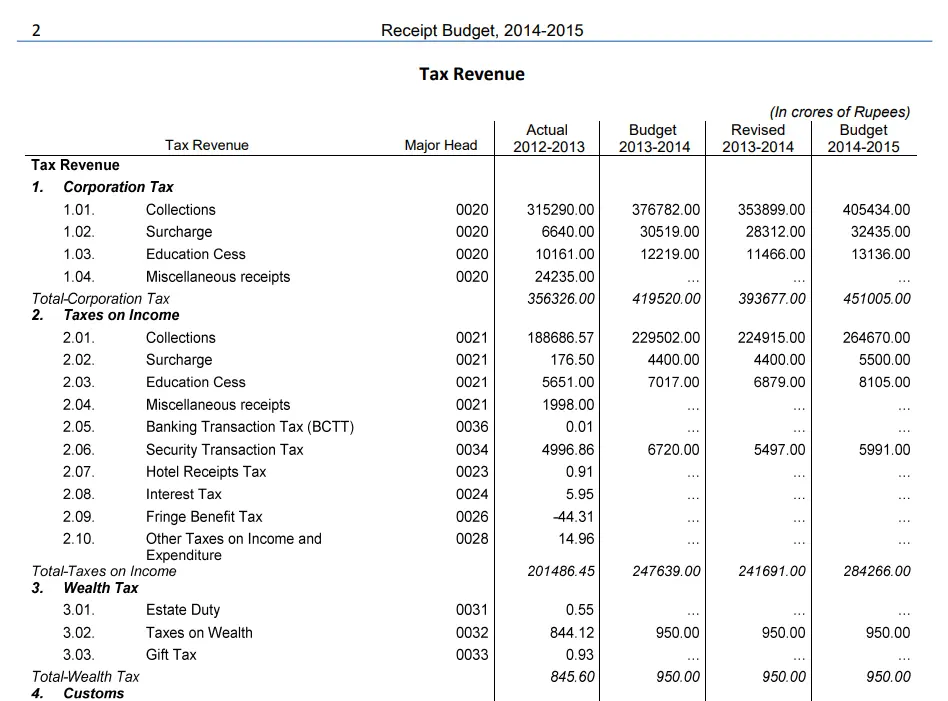

No, Corporate Tax collection has not declined during Modi’s tenure. In fact, it has seen a substantial increase. In the fiscal year 2013-14, Corporate Tax collection amounted to 3.93 lakh crores, whereas in 2023-24, it reached 10.98 lakh crores, a remarkable increase of approximately 175 per cent.

However, an interesting observation emerges when comparing Corporate Tax rates during the UPA and NDA regimes. Despite lower tax rates under the NDA government, actual tax collection surpasses that of the UPA era. A report from March 2013 indicates that the effective Corporate Tax for domestic companies was 33.99%, while foreign companies, including branches of overseas companies and smaller entities, faced a tax rate of 43.26%.

This underscores a fundamental principle of capitalism versus communism: imposing lower taxes on corporations incentivises them to invest more, ultimately leading to higher tax revenues. A report by The Deccan Herald highlights that over 1.85 lakh companies were incorporated in the country during the financial year 2023-24, the highest recorded number for any financial year.

5- Is India Alone in Adopting Lower Corporate Taxation Policies?

Contrary to the assumption, many countries follow a policy of lower corporate taxation to spur investment, job creation, and economic growth. For instance, Australia imposes a 30% corporate tax, Greece 22%, Israel 23%, Luxembourg 23.94%, Norway 22% to 25%, Spain 25%, Sweden 20.6%, Switzerland 8.5%, Taiwan 20%, UAE 9%, United Kingdom 25%, United States of America 21%, Japan 23.2%, and even Communist China taxes corporations at 25%.

This indicates that lower corporate taxation is a common strategy employed by numerous developed nations to incentivize investment and economic activity.

Conclusion:

The notion that the Indian middle-income bracket is burdened with higher taxes compared to the UPA era is unfounded. Rather, the increase in tax revenue can be attributed to a growing willingness among Indians to contribute more to taxation under the Modi administration. Conversely, during this time, there has been a notable uptick in corporate tax collection, owing to a surge in the number of corporate entities registering in the country. The strategy of offering reduced corporate taxes serves as an enticement for increased corporate investment within India, ultimately fostering economic development.