On August 21, 2022, Rahul Gandhi, shared a chart and claimed in his tweet that the central government is favouring corporate taxpayer over individual taxpayer by collecting more taxes from the general public.

Click here for archive link

Fact Check

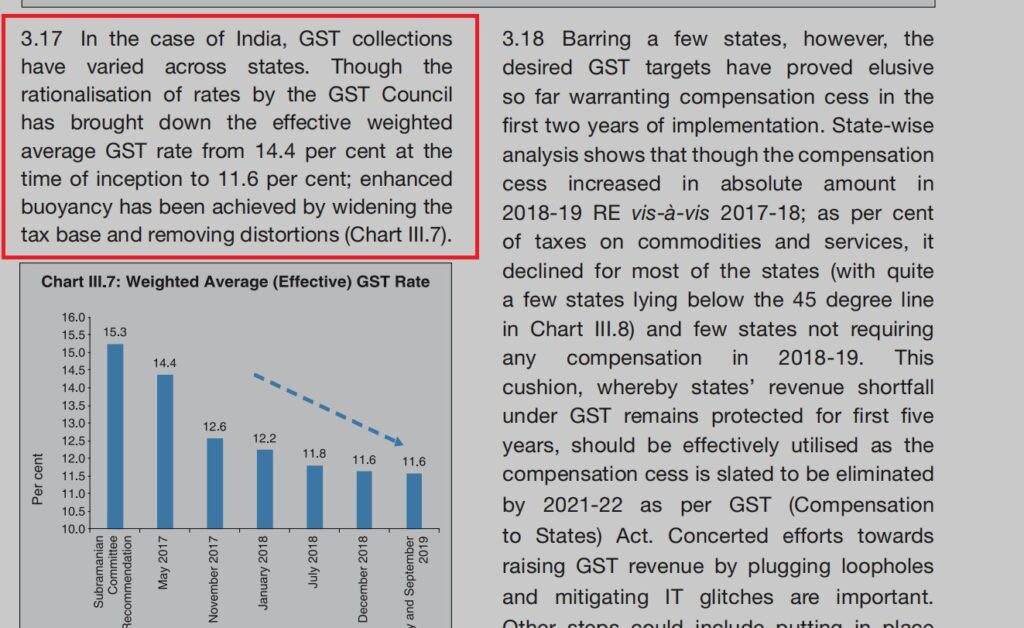

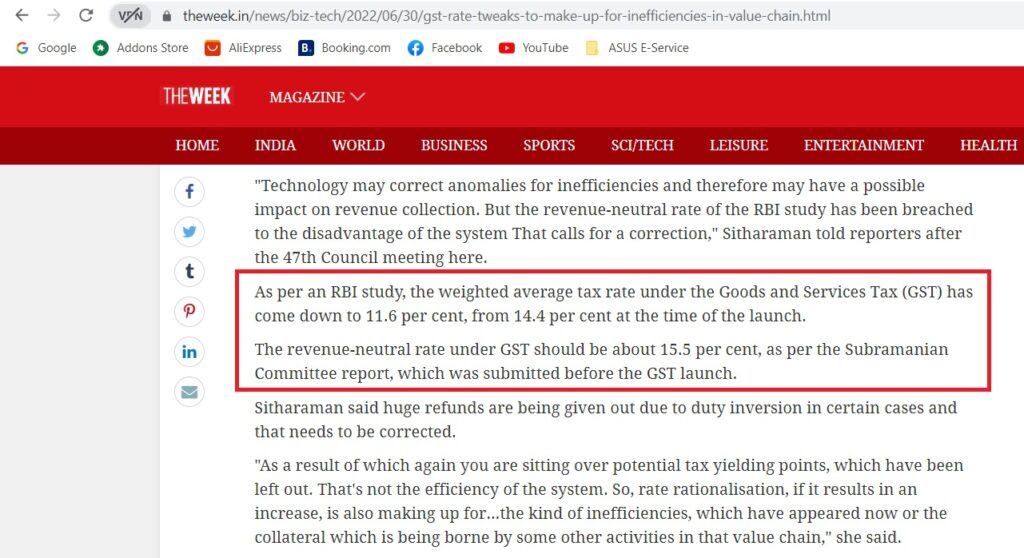

In our research we established that as per RBI study the weighted average tax rate under the Goods and Services Tax (GST) has dropped from 14.4% at the time of the launch to 11.6% now.

The Week report states that Subramanian Committee study, which was submitted before to the implementation of the GST, estimates that the non-revenue tax rate of GST is approximately 15.5%.

Click here for archive link

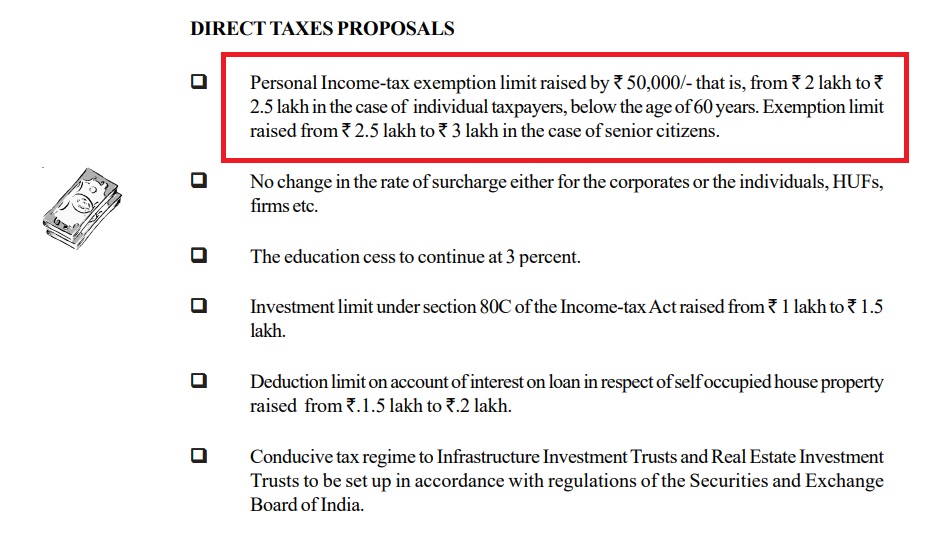

The increase in the income tax exemption threshold from Rs 2 lakh to Rs 2.5 lakh for all person taxpayers under the age of 60 in the 2014 budget, announced by finance minister Arun Jaitley. He also increased the income tax deduction limit for investments in Section 80C goods from 1 lakh to 1.5 lakh.

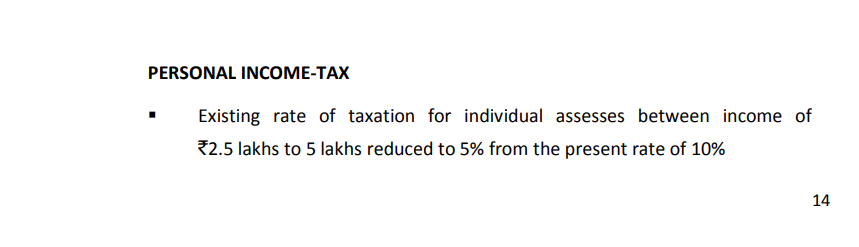

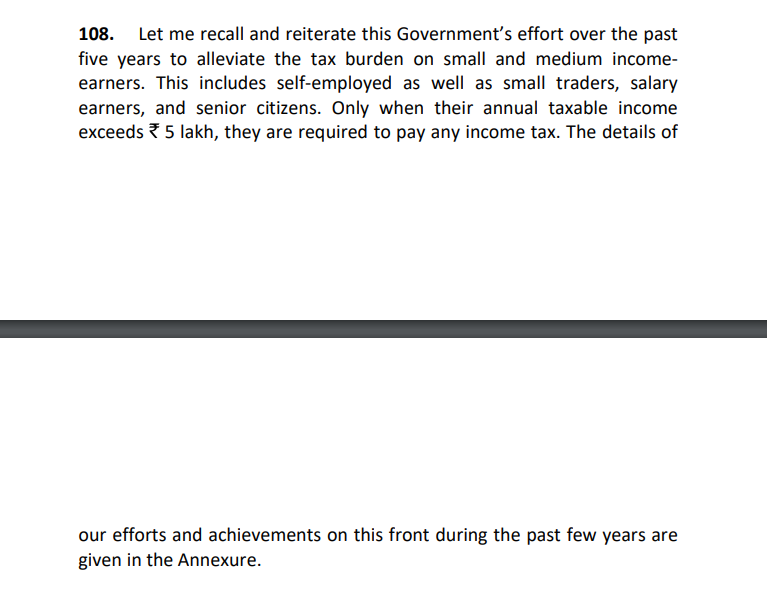

For individuals making between Rs 2.5 lakh and Rs 5 lakh in 2017-18 budget, the tax rate was lowered to 5% from 10%. Further, the Finance Minister Nirmala Sitharaman announced in the 2019 budget that for the fiscal years 2019–20, person with taxable income up to Rs 5 lakh will not be required to pay tax. However, if the individual’s income is higher than the basic exemption limit of Rs. 2.5 Lakh, he must submit an ITR (if age is below 60).

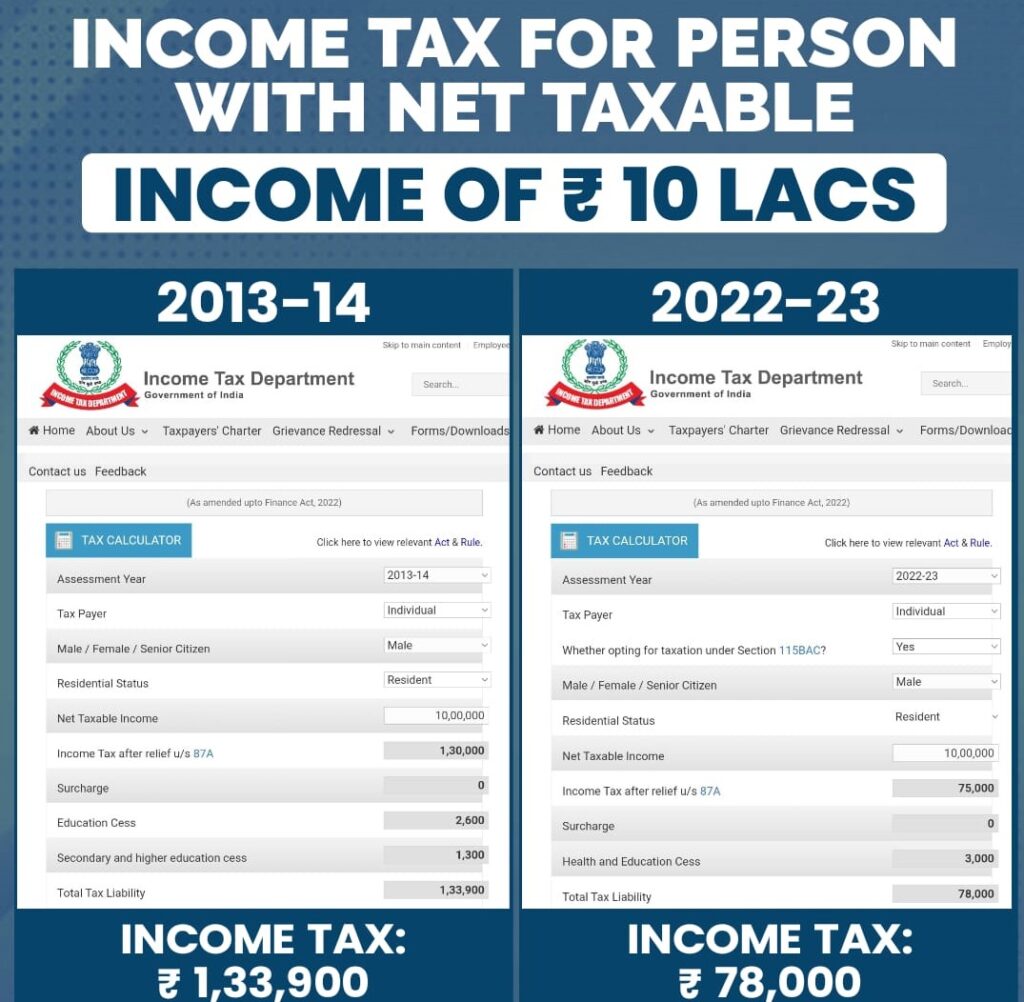

Data from the Income Tax Department shows that an income tax payer with a net taxable income of Rs. 10 lakh was worth Rs. 1,33,900 in 2013–14, whereas its just Rs. 78,000 in 2022–23.

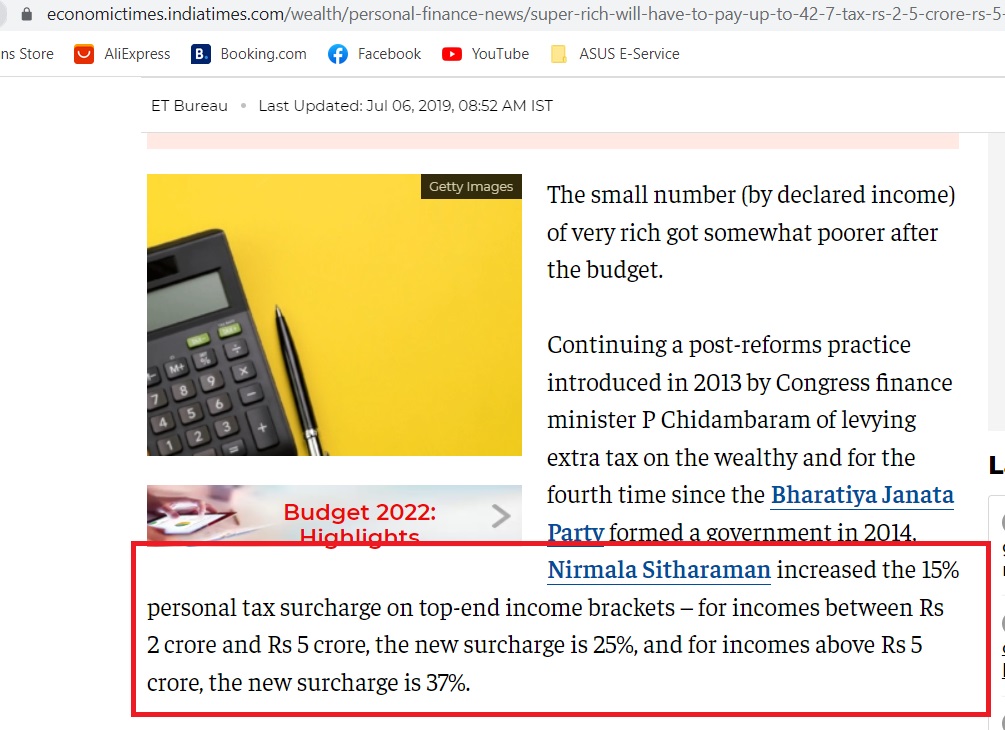

While personal tax rates for middle class have been reduced, tax rates for rich have increased. Income Tax India stated in a tweet shared on August 12, 2022, that the corporation tax revenue for the fiscal years 2022–23 increased by 34% compared to the prior fiscal year (2021–22). Over 58% more corporate taxes were collected in FY 2021–22 than in FY 2020–21, totaling Rs. 7.23 lakh crore. The revenue for FY 2021–22 are greater by over 9% even when compared to those from FY 2018–19 (the pre–COVID period).

Click here for archive link

Defying Rahul Gandhi’s assertion that the BJP administration favors corporations, according to Economic Times report, the 15% personal tax surcharge on top income brackets was hiked by Nirmala Sitharaman to 25% for incomes between Rs 2 crore and Rs 5 crore and 37% for incomes over Rs 5 crore.

Click here for archive link

Therefore, Rahul Gandhi’s claim that the BJP administration is favouring corporate taxpayer while raising taxes on the general public is not true. According to our fact check report, the BJP government has occasionally given relief to the tax payers, whether it was by cutting the GST from 14.4% when it first launched to 11.6% presently or by lowering the tax rate from 10% to 5% in the 2017–18 budget for people making between Rs 2.5 lakh and Rs 5 lakh.

| Claim | BJP government is favoring corporates while charging more tax from the general public |

| Claimed by | Rahul Gandhi |

| Fact Check | False |

The goal of the Only Fact Team is to provide authentic and transparent news fact and debunk misinformation that is being spread out with the intention of demeaning anyone’s image.

Dear Readers, We are working to debunk fake news which is against India. We don’t have any corporate funding like others. Your small support will help us grow further. Please Support.

Jai Hind!