Aam Aadmi Party’s Twitter handle Gujarat Mission 2022 tweeted on August 3,2022 claiming that the BJP government is tarnishing the identity of Gujarat by imposing 18% GST on Garba, while the Aam Aadmi Party protested against it in Ahmedabad, Tapi, Patan and Sabarkantha.

AAP leader and Surat Municipal Corporation Drainage Committee member Vipul Suhagia also tweeted on August 3 in which he said that the BJP government, campaigning in the name of Hindutva, imposed 18 percent GST on garba against which Aam Aadmi Party office-bearers played garba and protested against it and they were Detained by police. This tweet was endorsed by AAP leader Gopal Italia.

Aam Aadmi Party Gujarat President Gopal Italia also tweeted that the protest was staged by the corrupt BJP imposing 18% GST on Garba.

The newspaper headline used in the posters used by AAP activists for the protest is taken from Divyabhaskar of August 2,2022 . Which are as follows. It has been claimed that 18% GST will be levied on playing garba from 2022 and imposing GST on garba passes will increase the burden on Garba players.

Fact Check

Although GST has been in effect since 2017, Divyabhaskar’s headline incorrectly said that the government will begin imposing it on garba passes in 2022, increasing the burden on garba players (khelaiyas). Many well-known huge garba organizers attempted to evade GST in the years 2018 and 2019 under the guise of donations, and in the years 2020 and 2021 commercial garba could not be staged owing to Covid, thus GST will be implied on passes this year. This indicates that Divyabhaskar intentionally used a misleading headline in an attempt to deceive the people.

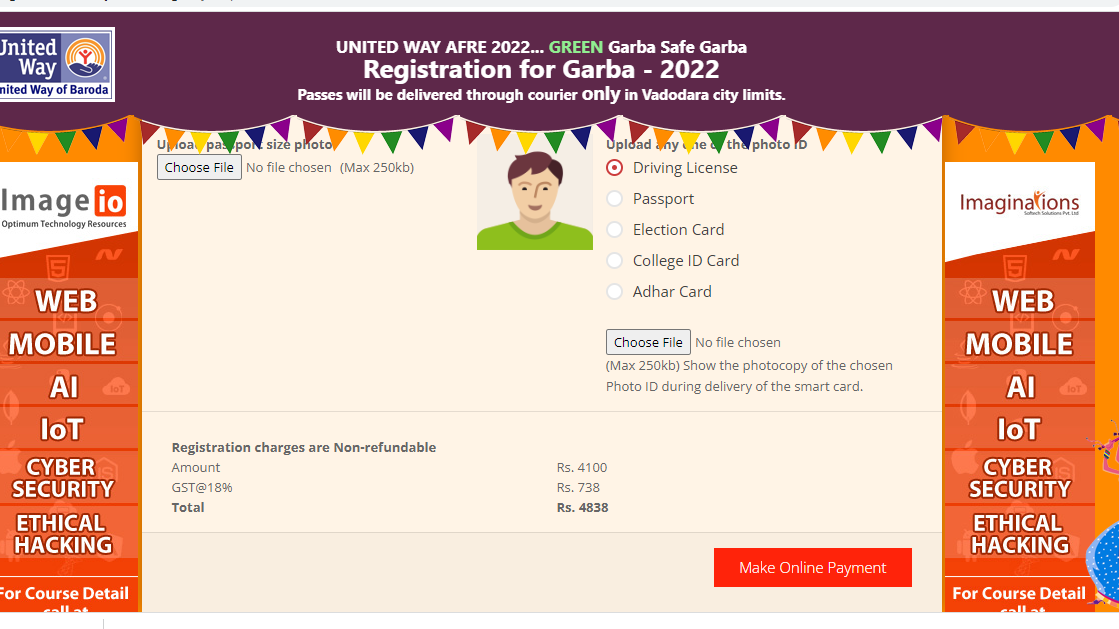

The United Way and the Palace Heritage Garba Festival’s official GST account were investigated by the GST Department after a report in The Times of India on October 16th, 2019 showed that the United Way takes the cost of the Garba pass as a donation. Since a result, as of this year, the United Way Garba organizers have individually incorporated GST in the pass fee.

Minesh Patel, a United Way trustee, stated that although their NGO does not sell tickets or passes, it does accept donations. However, at the government’s urging, it also accepts GST payments and issues receipts. After further research, it was discovered that the registration price for the 2022 Navratri festival differed from the price for the 2020 festival by about 300 rupees, and that the 2022 registration fee also included GST separately.

Here is one instance of tax avoidance by organizers both prior to and during the implementation of the GST in service tax.

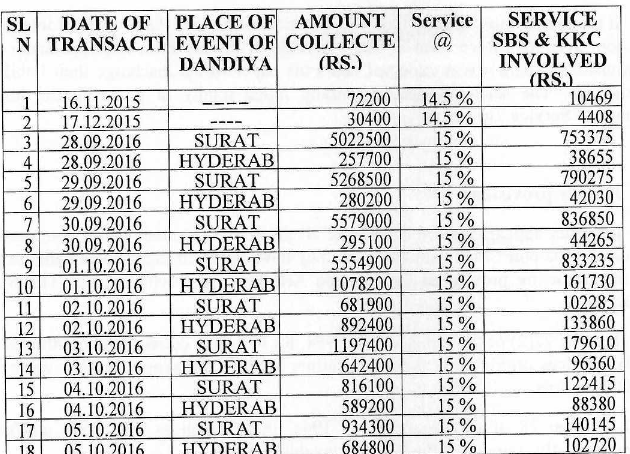

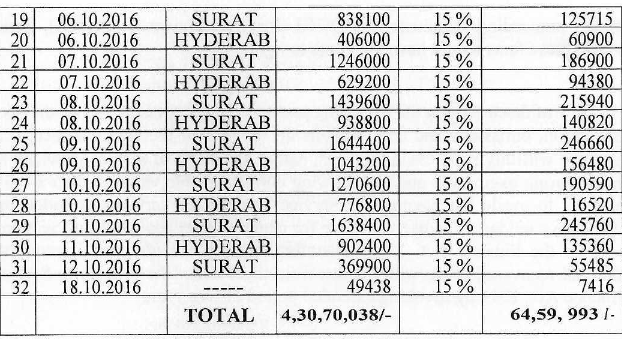

This is the case of 2015-17, which came under notice in year 2019. According to information acquired by the DGCEI (Director General of Goods and Service Tax Intelligence) officials, M/s. coconut media box LLP, which organizes corporate, individual, and governmental events, was based in Ahmedabad. Information acquired suggested that M/s CMB had lowered their taxable income in the ST-3 reports they had submitted by failing to pay their tax obligations on the full amount of money received in exchange for the supply of the aforementioned services. Further, it was noticed that ‘Navratri Utsav/ Dandiya Ras’ events organized by M/s CMB in the financial year 2015-16 and 2016-17. However, they had not discharged appropriate service tax on the amounts collected from the event participants. which are taxable under section 66B of the Finance act, 1994. Other garba organizers have also failed to pay the correct amount of tax in a similar manner. After that, the GST agency conducted a raid on them during the 2019 fiscal year.

When looking through the ledgers of the sales of service related to Navratri Utsav during the period FY 2015-16 and 2016-17, the service tax liability on income of Rs.4,30,70,038/- received for provision of taxable service works out to be Rs.64,59,993/-, which is computed as below;

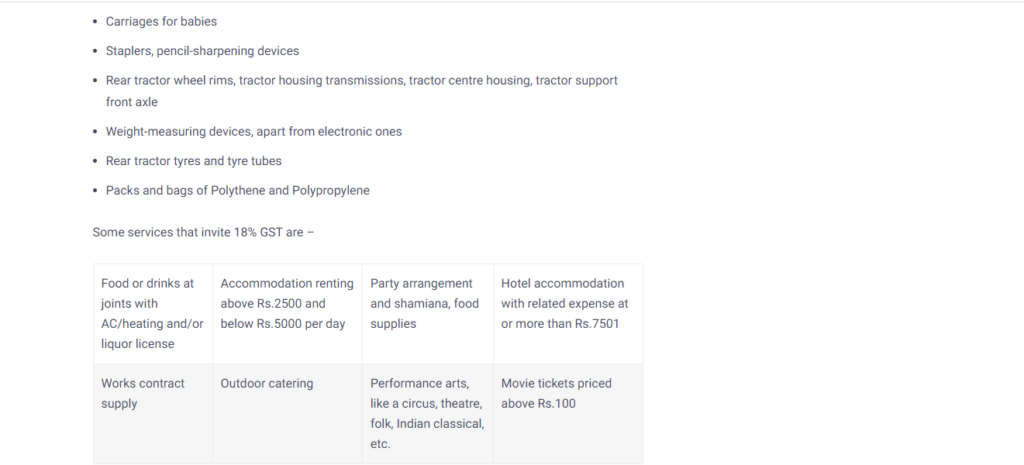

18% GST is not implied for the first time. Circus, traditional Indian arts, and even cinema tickets costing more than Rs 100 are already subject to an 18% GST. GST was charged on passes that cost $250 or more in 2017–18. Passes that cost Rs 499 or more are now subject to GST as of 2019, when the cap was raised to Rs 499.

The above photo is taken from Aam Aadmi Party’s twitter handle during their demonstration. Although one of the posters used said that IPL revenues are tax-free and that garba is subject to an 18% GST, in reality, IPL tickets are also subject to this tax.

It has been established, based on our investigation and enough evidence, that street garba and garba events hosted by modest organisers with ticket prices under 499 are exempt from the 18% GST. Only commercial garba with a price over Rs 499 would be subject to an 18% GST. Aam Aadmi Party and Divyabhaskar have attempted to deceive the public.

| claim | 18% GST will be levied on playing Garba for the first time. |

| Claimant | Aam Aadmi Party worker and Divyabhaskar newspaper |

| fact Check | False |

The Only Fact India team’s goal is to dispel misinformation that are circulated with the objective of tarnishing anyone’s reputation by providing accurate and transparent news facts.

Dear Readers, We are working to debunk fake news which is against India. We don’t have any corporate funding like others. Your small support will help us grow further. Please Support.

Jai Hind!