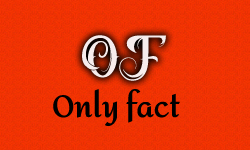

The Indian National Congress’s official Twitter handle tweeted about the number of tax impositions on food items during the UPA regime.

Click here archive link

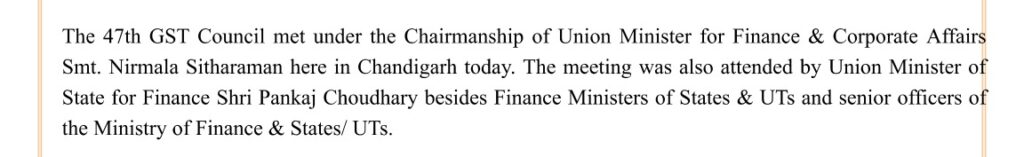

The GST council, at its, 47th meeting held in Chandigarh on June 29, 2022, levied a 5% GST on ‘pre-packaged’ and ‘pre-labeled’ food items such as rice, wheat, curd, lassi, based on the recommendations by the GoM on Rate Rationalism, which included Ministers from the TMC, CPIM, and Congress rule states were part of it.

PDF link, here

Fact check

While digging into the matter, our research discovered the contrary.

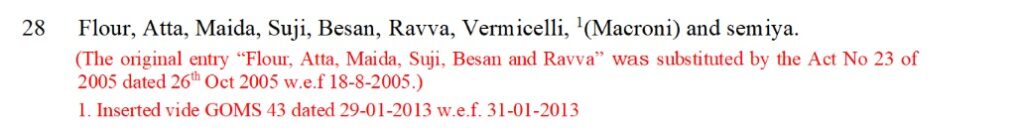

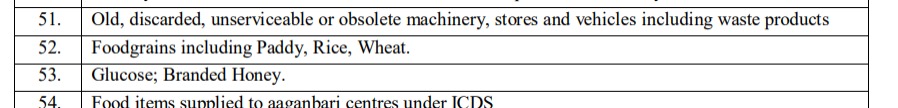

In our research, we established that during the UPA regime taxes were increased from 4% to 5% on flour, atta, maida, suji, besan, paddy, rice, wheat, and branded honey.

PDF link, here

As per the report by Economic Times, the official made a statement that imposing 5% GST over pre-labeled and packed food items is not happening for the first time.

Hence, the infographic shared by the official Twitter handle of Congress claiming 0% tax on food items during the UPA regime is a forgery.

| Claim | No Tax During UPA On Food Items |

| Claimed by | Congress Official Handle |

| Fact Check | False |

The Only Fact India team’s aim is to debunk lies and misinformation spread intending to mislead the readers. Jai Hind!

Dear Readers, We are working to debunk fake news which is against India. We don’t have any corporate funding like others. Your small support will help us grow further. Please Support.

Jai Hind!